Should You Pay Off Your Mortgage Before Retirement?

Once you made the decision to get out of the rat race, you need to start putting in place a plan to lay the best groundwork for a blissful retirement. For most people, this means minimising financial burdens so as not to be subjected to financial jolts in retirement years.

One of our biggest expenses, if not THE biggest, is likely to be our mortgage. Conventional wisdom is to pay off mortgage before retirement to secure better peace of mind.

I’d like to share my own experience to offer a different perspective.

In 2009 as I prepared to move overseas, one of my top priorities was to minimise my financial burdens in Singapore before relocating. Taking well-intended advice from friends, family members and even a couple of financial experts, I paid off my mortgage using my pension savings as I wanted to minimise my expenses and for more peace of mind. The feeling of being mortgage-free was liberating indeed, I smugly gave myself a pat on my back 🙂

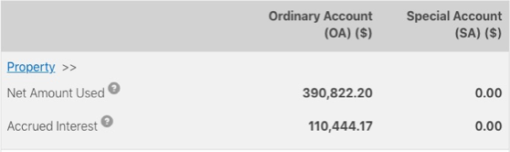

10 years on, with a little more financial savviness under my belt, I look back at that decision with regret. Let me explain why with this snapshot from my pension account.

The ‘Net Amount Used’ was the amount withdrawn to pay off my mortgage. The ‘Accrued Interest’ represents the 2.5% interest, plus compounding, that I would have earned had the sum not been withdrawn. Note that this compounding happened without me making any further contribution!!

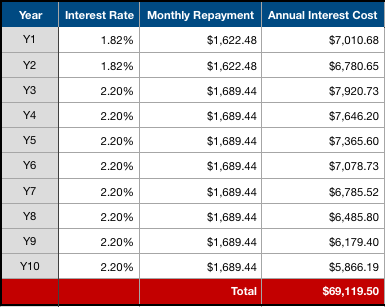

Now, let’s look at the interest costs of a mortgage using simulation of an existing home loan package offered by a local bank, with the following terms:

- Interest fixed at 1.82% for first 2 years

- Floating rate from 3rd year onwards (projected at 2.2%)

- Loan tenure of 25 years

The difference between interest earned in my pension savings versus mortgage interest cost if I had not chosen to pay off my mortgage amounts to a whopping $41,324.67 ($110,444.17 – $69,119.50)!

These savings are just for the first 10 years! The difference will be larger in subsequent years due to lesser interest cost on the mortgage arising from decreasing principal and the bigger compounding effect on a larger base in my pension fund.

So despite many proponents singing the “Pay Off Debt Before You Retire” tune, you should take stock and assess your own situation to arrive at the best and most appropriate decision for yourself. Whether you are planning to retire in 10, 5 or 2 years, do your own sums instead of taking advice blindly just because it is common practice, even from the experts.

In addition, there are other advantages to NOT pay off your mortgage:

- Irreversible: Once a property has been paid off, it is not easy to get financing again as most people will not have income when they retire to qualify for a loan. And for those who do, it is likely to be insufficient or unstable, which will not meet loan conditions.

In my case, a public housing once paid up cannot be re-mortgaged again, unlike private properties. The moment I discovered my ‘error’, I approached banks to finance my apartment but it is simply not allowed under the rules. You can always choose to pay off in full at a later stage when circumstance dictates, for example if interest rate spikes up. Keeping the mortgage opens up, instead of limits, your options.

- Inflation: Mortgage repayment amounts are fixed so real value decreases over time due to inflation. The value of $1,689 in 10 years time will be worth lesser than now, so holding fixed value debt actually allows inflation to work for you instead of against you.

- Cash buffer: Holding on to your cash instead of using it to pay off mortgage provides buffer in times of emergency, contributing to greater peace of mind. And cash has ultimate liquidity compared to everything else.

- Bank relationship: Keeping relationship with your bank can be beneficial, especially if you have built up a long and good track record of prompt repayment. This can give access to interesting promotions or services, such fixed deposit interest rates, new investment products or exclusive invitation to product launches. Perhaps even tap on this relationship for a loan for your children.

- Opportunity cost: The amount used to pay off mortgage could be invested in income generating investment such as REITs or other dividend-paying stocks, which can be used to supplement your mortgage interest expense

Keep an open mind that conventional idea to pay off all debt may not be your best option. Just because you are able to, does not mean you should do it. Just because it is common practice, does not mean it is best for you. For me, the peace of mind was not worth the interest loss in my pension account, especially since I was working and have the means to service the mortgage.

I share this as one of the few regrets on my path to retirement. Whenever I log into my pension account, I am reminded of this folly. I hope that by recounting this episode, it provides a different perspective and motivates you to explore smarter options instead of following the crowd. Especially in the current low-interest climate, it makes a lot more sense to use low-cost leverage to increase your retirement nest and to achieve bigger peace of mind.

To smarter decisions,

Savvy Maverick