Now That Inflation Is Here – Should You Pay Down Your Mortgage or Invest?

Across the globe, prices are going up and up, with no sign of abating.

Average inflation in the Eurozone is 4.9% in November, up from 4.1% in October. The Netherlands reported 5.2% inflation while its closest neighbours Germany and Belgium fared even worse at 7.1% and 6% respectively.

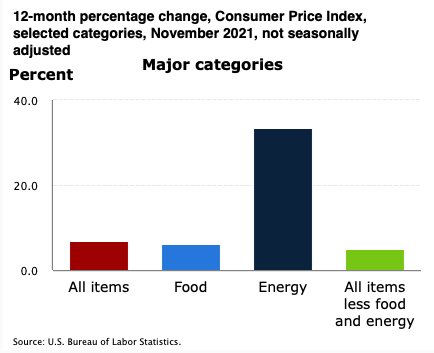

US inflation has been steadily climbing since early this year, reaching 6.8% in November, the highest recorded since 1982. Singapore, my home country, recorded its highest inflation since 2013 in October, at 3.2%.

Price increases exert pressure on interest rates and decreases the value of money, which makes it not prudent to hold on to large amount of cash beyond what is needed to meet emergency needs. It is perhaps timely to consider using that cash to either pay down your mortgage or to invest. Which is smarter?

There is no one-size-fit-all answer as much depends on your personal situation and attitude. While I have a definite bias, there are arguments supporting each option, which I’d like to lay out here to help in making an informed decision.

Mortgage Pay-down

- Peace of mind – This is no doubt the biggest motivator for most people who favour paying down their mortgage, or even fully, especially for those in retirement. There is something about being debt-free and owning your property outright which makes it extremely satisfying, along with the sense of pride.

- Mortgage interest vs investment return – If your preferred investment return is close to your mortgage rate, it is better to pay off the mortgage as that is a definite saving – a bird in hand – compared to investing. The latter always carries some risk and the projected returns are not guaranteed. However, given the current high-inflation-low-interest environment, this is not be the strongest argument now.

- Mortgage expiry – If your mortgage is expiring within the next 2 years and your intention is to renew it, it may be prudent to make some early repayment to reduce your debt quantum since interest rates are expected to raise further.

- Cash flow – You get better cash flow once the mortgage is paid off. This additional cash may come in handy, especially when inflation stays high. And if you invest this cash, you hob onto the investment bandwagon and can start earning returns.

- Retirement income not inflation-hedged: Is your main source of income in retirement your pension or an annuity pay-out? Is it inflation-adjusted? If not, then it is better to pay down some of the mortgage to reduce the borrowing as much as possible as the debt will only cost more in real terms when inflation spikes higher while your pension stays the same.

- Indirect investment: With the dearth of investment property in the market and huge price increases over the past couple of years, paying down your mortgage can be viewed as an indirect investment in your own property instead of buying into an over-valued property.

Now that we have explored the reasons for paying down mortgage, let’s look at the flip side of the coin which is to invest that stash of cash. So what are the factors favouring investment over mortgage repayment?

Invest

- Better returns – There are many instruments that give better return than the saving you can get by paying down your mortgage. When you invest, you let money work harder for you. Who does not like that? For example, return in broad market indexes has beaten mortgage rates hands down over the years, plus you can collect dividends along the way if invested in income stocks. Having said that though, you should have at least 5 years investment horizon to neutralise the volatility of the stock market.

- Compounding effect – Investing allows you to take advantage of the powerful phenomenon of compounding, which is like an avalanche that snowballs bigger and faster over time. The bigger the investment quantum and the longer the investment horizon, the bigger the effect of compounding. Every dollar invested today creates more value than the same dollar invested 10 years from now. Paying down mortgage deprives you of the quantum and time needed to maximise this compounding.

- Liquidity – Money invested into liquid assets like stocks and mutual funds can be easily accessed when needed. Living in such uncertain time now, with economies struggling to manage the resurgence of Covid infections, having access to cash whether for emergency or other life-changing opportunities is comforting and provides for peace of mind. Mortgage repayment is not reversible.

- Good Debt – Inflation shrinks debt. This means the value of your mortgage decreases accordingly by the inflation rate each year. Take for example my investment portfolio in the Netherlands, the outstanding loan value has shrunk by 5.2% while rental increment will be indexed to inflation, adjusting upwards every year. Double winner. And with a mortgage rate significantly lower than current inflation rate, my borrowings are effectively at negative real interest rate. Savers are paying borrowers like me for taking on debt.

Just as the world is not black and white, there are other alternatives besides using all your extra cash to pay down mortgage or invest it fully. One alternative is to re-finance to lock in better terms now if penalty charge is not overly hefty. You can deploy your cash holding to reduce the mortgage while possibly getting better mortgage term at the same time as most lenders offer more attractive rates for lower loan-to-valuation ratio since their risk exposure is lower.

We recently re-financed and extended our mortgage duration by another 5 years. The largest of our loans expires in Aug 2022 so as a pre-emptive strike against a bigger (expected) rate hike, we decided to re-finance to ride out further hikes in inflation and interest rates. Although the new rate of 1.83% means paying more than the 1.67% rate previously, it gives us security of not having to pay much more later. We are both old enough to remember the era of mortgage rates in the teens early 80’s. We used some of our extra cash towards paying the penalty to secure this peace of mind.

If you have a variable mortgage, now is a good time to fix it. This was exactly what we did 2 months ago for another of our mortgages, switching a variable mortgage to a 15-year fixed rate when we started seeing mortgage rates inch up.

Splitting your cash to pay down some mortgage and investing the rest is a hybrid option that allows you to enjoy both the benefits of reduced debt and all the advantages that investing brings while relieving the impact of inflation.

My personal preference is clear: I would invest over paying down a mortgage simply because one of my goals for 2022 is to still actively invest to grow my wealth. Besides, comparing current inflation to mortgage rate, it is virtually using free money for a proven – and my favourite – asset class. The one time I paid off a property purchase, I have had regrets till today. Mortgages are truly one of the best good debt around.

And if you live in a country where mortgages are tax deductible, like in the Netherlands and US, this effectively reduces the cost of borrowing so do factor that in when assessing your personal situation if applicable.

After all is said and done, every case is unique in terms of risk appetite, age, life stage, goals, time horizon, mortgage terms and tax environment. What is important is to take into account what matters most to you, and the people you love and care, when making the decision so that you come out tops in this inflationary time.

To wise decision,

Savvy Maverick

(Main image: Towfiqu Barbhuiya, Unsplash)

Disclaimer: The views expressed here are drawn from my own experience and do not constitute financial advise in any way whatsoever. Nothing published here constitutes an investment recommendation, nor should any data or content be relied upon for any investment activities. It is strongly recommended that independent and thorough research is undertaken before making any financial decisions, including consulting a qualified professional.