My Experience As Foreign Buyer of Spanish Property

What makes investing in a foreign country so interesting is the opportunity to have a deeper experience with its culture, practices, a perspective of its infrastructure and to some extent, the quirks of its society. And so it is with this mindset that my other half and I embarked on the process of buying property in Spain.

Every country has its own set of rules governing real estate, ranging from investor-friendly and hence easy-to-navigate, to waddling into an ocean of bureaucracy, restrictions and unexpected costs and frustration.

Drawing from personal experiences in several countries, I must say that the Spanish regulations for foreigners buyers of real estate, while not restrictive, lean towards the more complicated and bureaucratic side. Plus I have the added challenge of not speaking the language at all and my other half speaks only enough to order drinks and a meal at the restaurant, which mostly ends up the wrong dish by the way 😉

Spanish Attraction

Thanks to its glorious weather, stable political climate, affordable cost of living and good social infrastructure, Spain is fast gaining status as a preferred destination for 2nd home, retirees and digital nomads.

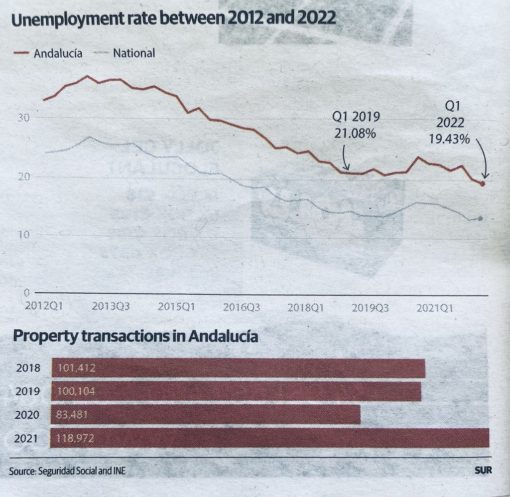

Andalucía, where Costa del Sol is located, has not only recovered from pre-pandemic levels but exceeded in key indicators such as employment, exports and foreign investment, as cited by the INE (Instituto Nacional de Estadistica), the National Statistics Institute. Zooming in to Marbella, real estate transaction recorded an increase of 80.4% compared to 2020. And across Andalucía region, 1st quarter 2022 already saw an uptick of 37% in transaction.

Majestic mountains silhouetted against kilometres of beaches, beautifully landscaped golf courses and breath-taking views of the Mediterranean Sea. Where in the world can one glide down a ski slope in the morning and head to the beach for dinner the same evening? So besotted were we that we decided to invest in a rental property and to set-up our 2nd home here.

So here are some sharing of my experience in buying property in Spain as a foreigner.

- Purchase taxes and stamp duty: Spain adopts a national framework governing property transactions but allow each autonomous region to set their tax rates and stamp duties, resulting in different cost structure depending on location of the property. Buyers of resale homes pay the ITP, which is equivalent to stamp duty in other countries. This is lower than what buyers of new homes pay – a combination of IVA (like VAT) and AJD which is a Documented Legal Acts tax. Examples of taxes and duties across some popular regions are provided below to showcase the difference:

- Mortgage: Though variable interest rates are common, this is starting to change due to rising interest rate as more borrowers opt for fixed rates. Mortgage interest offered to foreigners tend to be higher than those for locals, in the range of 2%-3% and loan quantum is capped at 70% of valuation or transacted price, whichever is lower. A maximum of 35% of net income can be used for total mortgage payment, ie interest and repayment. Additionally, loan duration is commonly up to the age of 70 years.

As a rough indication, take for example a 60-year-old overseas retiree with a net monthly pension income of €3,000. He can be offered a mortgage where monthly interest and repayment does not exceed €1,050 (€3,000 x 35%). Using simple linear computation at mortgage interest of 2.5%, the maximum loan quantum he can qualify for would be approximately €100,000.

- Proof of income: Deriving no income from Spain (yet), it was surprising that our bank took into account our overseas rental, pension and other income in assessing our mortgage application. Dividend income is stoutly excluded, which defy logic since these are regular and fairly stable income too.

With inflation at all-time high over the past 2 decades, it was a no-brainer to take advantage of the negative interest rate of a mortgage, akin to being paid to borrow money to invest. This is 1 great example of deploying Other People’s Money at its best! The higher the inflation rate, the more the debt will shrink in real term, making mortgage 1 of the best tools against inflation.

- Agents’ fee: At 5% this is slightly negotiable and is borne by fully by Sellers. Fees are split equally with the buyer’s agent if there is one. Most agents in Marbella speak English so it makes sense to appoint one as the good ones can provide a better understanding of the neighbourhood and its surrounding, some historical perspective and for property selection and appointment-making, since their cost is borne by the Seller.

- Lawyer: While a notary is compulsory and a lawyer is optional, I consider both equally important, especially for foreigners. A notary legalises and brings documents to the public domain; a lawyer conducts due diligence to prevents buyers from buying into a problem. Besides registering property deeds, lawyers’ tasks include:

– Conduct all necessary searches to ensure no breaches/claims

– Verify Licence of First Occupation (required for short-term leasing)

– Act as Power of Attorney if needed

– Apply for NIE

– Arrange utilities (water, electricity) and payment of owner’s association contribution.

– Ensure property is delivered unencumbered

In Spain, seller’s debt is passed on to the buyer upon transfer so it is vital to have a lawyer check that all debt is cleared. Lawyers in Marbella typically charge 1%-1.5% fee or a fixed scale based on purchase quantum.

Buying With Mortgage

Buying a property with mortgage in Spain has additional procedures and hence, more costs. The additional processes and/or requirements include:

- Valuation: The very first thing a bank requires for processing mortgage application is a valuation report to ascertain the market value of the property. Costs for such valuation report in Marbella range from €300-€600, usually by a panel approved by the bank.

- Life insurance: Banks will require owners to take on a life insurance as part of risk mitigation in the event of death or total permanent disability of the borrower. Such policies are often arranged through the bank as part of the condition of mortgage, usually with an insurance partner. Premium vary accordingly to value and duration of the mortgage.

- Property insurance: In addition to life insurance, lenders will also require that owners take on property insurance to cover for instances of fire damage, leakage, renovation accidents and damages to the mortgaged property. For property below €500,000 such insurance typically costs €300-€400 a year, a sum well worth the peace of mind.

- Mortgage Processing Fee: Banks typically charge a fee for processing the mortgage, ranging from 0.5% – 2%.

- Bank Notary Fee: As the mortgage has to be legalised and this is added to the fee of the Notary when signing the public deed of sale. Hence notary fee are higher for property purchased with mortgage versus outright cash purchase.

1 Other Quirk

Buying an overseas property necessitates opening of a local bank account for payments and deductions such as monthly mortgage repayment, community dues, property tax, sewage, trash and other municipal service charges. For rental property, a local bank account is required to receive rental payment.

All mortgage providers require opening of a bank account which is why we opened ours at Banco Sabadell, one f the major banks in Spain.

Now imagine my surprise at the exorbitant fees levied by Spanish banks, referencing bank Sabadell as an example:

- Online transfer to another local bank: 0.4% (for amount > €20k)

- Receiving funds from non-EU countries: 0.25% (minimum charge €6)

- Transfers to other banks within EU countries: 0.75% (minimum charge €22)

- Online transfer between own bank accounts: 0.05% (minimum charge €1.20)

- Online transfer to other banks: 0.4% (minimum charge €4.50)

Having bank accounts in several countries, I have never encountered such high bank charges. Especially for property transactions, which run from hundreds of thousands to millions, these fees add up substantially. And to top it all off, the Sabadell branch at our neighbourhood operates from 9.30am to 2pm, Mondays through Fridays.

Parting Shots

Coming from both scenarios of buying with a mortgage and without, I can safely say there are significant differences, the most striking being:

The fact that property transactions are increasing despite the points highlighted, attest to the attractiveness of owning a property in the Costa del Sol. For eager buyers, its many other attributes more than compensate for these quirks, which are accepted as part of the price for owning a slice of paradise on earth.

If you are interested, here are some property sites to browse for your dream home:

No pain, no gain, no Spain!

Savvy Maverick

Disclaimer: The views expressed here are drawn from my own experience and do not constitute financial advise in any way whatsoever. Nothing published here constitutes an investment recommendation, nor should any data or content be relied upon for any investment activities. It is strongly recommended that independent and thorough research is undertaken before making any financial decisions, including consulting a qualified professional.