Entrepreneurship vs Investing – Why I’ll Always Choose One Over The Other

At the end of this month 30th April our only shop tenant – a candy shop – ceases operation, after more than 10 years in business. It is 1 of the sad developments in an otherwise successful 1st quarter on a personal front. While neither our longest nor highest paying tenant, this husband-and-wife team holds a special place in my heart.

Why? Because entrepreneurs are a special breed. They are the embodiment of magic in our earthly planet. Imagine seizing upon a dream or an idea and making it into reality. This dogged determination catapults them into gravity-defying heights, like twinkling stars in the sky.

Lure of Entrepreneurship

Our society is captivated by success stories of tech unicorns like Facebook (a.k.a Meta), Instagram, Spotify, Uber, AirBnB, Twitter to name a few. These tech start-ups have inspired many to embrace entrepreneurship because they have proven that odds can be beaten.

Starry-eyed youth and the strong-at-heart believe they have what it takes to start a business where 50% will not make it past the 5-year mark. Driven by such optimism, entrepreneurs embark courageously on a path fraught with stress, hardship and possibly failure. Peter Thiel labelled them definite optimists in his book Zero to One – those who dare to create and shape a better future, not just for themselves but also for society as a whole.

Being an Entrepreneur

Despite its shiny lure, entrepreneurship is hard. It means taking everything on one’s shoulders, being engulfed in endless worries, fire-fighting and having to wear multiple hats to keep the plates spinning in mid-air. It means sacrificing time with family and friends, foregoing hobbies, working long hours, being responsible for employees, coping with financial woes and even flirting with financial ruin. Managing a business demands 110% of time and attention, making it impossible to build a safety net to soften the fall should the business fail. It is putting all eggs into 1 basket!

Our shop tenants take on sales, marketing, inventory replenishment, customer service and book-keeping on top of spending 8-10 hours manning the shop as profit is too thin for hired help. On occasion when help is needed, as when 1 of them falls ill or during busy period, their daughter who lives in another city has to come back to lend an extra pair of hands.

Every year, they allow themselves only 10 days’ of vacation, always in January or February, and almost always in Netherlands. Why? Because shutting the business means no income and winter is when income lost is minimised. Vacationing in the Netherlands means being able to scramble back should there be an emergency. Such is the lot of small and medium business owners.

Even though I admire the entrepreneurial spirit, given the choice, I would always choose to be an investor.

Cashflow Quadrant

In his follow-up book ‘Cashflow Quadrant’ to the phenomenally successful ‘Rich Dad Poor Dad’, Robert Kiyosaki grouped people into 4 categories, namely:

E = Employees, a group craving security through employment and the most risk-adversed

S = Self-employed who are less risk adversed, work for themselves and hire no employees

B = Business owners, the biggest risk takers who start businesses and hire teams

I = Investors, the most financially literate group that uses money to generate income.

In order to become wealthy, it is essential to move from the left side of the quadrant to the right, i.e. away from being Employed or Self-Employed to become either a Business Owner or Investor.

Even though both Business Owners and Investors are on the right side of the quadrant, they are not created equal in my view. Investors have more choice, enjoy better lifestyle and most importantly, have more time at their disposal.

Investors versus Business Owners

Responsibilities: Investors do not have to worry about staff, sales, marketing, products or services, operations, keeping tab on competition, cashflow woes and more. The magnitude of responsibilities entrepreneurs take on is way disproportionate to those of investors.

Risk and Diversification: Investors can deploy funds across different asset classes, industries, geographical region or currencies to diversify risk. A business owner however, is committed to 1 industry and switching is impossible. Like entrepreneurs, investors also take on risks whenever they make an investment. However some of their risks can be managed or minimised through portfolio diversification, position sizing or the use of tools like options.

Disruption: With technology changing at such a rapid pace, businesses run the risk of being disrupted by new technology, innovation, obsolescence and shift in consumer preferences. Every business faces longevity challenge, even big established companies.

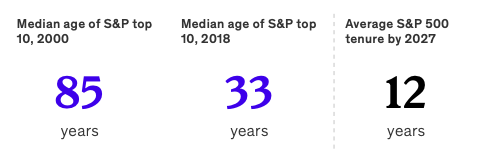

The median age of the top 10 companies listed on S&P was 33 years in 2018 and the average S&P500 tenure is expected to be only 12 years by 2027.

Here too investors can adopt appropriate portfolio plan such as tighter exit strategies and more active management instead of the buy-and-hold strategy which is no longer valid. The statistics itself bode for the difficulty in maintaining the growth and survival of a company.

Financial stress: Businesses require timely funds for essential expenses like rental, employees’ salary, stock replenishment, sales and marketing expenses which often cause tremendous stress to business owners.

Time factor: Running a business, regardless big or small, requires significant time commitment. Small business owners like our tenants, who cannot afford hired help, man the shop themselves, sacrificing vacation, weekends and many events with family and friends.

Even owners of big organisations that can afford to hire top talents are not immune to this. Elon Musk is known for working 80-100 hours per week, through birthdays (his, family’s and friends’) and rarely taking vacation. While not all entrepreneurs are workaholics, he is not a big exception I suspect.

Investors on the other hand, can control the amount of time and effort spent managing their portfolio by appointing management company to manage their property portfolio or choose to invest in Mutual Funds instead of executing trades personally.

Location independent: Investors can structure investment portfolio such as to be able to manage it wherever in the world, in whichever time zone as long as they have access to internet, laptop/computer or smart phones. An investor friend of ours has been sailing on his yacht with his family the past 3 years, while managing his portfolio on-the-go.

No Fault of Their Own

The success of a business does not lie solely in the hands of entrepreneurs. External factors can have huge adverse impact on their business and for which they cannot do much about:

- Legislation (eg. China education industry fiasco)

- Natural disaster (eg earthquake, floods)

- Pandemic resulting in movement restriction (eg Covid)

- Strikes and slow-down (eg global Occupy movement)

- Technological disruption (eg. cannibalism by new invention such a smart phones)

Our shop tenants experienced this first-hand during the 2 Corona lockdowns in the Netherlands, despite several months of rental support from us. During the 2nd lockdown, it became apparent that their entrepreneurial spirit was dimming by the day as their personal reserve got depleted. Their retirement plan dissipated right before their eyes and they could do nothing about it. That was when they made the decision to call it quits.

So a star flickers out, and the sky is lesser bright because of it. I will miss their particular star …maybe it will pop up in another place, another time.

Star-gazing…

Savvy Maverick

~ This post is a tribute to our tenants Hanneke and Wilfred ~

(Main image: Brooke Lark, Unsplash)