Dealing With A Triple Whammy – Rising Interest, Inflation And Bear Market

A triple whammy of rising interest rate, surging inflation and bear market are upon us. And to make matter worse, recession and nuclear war threat are stoking the fire of an already overheated brew, threatening to boil over. When was the last time such calamities reared their heads all at once? Never before…so what can one do?

1. Rising Interest Rate

In line with the rising US Fed benchmark rate, all interest rates have increased, markedly. In US, 30-year fixed home rate has risen to average 6.81% compared to 3.13% a year ago, the highest since 2006. The Netherlands is not faring any better with 5-year fixed home loan rate skyrocketing to 5% compared to a mere 1.5% a year ago. And in Singapore, 2 & 3-year mortgage rates have more-than-doubled to 3.5% – 3.85% from 1.5% – 1.8% compared to September last year, prompting the government to introduce new property cooling measures to stave off excessive borrowing in a climate of rapidly rising mortgage rates.

In the face of such steep increase, it is better to switch to a fix-rate mortgage from a variable one? That ship has sailed, in my humble view. However, if the thought of further mortgage rate increases is making you lose sleep, here are some options to explore:

- Switch to shorter fixed term loan between 2-3 years. Hopefully inflation will be under control and the Ukraine war will have an outcome by then. Fixing for longer term is costly as interest rates are close to historical high.

- Extend loan duration to reduce monthly repayment to ease affordability.

- Overpay current mortgage if you can. Paying down a 4.5% mortgage makes better sense than earning 3.5% on fixed deposit. The bigger the loan principle the bigger the saving. Most mortgages allow for certain repayment percentage every year without penalty, by doing this you give yourself some slack down the road.

- Re-finance if the loan is nearing expiry and penalty charges not excessive. You are entitled to better mortgage rate with reduced loan-to-valuation (LTV) ratio if you have been paying down principle in addition to monthly interest. Recent spikes in property prices would have helped to lower your LTV too.

Money Management

Review and pay off ‘bad’ debt such as credit cards first. These typically charge high interest rates so prioritise these pay-down over other loans.

Move emergency funds into higher rate savings account or an interest-bearing current account as banks start paying higher interest rates on these accounts too.

House-hunting

It is no longer sensible to be house-hunting unless no other accommodation option is available. Otherwise you will be burdened with hefty interest payment for years to come. Prices in some markets are starting to soften, so wait and let the market do its work for you.

In fact, my husband and I are in the midst of negotiating a sale to take advantage of still overzealous buyers who can afford a place in the canal district of Amsterdam. Having reached our investment objective, we choose to exercise our exit strategy to pocket real profit rather than letting paper profit disappear in a puff.

With cash-on-hand, the idea is to wait for opportunistic buys when the market crashes. This confidence is borne out of our experience from the last GFC where calculated contrarian moves grew our wealth multi-fold, enabling our early retirement. Real estate is cyclical and has a repeatability feature, which makes it a great wealth tool.

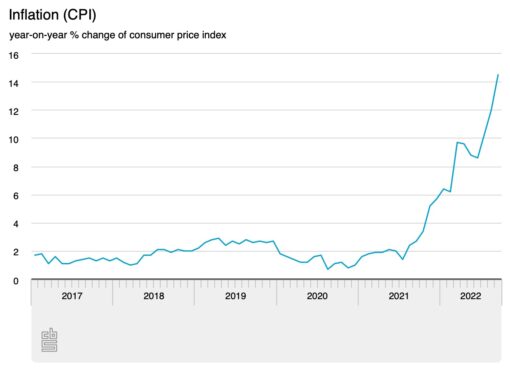

2. Untameable Inflation

The bigger monster that governments around the world is trying to slay is inflation. US Fed Chairman, Jerome Powell, has made it clear that the Fed will do whatever it takes to bring inflation down. The expectation is for benchmark interest rate to hit 4.6% by the end of 2023, which means likely 4 more quarters of hefty rate increases. So we are all in for a lot of pain before things start to ease.

Inflation in September reached 14.5% in The Netherlands, largely driven by energy prices that has soared 200% compared to September 2021. The US inflation in August is 8.3%, almost quadrupling in the past 2 years. Singapore’s August inflation hit 7.5%, the highest since 2008. At such high level, managing cost of living becomes a priority.

While some ways of dealing with inflation has been explored in an earlier post, here are additional ideas, to mitigate the unforeseen severity:

- Prioritise expenditures in favour of those that help save costs, like installation of double glazing or solar panels instead of renovating the kitchen. This will save on heating costs as winter nears. A friend postponed her annual summer vacation to January and February next year so she can save on heating costs and escape the Dutch winter misery. So get creative with your spending!

- Review expenses to cut out the unnecessary. Are 2 cars really necessary, a 500mb internet speed at home or subscriptions paid for but hardly made use of? Take this opportunity to review and eliminate redundant expenses. Survive first, thrive later.

- Make lifestyle changes for a better and healthier you while saving costs at the same time. Take public transport to work instead of driving. Walk or cycle instead of taking the last-mile cab ride. Stop or reduce smoking, lessen alcohol intake and eating out. Save and get healthy at the same time.

- Barter trade by exchanging services. I looked after the dog of a friend when she went on summer vacation in exchange for shortening curtains for our apartment in Spain. Everyone has some skills or can take on errands to trade for something else in need. Before the money economy, bartering was the way to trade.

- Recycle and give new life to things that are just taking up space and gathering dust in storage. Buy 2nd hand instead of brand new where feasible. There are so many platforms to sell and buy 2nd hand stuff nowadays.

- Shop smart by buying house brands, during sale or in bulk with friends and neighbours so everyone pays less.

- Plan grocery shopping and meals to reduce food waste. Globally, 1.4 billion tons of food is wasted every year. Besides saving on food bills, it also helps environmentally as food waste is a big part of landfills.

- Try a side income. Offer paid car pools if you drive regularly to work, make money from a hobby such as baking or start an online shop.

3. Bear Market

We are officially in bear market territory with major markets plunging more than 20% from their respective peaks. The S&P 500 has dropped more than 25%, Nasdaq -30% and DOW -20%. The sea of reds accurately reflects the bloodshed in the stock market.

Contrary to popular belief, bear markets occur quite frequently, every 4 years or so, though the magnitude is not like what we are experiencing now. On average, bear markets last 289 days with the shortest lasting a lot lesser. The pandemic-induced episode in March 2020 took just 45 days to make a V-shape recovery. Seriously, blink and you will miss it.

What is notable and a fact is that bear markets have always recovered to move on to new heights. The markets reward the patient and cool-headed so we would all do well to keep long-term objectives in mind, stay invested and ride out the turbulence.

Buckle up, a rough ride ahead!

Savvy Maverick

(Main image: Ondacaracola, Dreamstime)

Disclaimer: The views expressed here are drawn from my own experiences and do not constitute financial advice in any way whatsoever. Nothing published here constitutes an investment recommendation, nor should any data or content be relied upon for any investment activities. It is strongly recommended that independent and thorough research be undertaken before making any financial decisions, including consulting a qualified professional.