Why The 4% Retirement Rule Is Dead

Planning on retiring based on the 4% retirement rule? To say that one is on shaky ground is an understatement because the assumptions and scenarios upon which this strategy was developed no longer apply.

The 4% retirement rule was first proposed in 1994 by financial advisor William Bengen to provide a simple and effective way to compute retirement funding, which has been widely adopted and tested.

For the uninitiated, the 4% retirement rule computes the amount that allows one to withdraw 4% from their retirement chest to fund living expenses and adjusted for annual inflation rate, while at the same time ensuring that the fund will last for at least 30 years. This amount is invested in income generating assets, split equally between dividend paying stocks and bonds. Assuming one starts with $1,000,000 and using an annual inflation rate of 3%, one withdraws $40,000 in the first year; $41,200 the second year and so forth.

So what’s wrong with the 4% rule? Plenty

Life Expectancy

For a start, people are living longer. It is projected that one third of all 65-year-olds today will live beyond 90 years, and approximately 1 in 7 beyond 95 years.

_________________________

The global number of centenarians is projected to increase 10-fold between 2010 and 2050.

~ World Health Organisation

_________________________

Retiring at 60 or 65 years and living beyond 90-95 years is an increasing possibility, especially in developed countries where standard of healthcare and social infrastructure is good. Outliving one’s funds is a serious concern so a re-look at the 4% retirement rule is warranted.

Healthcare Costs

Longer life means higher healthcare costs as health impairment increases with ages. Some of these can be long-term care which adds up over time, such as dementia, kidney dialyses. Many insurers are treating old-age health needs as uninsurable and discontinuing such insurance policies which will require one to dip into one’s own resources, dampening the efficacy of the 4% withdrawal rule.

Early Retirement

There is a growing trend towards early retirement as the notion gains traction, especially with the FIRE movement. The pandemic over the past year-and-a-half caused many to realise the possibility and appeal of a different lifestyle and life goals. Someone retiring at 50 or younger needs to ensure that funds last for at least another 40 to 50 years.

Rising Inflation

Inflation, while at historical low in recent past, has been rising steadily across major economies since beginning of 2021. Inflation is expected to continue inching higher due to the massive liquidity pumped into the global economy to bail out hardship brought on by the pandemic from business closures, mandatory lockdowns, trade and travel disruption. The 4% rule was formulated at a time when inflation was assumed to remain between 2%-4%.

For those planning to draw pay cheques from bond, stocks portfolio and life savings, the expected rise in inflation is a hidden destroyer of wealth, eroding purchasing power. While the 4% rule allows for inflation-adjusted withdrawal, the higher inflation rate will reduce the investible pot, affecting returns and earnings, and may lead to earlier depletion of fund.

Interest Rates

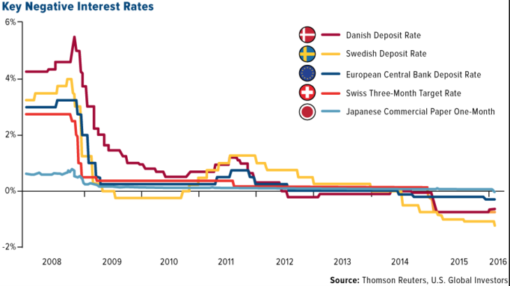

To add insult to injury, we are living in a period of historical low interest rates, even going into negative territory, something unthinkable before. The paltry interest earned, if at all, is not enough make up for inflation rise which means further drawdown from retirement war chest. This twin phenomenon of rising inflation and low interest rates is equivalent to burning the retirement candle at both ends.

Economic Volatility

Economic cycles are compressed, volatile and more susceptible to black swan events such as the 9-11 bombing of the Twin Towers, the 2008 Global Financial Crisis and most recently, the Covid pandemic. Such events leads to higher peaks and deeper troughs, making it even more challenging to navigate investment within a retirement landscape.

Investment portfolios will be submitted to more shocks and jolts, which means portfolio earnings will be impacted with more frequent and deeper market down cycles, bringing more uncertainty to the 4% withdrawal rule.

Calamities

The world is experiencing more severe and frequent calamities as a result of climate change. Recent calamities include:

-

- Covid pandemic

- Volcano eruption in the Philippines, Japan, Vanuatu, Indonesia

- Earthquakes affecting China, India, Iran, Philippines, Russia Turkey, Haiti

- Forest fires in Morocco, Greece, Italy, Siberia

- Flooding in Germany, Belgium, the Netherlands

- Hurricane in coastal cities in the USA and typhoons in parts of China

The IPCC report released in Aug 2021 cited ‘irreversible’ damages to the environment that will take decades and even centuries to recover. Some of us may be forced to relocate, rebuild our houses and lives, for which dipping into retirement funds will be required. The 4% withdrawal rule was not designed to take such shocks.

Regulatory Risk

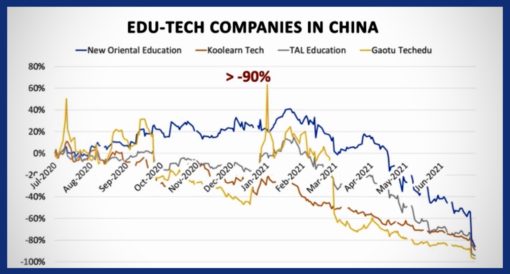

The wipeout in billions of stock values of Chinese listed companies by the Chinese authority to tow them in line over antitrust practices, data security, employee welfare and cost-of-living issues demonstrates how far-reaching regulatory actions can have on one’s retirement.

Or the recent furore over regulatory changes to the Malaysia My 2nd Home (MM2H) retirement visa scheme affecting thousands who have relocated to Malaysia for their retirement. Nicely laid out plans to stretch one’s retirement dollars and live out one’s life in a tropical paradise decimated at the stroke of a pen. Imagine having to uproot, start anew and rebuild one’s life based on a retirement strategy that never caters to such development. Timely reminders that the best laid plans are at the mercy of regulatory actions.

What Can One Do?

Given the onslaught of assaults due to an increasingly VUCA (Volatility, Uncertainty, Complex and Ambiguity) world, a sensible approach is to protect one’s retirement plan by incorporating more income streams.

Multiple income streams, in addition to the traditional income from stocks and bonds proposed under the 4% retirement rule, can be derived from:

-

- Annuity payout

- Rental income

- Peer-to-peer lending and crowdfunding

- Part-time work that one enjoys

- Consulting for those with appropriate skills

- Non-market related investments such as viatical settlements

- Online business or shop

- Cryptocurrency

The other suggestion is to add F.I.R.M (Financial Intelligence Retire Magnificently) strategy to fortify one’s retirement portfolio to better withstand the shocks and hard knocks that may come. F.I.R.M can be applied throughout one’s lifetime, even into twilight years as long as mentally capacity is competent.

New Retirement Mindset

Bearing in mind that the new retirement mindset is not about just stopping work but more about doing things that one truly enjoys and derives pleasure from, drawing from financial, emotional resources and skillsets accumulated, to live a life that one desires.

It is never too late to take action. Relying on the 4% withdrawal rule blindly is deadly given the VUCA environment. By incorporating more income streams and applying the F.I.R.M strategy, one’s retirement is better protected and more robust.

Safety doesn’t happen by accident. ~ Unknown

Stay safe,

Savvy Maveric

Disclaimer: The views expressed here are drawn from my own experience and do not constitute financial advise in any way whatsoever. Nothing published here constitutes an investment recommendation, nor should any data or content be relied upon for any investment activities. Independent and thorough research is to be undertaken before making any financial decisions, including consulting a qualified professional.