Keeping Cool During Market Meltdown

The market has been on a downward slide since the beginning of the year, with major markets losing 10% or more. The Russia-Ukraine war added fresh jitters to an already panicky market, exacerbating the bearish sentiment brought on by inflationary concerns and rising energy prices. Not just the US market but also Singapore, Hong Kong and China (since 2021), markets that I invest in. So what should regular investors like me do?

- Sell to stem further losses?

- Hold, wait for the storm to blow over and hope the markets stage a strong come-back?

- Buy more as many stocks are now more reasonably priced?

My stock portfolio suffered a big dive, wiping out 80% of profits despite it being 70% invested in stable income stocks. Luckily the overall portfolio value is still in the black, even though I’ve given back most of my profit. A couple of friends’ portfolios have gone into negative territory, which is painful. Other well-intentioned friends advised to liquidate and hold cash.

Seeing profit disappear is hard to swallow. I was more accustomed to seeing greens instead of a sea of ‘reds’ when scrolling through the Apps. Doubts started to creep in about the quality and resilience of my portfolio. I took comfort that it is only ‘paper loss’ and that it is being compensated by on-going dividend earnings and gains in real estate, collectibles and cryptocurrency. This underscores the importance of portfolio diversification, not just within asset class, but especially across different asset classes.

Navigating Market Turbulence

After about a week watching my profits steadily plummet, I decided to retrieve and review my personal Investment Policy Statement (IPS), which was drawn up in 2018. I wanted to draw some comfort and assurance by revisiting my investment goals and strategies, including when to exit.

- Investment goal: One of the goals is to have the combined portfolio of real estate, stocks, crowdfunding and other assets generate returns to cover at least 125% of living expenses. This is to allow for leftover funds to enjoy other ‘niceties’, reinvest to grow our wealth and for charity as well as legacy purpose.

Investment income is our only sustenance since we neither work nor own a business. Liquidating some of the loosing positions would impact this goal as 70% of our stock portfolio is invested in income stocks, generating a steady stream of dividend earnings. It is possible for our other income streams can make up for it (eg. rental income that will be adjusted for inflation at renewal) or we could make do with covering 100% instead of 125% of living expenses, foregoing niceties and secondary goals while market remains depressed. But wait, this is where the next point kicks in.

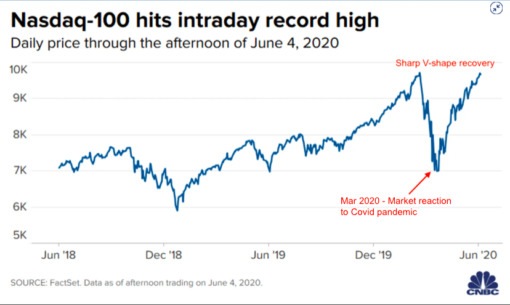

- Investment horizon: Our investment horizon is stated as 25 years and continues to be valid. Stock markets experiences ups and downs over the short term but in the long run, it has always shown to bounce back and continues to trend upwards. Markets have rebounded from every crisis and has repeatedly gone on to break its own ceiling, the only difference being recovery time.

History has ample examples where a market recovery happened very quickly, such as during the Covid pandemic where the recovery was a sharp V-shape, catching almost everyone by surprise. Staying out of the market can mean loosing out on such recovery, which is the best time to build wealth. It also could mean being on the wrong side of the wealth transfer.

- Target investment return: I had set different target R.O.I’s by strategy as they can be quite wide-ranging, as such:

– Dividend stocks to deliver at least 2% above inflation

– Options 40%

– Growth stocks and/or opportunistic buys 25%

Adhering to this rule means buying when market goes down since stocks would be cheaper and better valued. So I have started increasing stakes on a few good counters as well as adding 2 new stocks to my portfolio that were on my watch list.

Since not knowing when the market will bottom out, I am buying in phases whenever the markets go into another deep correction. With markets so high-strung and investors on their toes, I reckon there will be more buying opportunities.

Having wrapped up my first buying spree in the 1st 2 weeks of March, I am allocating additional funds for another 2-3 more tranches so am waiting with bated breath. Seeing the unit cost price being averaged down by the additional purchases appeased my uncertainty since it means better return and yield.

- Portfolio Rebalancing: The portfolio is to be re-balanced at least once a year or when market events warrant, like when profits has been wiped out 80%. Going through the re-balancing exercise presented me a chance to do portfolio clean-up by getting rid of a couple of losing positions and allocating the proceeds to better counters.

One of my portfolio sizing rules is maximum 7.5% weightage for any individual stocks, for which 2 of my holdings exceeded marginally. I have 3 options: (i) choose to do nothing and wait until year-end to re-balance, (ii) sell some of these 2 stocks to bring them in line with the rule or (iii) buy into other good counters to keep the exceeded weightage in check. I chose the last option, taking advantage of the current attractive pricing to buy into 3 existing counters by topping up the proceeds from the disposal of the 2 duds.

Revisiting the investment policy statement affirmed my investment goals and strategies, strengthening my portfolio through the re-balancing.

Sell, Hold or Buy?

Back to the dilemma whether to Sell, Hold or Buy? I deed all 3:

Sold: 2 loss-making counters, both under Growth/Opportunistic category, to tighten up portfolio quality. Selling at a loss is hard as it means converting paper loss into out-of-pocket real loss but sometimes it is necessary when a bigger plan is at play.

Hold: Holding on is what I have done with the majority of my portfolio. These are fundamentally strong stocks paying good dividends which, together with rental income, fund my retirement living. Sometimes keeping cool and doing nothing is best if investment case still holds true. Overarching long-term goals should overrule short-term market jitters.

Bought: 2 new counters that were previously on my watch-list as well as topping up 3 existing income stocks.

As can be seen, whether to sell, hold or buy depends on one’s overall investment plan, strategy and market opportunity. My personal investment policy statement gave me the assurance and impetus to undertake all 3 actions to strengthen my portfolio.

An Investment Compass

Investing is very much influenced by emotions and psychology, especially in the absence of a clear and coherent plan. It is not easy to stay calm when all hell breaks loose, which was what the past couple of months felt to me.

Having the investment policy statement is like a compass to guide me through choppy water giving clarity, direction and confidence resulting in the right behaviour. It acts as a playbook laying out what should be done when a market situation changes. It helps to reinforce long-term goals over short-term challenges and indecision.

Most importantly, it keeps me from selling in the heat of the moment, jeopardising my long-term plans and goals.

Keep cool,

Savvy Maverick

(Main image: Todd Turner, Unsplash)

Disclaimer: The views expressed here are drawn from my own experience and do not constitute financial advise in any way whatsoever. Nothing published here constitutes an investment recommendation, nor should any data or content be relied upon for any investment activities. It is strongly recommended that independent and thorough research is undertaken before making any financial decisions, including consulting a qualified professional.