Rent vs Buy – Which is Smarter?

For as long as home ownership has existed, the question of whether it is better to buy or to rent has been a perpetual debate. Traditional thinking is that buying is better as you have something to show after years of hefty payments. Owning a property also gives many people peace of mind and sense of comfort, security and pride.

The idea of home ownership has been drilled into our DNA since young, especially in Asian society. For ages, the path to wealth and riches has been through land/property ownership. In the past, the rich were land owners. Add to that, the notion of owning a home is seductive – everyone thinks of owning their dream home at some point or other. Owning a home is liberating and self-validating….or is it?

Owning a home is one of life’s biggest and most stressful responsibilities. It commands financial commitment of 20 to 30 years. A lot can happen over this period: losing one’s job, relocation, having children, getting divorce, sickness etc. During economic downtime, home equity can be destroyed and the ongoing mortgage can weigh down on one’s finances. Owning a home also ties one down, making it is less easy to just pack and head for an exciting job overseas or for a new relationship.

Let’s look at the benefits and disadvantages of owning vs renting one’s home :

Own Your Primary Home

| Pros | Cons |

|---|---|

| Sense of stability, security & pride | Hefty downpayment |

| Property appreciation | Maintenance and upkeep |

| Full ownership upon paid-up | Condo owner’s association cost |

| Freedom to renovate/decorate | Insurance costs |

| Benefit from inflation | Property taxes |

| Equity build-up | Illiquid |

| Serve as collateral | Immobility |

| Legacy for future generations | Mortgage liability |

| Room rental | Possible equity loss |

| Reverse mortgage | Opportunity costs |

Renting Your Primary Home

| Pros | Cons |

|---|---|

| Freedom and mobility | Limited say in decoration/renovation |

| No ownership costs (tax, insurance etc) | Uncertainty as lease can be terminated |

| No mortgage debt | Limited say in residents’ |

| Not affected by interest rate changes | Rental payments ‘go-down-the-drain’ |

| Pack & move to newer/nicer units | No inflation protection |

| No big downpayment | Less control over rental price |

| Location & lifestyle experience | Cannot build equity |

Having rented and bought multiple properties, across countries and cities, in different markets and at various life stages, I truly advocate renting your primary residence. It gives so much freedom for new adventures, experiences and investment opportunities.

In this day and age, there is much to explore beyond one’s own country and culture, not just on the job front but also in terms of personal network and development. For the young and young-at-heart, go forth to make the world your oyster with less strings attached. Internet has demystified local customs, lifestyles and unknowns to make travel one of the most exciting, enriching and rejuvenating experiences.

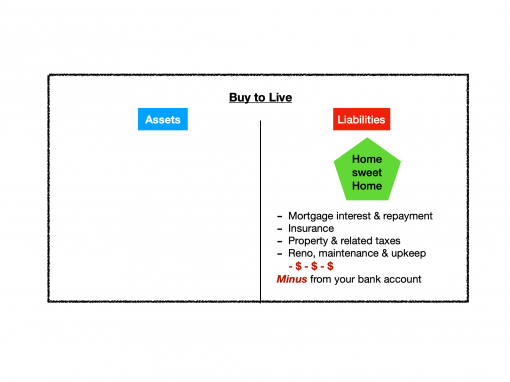

Before buying a property, it is essential to understand the building blocks of wealth: assets and liabilities.

Assets put money into your pocket; liabilities takes money out.

One becomes wealthy by owning more assets and less liabilities. Makes sense?

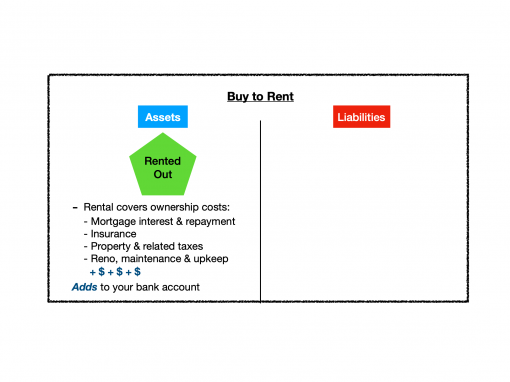

Buying to rent means acquiring an asset as it generates an income stream. Of course this means rental income must exceed ownership costs, eg: mortgage repayment, maintenance and upkeep, tax and insurance. This speeds up the journey to wealth and retirement.

When buying a rental property, you enjoy all the Pro’s cited under property ownership and yet eliminate some of the Cons since rental income compensates for:

- Maintenance and upkeep

- Monthly home owner’s association costs

- Insurance

- Property tax

- Depreciation

- Reduction in home equity

My path to financial freedom is built mostly from rental properties so I am a die-hard fan of this asset class. In return for some effort in managing leases, property upkeep and attend to tenants’ requests or complaints, the returns far outweigh the hassles.

When the right properties are bought for rental purpose, they generate stable income, will likely appreciate over time and attract tenants easily when vacancy arises. Rental property is one of the most proven assets one can have, granted that some initial capital is required, which is why saving is the very first step towards wealth and retirement.

Despite owning multiple properties in Singapore, America and Holland with my partner-in-crime, our residential home in Singapore is a rental property in prime district 9. We also live in a monument house circa 1585 in the lush and scenic eastern part of Holland. Our Dutch home was bought as a mixed portfolio from a family office comprising of a shop, a small office, an atelier with a garage below and a 300 sqm house with a rooftop terrace and wine cellar. During spring and summer when we are in Holland, we live in the 300sqm house and the rental income from the other properties within this portfolio more than pay for our mortgage and all other costs. So even though we own the house we live in, it is an asset and not a liability.

When you rent your primary residential home, you enjoy all the ‘Pros’ listed in the 2nd table above plus you can negate some of the Cons if you:Opt for unfurnished or partially furnished apartments so you can buy/use your own furniture for a sense of homeliness. You can also opt for furniture rental service where available. Your choice.

- Circumvent the lack of say in the property or its surrounding by letting your landlord know if you have strong opinions about the space.

- Instead of thinking of rental payments as ‘going-down-the-drain’, think of the returns you make by investing the amount that would otherwise be used as downpayment. Rent is often lower than ownership costs as insurance, taxes, equipment replacement, upkeep and maintenance do add up.

- Mitigate inflationary forces by investing the ‘downpayment money’ in stocks, rental properties or other inflationary-protected investment tools so you earn income from these investments to cover your rental increment.

- Exercise your power of choice by moving to a lower cost area or downsize to a smaller unit when rental hikes. Remember, both landlords and tenants can have the upper hand in the rental market, it all depends on market conditions.

Admittedly, the inability to build equity is a fact but remember, it cuts both ways. Equity can go below what you owe the lender and if they to call up the difference, it can cause financial distress. So, no gain but also no pain.

From personal experience, my credo is: buy for investment, rent to live. This way, you always buy an asset and not a liability.

Buying an asset means money is working for you by generating positive cashflow. To enjoy the full benefits of renting your primary residence, you should invest the money that you would otherwise use as downpayment.

And if you still decide to buy your residential property after weighing the financial and emotional aspects, by all means. It is a personal choice and not just an economic one. And when you do so, my advice is not to pay it off fully. I know this is contrary to conventional thinking, you can read more about it here:

https://smartretirementtoday.com/2020/02/23/should-you-pay-off-your-mortgage-before-retirement/

Live free!

Savvy Maverick