Managing Our Expanding Digital Footprint In An Increasingly Digital World

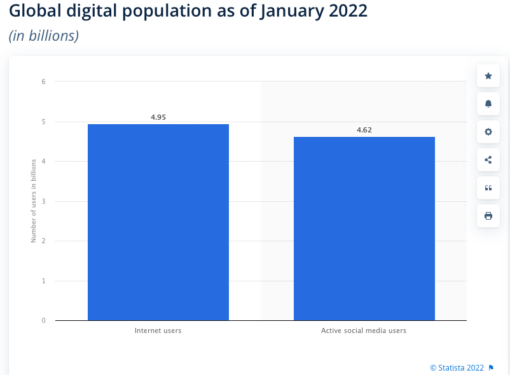

Living in an increasingly digital world means many of us are conducting more and more transactions online through our computers, laptops, iPads and mobile phones. Over 62% of world population today is connected to the internet and more than 50% of us are on social media.

Think about it: when was the last time you stepped into a bank for money matters or a travel agency to book a trip? Bank branches are shutting down in record numbers and travel agencies have largely disappeared as customers become more savvy digitally, expanding their repertoire of online self-servicing.

The global Covid pandemic has hastened this digital conversion as many hopped onto the digital bandwagon to cope with the many restrictions that were imposed. We turned to online meetings, banking, shopping, ordering meals, keeping in touch, learning online and even medical consultation. Most of the new converts are unlikely to go back to the brick-and-mortar way of doing things, having tasted the ease, speed and convenience of online options.

Our Digital Life

The average person is estimated to have approximately 150 online accounts requiring a password or some other form of identification to access. Many of us are living quite deep in the digital realm without being conscious about it. Simply scroll through the Apps installed on one’s mobile phone will attest to this.

I have even taken to digitising and moving to cloud storage almost all of my records so I can access whatever I need, whenever I want, wherever I am, for maximum mobility in retirement.

While this digital development brings immeasurable convenience, it also increases our digital footprint to an unprecedented level. Many of these digital activities and online transactions are not apparent to others beyond ourselves. And this has given rise to a pertinent need to manage access to our online accounts and digital assets in case something untoward happens to us.

There have been multiple cases of family members taking organisations to court for access of their loved one’s digital content and assets. One of the most well-known cases is that of Rachel Thompson vs Apple, in which the widow sued Apple for access to her late husband’s treasure trove of photos and videos. After more than 3 years of hassle, distress and hefty legal costs, the court ruled in her favour and ordered access to be granted. This is something we want to avoid.

Digital Assets

Digital assets are things of value (monetary or otherwise) but have no physical presence and are subject to ownership and/or right of usage. It runs the gamut from spreadsheets, photos, emails, websites, videos, chats, cryptocurrencies, game tokens, digital wallets to name a few.

While it is clear that some digital assets such as cryptocurrencies and balances in digital wallets belong to us, some others are not as clear or straightforward.

Contrary to popular belief, the content and data on all social media platforms such as Facebook, Instagram, Twitter, Google and Apple are owned by the respective technology organisations and not the users. Buried somewhere in the user agreement are statements prohibiting transfer of account and that the right of use ceases upon death.

Disparage Practices

It is interesting to note that most service providers do not allow access to a decedent’s content and data, not even to family members. And for those who do, practices differs as can be seen from some of these examples:

Apple: The Digital Legacy feature grants users up to 5 ‘Legacy Contacts’ who will be provided with an access key for access to information and content within a specified period of time. Thereafter, all account data and content will be deleted.

Facebook: User accounts will be memorialised and access provided to assigned Legacy Contact to perform limited function such as pinning of tributes and changing of profile picture. A 2nd option is to delete the account, for which all content – posts, photos, comments, messages – will be permanently and irrevocably deleted.

Google: Under the ‘Inactive Account Manager’, users can specify how their accounts are to be handled. This includes deciding which data is to be shared and passed on, for how long the account should remain open and the feature of leaving a personal note to the digital trustee.

LinkedIn: User accounts can either be memorialised or closed once proof of death is provided. Memorialised accounts on the platform are locked and no further updates or access will be allowed. Deletion of account can be requested and will be completed within 21 days of request.

Legislation

As in many modern living aspects, the law has yet to catch up on digital assets and digital inheritance. This is particularly true of digital assets with no commercial value but has enormous sentimental value to family members and close friends.

Examples include photos, videos, blogs, emails, posts, presentation, chats and messages. These contents are precious in preserving the memories and as keepsake, especially now that many of us no longer own physical photos or handwritten correspondences. As such, these contents form an important part of our personal legacy.

Privacy laws and intellectual property rights further add to the complexity of a comprehensive legislation. Until this vacuum is filled, there is a need for us to institute better control to ensure proper access to our content and data in the event of the inevitable. By taking a few simple steps, the dreadful court case cited above can be prevented.

Digital Access Log

Compile a Digital Access Log by listing down username(s), passwords and answers to recovery questions, where applicable. State in detail how each data and content should be handled, eg photos to family members, presentations to business partners, emails to spouse. This Digital Access Log should be shared with a trusted partner, such as spouse or a sibling, or be included as part of your will.

Most countries’ laws prohibit access of accounts by other than the account holder. However, this remains the easiest and most effective way for digital trustees to organise and distribute digital content and assets according to the wishes of decedents. The legal way is to seek approval from relevant authorities and parties, which can be a long drawn process, or wait for probate to kick in.

In some instances, having prompt access to a decedent’s account can help to circumvent payment of hefty inheritance tax. A Singaporean ex-colleague of mine did exactly that by accessing her husband’s stock trading account and sold off his US stock holdings shortly after his demise. He had provided her with access details and detailed instructions on desired handling of his portfolio. For the uninitiated, foreign owners of U.S. assets are liable to pay 40% inheritance tax on all US assets such as real estate, stocks and bond. Despite this not being legal, it is widely practised and it is difficult to be tracked.

Once created, one just have to maintain and update this log to capture new online access or update changes such as new passwords. The log can be updated whenever there is a change or at a regular frequency like quarterly. At the very least, the digital access log should be reviewed annually. In fact, make this part of annual review and year-planning exercise.

This log also paves the way for a comprehensive capture of one’s digital assets that can be easily included to the Schedule of Assets for legacy planning. Our digital life needs sprucing up and decluttering as part of legacy planning too, no difference from our earthly life and possessions.

In a world where we navigate seamlessly between one digital platform to anther, this log is a simple yet powerful and effective way to manage one’s expanding digital footprint. Foregoing this control means allowing a very important aspect of ourselves to fall into the arbitrary handling of service providers. It will also save a lot of hassle, time and costs for family members and loved ones.

As we wade deeper into the digital realm, it is prudent to accord some time to create and maintain a Digital Access Log, regardless of age. I view it as part of being a responsible digital citizen. It takes only hours to compile and maintain, but its impact will be beyond us, perhaps even for generations to come.

Bits and bytes for thought,

Savvy Maverick

(Main image: Li Zhang, Unsplash)

Disclaimer: The views expressed here are drawn from my own experience and do not constitute financial advise in any way. Nothing published here constitutes an investment recommendation, nor should any data or content be relied upon for any investment activities. It is strongly recommended that independent and thorough research is undertaken before making any financial decisions, including consulting a qualified professional.