Fixed Deposits and the Concept of Negative Interest Rate

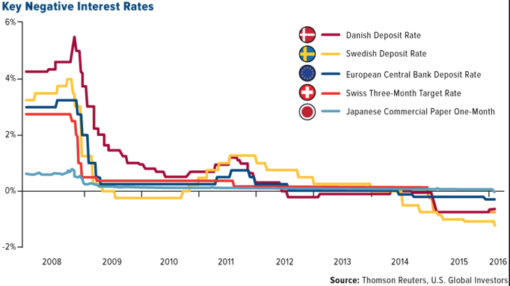

I remember vividly the year it happened – July 2009 – sending shock waves throughout the European financial world, and possibly the entire world. That was the year Riksbank, the oldest central bank in the world, introduced negative interest rate by charging commercial banks a fee for parking money with them. Since then, other countries have also adopted this unconventional monetary policy, including Denmark, European Central Bank, Japan, Britain and Germany

There are several reasons why Central Banks resort to such a drastic measure, chief amongst them is to boost lending to stimulate economic activities. By charging commercial banks a fee for parking their excess funds, the idea is to dis-incentivise cash hoarding in favour of lending out to so as to earn positive interest income instead.

Why do banks still park money with Central Banks if they are paying interest instead of earning interest? The reason is that Central Banks, especially those enjoying triple-A rating like Germany, offer a safe haven for deposits with little risk of default. So in exchange for this safety, banks are willing to pay a safe-keeping fee which is the negative interest rate.

In the Netherlands where I am currently based, ABN Amro offers a negative rate of -0.5% for balances above €500,000 which will be revised to €150,000 from July 2021. ING and Rabobank, which together with ABN Amro makes up the 3 biggest banks in the Netherlands are also offering -0.5% rate for balances above €250,000.

_________________________

Negative interest rate really refutes the concept of savings for regular consumers.

_________________________

Regular savers put their money in reputable banks with the objective of earning interest income, at relatively low default risk. This is an age-old idea indoctrinated by our grandparents, parents, older relatives, conservative friends, education system and yes, the financial institutions.

In the current low interest environment however, fixed deposits interest rates are not keeping with inflation rate, or even below zero as can be seen in The Netherlands. Savers are effectively paying money to the banks to keep their money safe instead of earning real interest income, which is the idea behind fixed deposits in the first place.

So why are fixed deposits still so trusted and loved?

- Easy-to-understand and straightforward

- Safe investment instrument

- Guaranteed principal

- Guaranteed interest income at maturity

- Cumulative rollover interests

- Enforce a saving discipline

- Unaffected by market events

- Staggered maturity for planned expenditures

- Loan facility up to a percentage of principal amount.

Other than a stash of emergency fund and a war chest for opportunistic investments, I am invested at all times across several asset classes. My favourite is real estate which I view somewhat as ‘fixed deposit’ but with added inflation hedge and regular stream of income. This is how I liken investing in rental property to fixed deposit

Easy to understand and straightforward – The concept of rental property is universally understood. Buy a property at or below market value, fix it up and rent out for regular income. As long as rent is more than ownership costs (mortgage, insurance, taxes and maintenance) what is left over is earnings.

Safe investment instrument – One buys into a solid brick-and-mortar asset that cannot be stolen, liquidated or easily destroyed

Principal guarantee – A property held over mid-to-long term will likely retain its value or even appreciate. In this regard, good property in great location in countries where land ownership laws are clear and market mechanism is allowed to operate is important.

Interest income – Rental income is equivalent to the interest one would earn from a Fixed Deposit, with 3 important differences: it is more regular (monthly), much higher compared to the dismally low Fixed Deposit rates AND it is inflation protected

Cumulative rollover interests – Instead of rolling over at maturity to enjoy cumulative effect, rental income compounds monthly offering greater liquidity. Monthly rental collected can be used to fund living expenses or invest to generate more income.

Saving discipline – The principal pay-down within most mortgages works like enforced savings requiring regular commitment over a period of time, with added equity build-up.

Impact by market events – This tends to be limited and not as immediate since rent is locked-in during lease period. Rents do get adjusted downwards upon lease expiry during economic downturn but hey, this adjustment can also go up during good times. Historical data shows rental increase over time far outweighs contraction, both in terms of frequency and duration.

Staggered maturity – The holding period or exit strategy for investment property can be planned to meet major expenditure such as round-the-world trip in retirement, help children buy matrimonial property, education for grandchildren, estate planning etc. Admittedly, this feature is less attractive compared to Fixed Deposit, but its other advantages more than make up for it, in my view

Loan facility – Real estate is one of the most preferred collateral offering higher quantum and often the lowest interest rates. It is easy to get loan or overdraft facility against a property. In fact, borrowing against equity is a good way to secure investment funds and to unleash accumulated wealth to work for you.

However, property may not be the cuppa for everyone, given its demand on time and investment quantum. Then investing in ETFs (Exchange Traded Funds) is a good alternative, especially for the novice. ETFs are affordable, provide instant diversification, hassle-free as stock-picking is not required and extremely costs-effective compared to mutual funds or unit trusts.

ETFs also offer higher liquidity as they are traded during market hours unlike mutual funds/unit trusts, which prices are set only at end of each trading day and can only be sold back to the fund manager instead of directly to other investors in the market. There are many ETFs, selecting the right ETF is key. Index ETFs are popular and sensible, as they replicate a market index such as the S&P 500 (SPDR), Nasdaq 100 (QQQ) or the STI (SPDR STI ETF and the Nikko AM STI ETF).

Unlike stocks, an index ETF like SPDR, for example, cannot go ‘bust’ as it holds 500 largest counters traded in the United States. Whenever a company falls out of this 500-biggest list, it will be dropped from the S&P index and replaced by the new qualifier. The index ETF executes this same change in its portfolio since it is designed to mirror the index, in the types of stocks as well as weightage. Some even pay dividends as offered by the underlaying stocks within the portfolio.

Putting money in fixed deposits is neither investing nor saving – it is ‘slaving’ for the lenders. Why would you work so hard to have your money devalued by keeping it with an institution that returns a lesser amount in return?

Is it better to be safe and save but end up poorer OR take calculated risks by investing in assets that add to your wealth and beat or keep up with inflation?

‘Ignorance is bliss’? Go figure.

Stay smart,

Savvy Maverick

Disclaimer: The views expressed here are drawn from my own experience and do not constitute financial advise in any way whatsoever. Nothing published here constitutes an investment recommendation, nor should any data or content be relied upon for any investment activities. Independent and thorough research should be undertaken before making any financial decisions, including consulting a qualified professional.