Take Advantage of The Housing Boom, With or Without a Property

From Australia to Singapore to Holland to United States, housing markets are in a frenzy with no sign of relenting. Month after month, records are being set in transaction prices, overbidding are in hundreds of thousands in excess of asking prices and properties are being sold within a blink of an eye.

Triggered by a confluence of factors such as limited supply in both new and resale stock, historical low interest rates, stomping of the market by Millennials, highest level of savings rate brought on by government handouts and expenditure restrictions due to lockdowns, inflationary fear, FOMO as well as cabin fever from extended work-from-home (WFH) adoption over past year.

Consumer optimism will continue to be buoyed as more get vaccinated, economies crank up to full gear and life return to pretty much like before except that the virus will live amongst us under control much like a regular flu bug, which it is after all. Given such a scenario, it is unlikely the housing market will cool down unless government intervenes or a major crisis hit. Both notions, ironically, trigger even more anxious buyers in a bid to take action before things change.

This is all good news for those who have had the foresight to buy into investment property earlier. They can take advantage of the current market high to sell and reap a handsome profit or hike rental due to the shortage of supply and desperate tenants.

What about the majority of people who own and live in their one and only property? If they decide to sell at a market high to capture the gain, they will surely need to fork out equally high price to buy a replacement property. Does this mean they should just fold their arms and watch all the action from the sideline? Not necessarily.

Property Owners

Sell and Downsize: For empty nesters whose children have left home or those looking to move out of landed property to an apartment for retirement years or those who can WFH and no longer need to live near office in the city, now is a good time to make the switch. As one is selling a bigger/better located unit for a smaller/outside of city area unit, a gain can be had.

In 2010 after I left to live and work in Holland, my parents decided to sell their terrace house for S$1.2million and moved into a 5-room HDB apartment that cost S$435,000. If they had sold their terrace unit at current market price, it would be worth at least $2million and a similar 5-room HDB flat in their vicinity would cost at most $600,000. Even if both property rose by the same percentage, the difference in absolute quantum would be more for the bigger unit because of the difference in starting base.

Re-financing: If selling is not in the game plan, taking advantage of current low interest rate to re-finance is another option. This allows one to extract equity for other purpose such as investment or to renovate and increase property value further. For those who prefer to be debt-free, refinancing offers the following advantages:

- Locking in low rates and enjoy peace-of-mind

- Reduce monthly repayment amount

- Shorten mortgage duration at existing repayment amount

Most lenders offer better mortgage rate for lower quantum of loan versus value of the property. It may be worthwhile to check with your bank or lender:

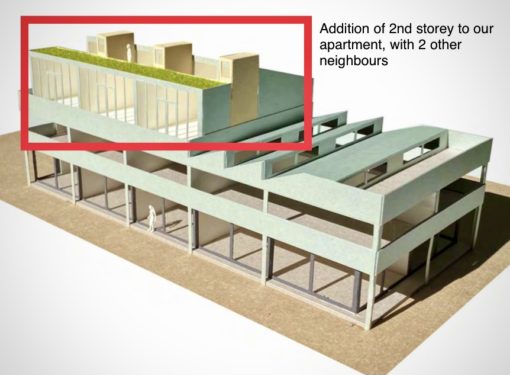

That is exactly what I am doing: take advantage of current low interest rates to renovate a SOHO (small office home office) investment property in Amsterdam. The duplex unit has separate accesses: ground floor is being let as a personal training studio and first floor is rented out as a residential apartment. Plans are underway to add a 2nd story to capitalise on the per square meter price that has doubled from when we bought it in 2015 to more than €5,500 sqm now.

Equity will be drawn from the unit’s appreciation to fund the construction costs and when completed, the unit will be bigger by 30-35%, commanding better price both in terms of rental (for the residential part) and overall value. For this option to make sense, the estimated increase in value of the additional space must be justified by the building costs and financial fees from re-financing the mortgage. Luckily for us, the undertaking is with 2 adjacent neighbours so we are able to share some of the costs such as architect fee and project management etc.

Those Who Do Not Own Property

Property Related Stocks: Increased property transactions naturally leads to more activities in property development, home improvement and upgrading sectors so investing in such stocks is a viable option. New home buyers would like to renovate to their liking while those who decide to keep their current property may consider some renovation now that they will be staying more years in it.

REITs and Property ETFs: For better diversification at a fraction of the price, which instantly lowers investment risk, REITs and property ETFs make prudent sense. Singapore is especially attractive for REITs as it offers a wide range from commercial, industrial, retail, healthcare, hospitality, infrastructure to data centres – some of which have demonstrated solid track record both in dividends as well as price appreciation. REITs are good vehicle for income portfolio due to the regular dividend pay-out and tax efficiency. Approximately 65% of my income portfolio is invested in S-REITs (Singapore REITs). As in all other investment endeavours, do proper and thorough research before investing

In US, there are a wide array of property ETFs which provides wide exposure covering different types of property from residential to industrial to healthcare REITs, giving good diversification and low expense ratio.

Real estate crowdfunding: The newest kid on the block, this is essentially a platform where investors pool their resources to fund a project or a company or a portfolio of REITs and in return earn a portion of the profits. Revenue can be from rental income or sale of underlying assets. The advantages of crowdfunding include a low investment quantum, as low as US$1,000, compared to purchase of a physical property, diversification of portfolio, elimination of the hassle of property maintenance or tenant management, and is very easy often via Apps.

Singapore has not caught on in this space yet with a couple of false starts past few years. However, being a product of the internet era and with enormous inefficiency of capital allocation in real estate, it is a matter of time that a better product be embraced. Hence it remains an interesting space to watch, especially with adoption of blockchain technology within the crowdfunding space, making it more safe, robust and transparent

The final question is: is it still a good time to invest in physical property? My personal take is that it is always a good time to invest in property as history has proven repeatedly its outstanding value over time, being a great hedge against inflation and provider of regular cashflow. With historical low mortgage rates and expected inflation, it makes even more sense as long as one buys into the right property at fair value.

I view investment property as equivalent to putting money in a “fixed deposit” but with a whole lot more benefits as expounded here.

Besides, owning an investment property positions one to take advantage of the next property boom. It’s never too late as long as it is the right property.

Bricks-and-mortar…forever,

Savvy Maveric

Disclaimer: The views expressed here are drawn from my own experience and do not constitute financial advise in any way whatsoever. Nothing published here constitutes an investment recommendation, nor should any data or content be relied upon for any investment activities. It is strongly recommended that independent and thorough research is undertaken before making any financial decisions, including consulting a qualified professional.