If 100 Is The New 80 – What Does It Mean For Retirement?

Is 100 the new 80?

As I follow 2 elections on opposite side of the globe: the US mid-term elections and Malaysia’s fifteenth general election GE15 taking place on 19 November, I can’t help but notice how the world is run by septuagenarians, octogenarians and nonagenarians.

- Joe Biden, President of The United States, will turn 80 on November 20th

- Nancy Pelosi, Speaker of the House of Representatives, is 82 years

- Mitch McConnell, Republican Senate Majority Leader, is 80 years

- Donald Trump, who is hinting at running for presidency at the 2024 election, is 76 years

- Mahathir Mohamad, Malaysia’s ex-Prime Minister, is contesting in GE15 at 97 years

- Anwar Ibrahim, former prodigy of Mahathir turned opposition leader, is 75 years

England’s Queen Elizabeth II held her reign until the ripe old age of 96 years. The Sultan of Brunei, Hassanal Bolkiah, current longest reigning monarch, is 75 years. And in my hometown Singapore, Profession Tommy Koh, Ambassador-At-Large with the Ministry of Foreign Affairs, a career diplomat with illustrious academic and legal stint, has just turned 85.

Irrefutable proof of how productive work life can be had in the run up to the centennial mark. No doubt that 100 is the new 80!

According to the WEF:

“A child born today in a middle-high-income country has a more than 50% chance of living to be over 105.”

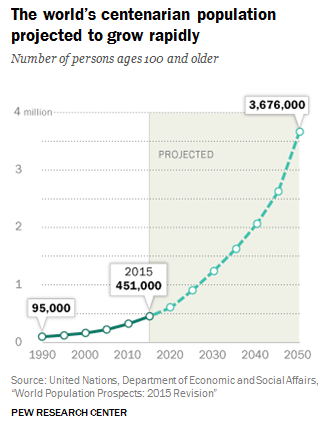

It is projected that centenarians will be the fasting growing demographic group, increasing to 3.67 million by year 2050. While longevity is good news, it does bring about personal challenges, in addition to social and economic issues.

Personal Challenges

Money

Chief among the personal challenges is doing something stupid like out-living our funds 😉 It will plunge one into an abyss at a point in life when one can ill-afford. Helloooo…anybody out there? (Echoes). A lucky few may still have family members to rely on but the majority would be on our own.

That is why there is no better time to start planning for retirement than now. And despite its popularity and wide adoption, the 4% retirement strategy is no longer applicable, precisely due to longevity reason.

We live in the information economy and this brings opportunities not available to our parents’ generations or generations before them. 1 way to plug this possibility of outliving our money is to continue doing ‘brain work’ to earn supplementary income, even well into retirement.

Investing is another way. Especially investments that provide inflation-hedged income to maintain purchasing power to cover living expenses. This is 1 of the main reasons why rental property is my favourite investment asset class.

Healthcare & Insurance

Truth is, the longer we live the more looking after ourselves will cost. Healthcare costs hasve sky-rocketed in recent decades and will continue to rise. In 2019, US healthcare cost was 16.77% of GDP while it was 9.83% in the Netherlands and 4.08% in Singapore. Comparing to the start of the millennia in 2000, healthcare costs have risen by 34%, 31% and 22% respectively. At current inflation rate, these increases will likely be even higher.

Healthcare costs between 2000-2019, L-R: US, Netherlands and Singapore. Source: World Bank

Those of us who work depend on company healthcare scheme much of our working life. But leaving work means giving up such benefits (and more) and we have to scoop up such costs ourselves to ensure continued coverage.

Hence, it is sensible to weed out the unnecessary to retain only the needed:

- Medical insurance – this is the single most important coverage, especially in the face of escalating healthcare costs. It pays – either fully or up to stipulated limit – for surgical procedures and hospitalisation expenses. Some policies even cover post-procedure recuperatory care.

- Life insurance – this is to help beneficiaries cover loss of income, cost of living and estate administration and to pay for inheritance tax. It is essential if you have debt and heirs to protect. 2 types of life coverage exist: whole life and term life insurance so it is wise to choose appropriately for maximum impact and cost management. Term life is much more affordable as it does not have a savings component and is limited to a specific time frame.

For those who plan to travel a lot in retirement, travel insurance is a good consideration too.

Mental And Physical Health

Imagine travelling at top gear and screeching to a halt and idleness suddenly, after 40 years. This sudden withdrawal from activities and interaction can have profound impact on mental and physical health.

Work, invented since the dawn of the Industrial Revolution, has become a huge part of our life and wellbeing. Besides providing a means of living, it also gives us purpose, routine, sense of identity, learning opportunities and social contacts. In other words, work gives us meaning. Try introducing yourself without saying what you do for work.

The best way to maintain mental and physical stimulation is to be active and participate in social activities and hobbies, especially those that take us out of the house. Interacting with others stave off loneliness (leading cause of depression) and keeps the mind active. Go on group tours even though you are fine to travel on your own; join a community or social club, take on part-time or voluntary work.

An old schoolmate’s dad retired at 68 after almost 50 years of work and quickly spiralled into depression and ill-health. He had not cultivated a hobby, personal interest or friendship outside of work. Instead of reaping dividends after years of toil, retirement brought on a numbing sense of loss of self. Within 2 years of retirement, he passed on.

Social Network

Maintain contact with colleagues or friends with whom you would like to spend time with in retirement. Do things together outside of the office to set up the structure for the friendship to extend beyond work.

And if you plan to move to a country with lower cost of living to stretch your retirement dollars, like many retirees nowadays, it makes sense to visit the country several times to get acquainted with its social infrastructure, get to know the locals and learn the language etc. It takes time to forge relationships but the effort to create and maintain such a social network will pay back in many ways in retirement.

Retirement 2.0

“Retirement is a journey, not a destination.”

Retirement is a journey where you can veer off the beaten track to explore untrodden paths, to discover and reinvent yourself. Like off-road driving, you need to adjust to the new terrain. It may be bumpy at times but it can also be exhilarating and empowering.

Think of retirement like other milestones in life: graduation, marriage, parenthood, hitting the big 5-0. Life continues after the event. For many years to come based on demographic outlook.

How longevity pans out depends on how prepared we are for it. The more prepared, the better and more joyful it can be. With the advent of technology, work itself has changed and the old status quo of retirement does not fit any more. Find and shape your own retirement 2.0 as there are more ways to retire than the traditional.

Working beyond 80 may be the exception now, but with longevity set to rise, it can become the norm in future. Here are some ideas to deploy your talent in retirement if you have prior experience as a:

Or try out some of these new economy roles:

To find more similar roles, check out these platforms:

The world’s oldest living employee Walter Orthmann, turned 100 years in May 2022 and has been gainfully employed for 84 years, and still counting. Bravo indeed!

The world may be on the verge of its first centenarian president/prime minister. Isn’t it time to think about and prepare for our longevity too?

Viva la vida,

Savvy Maverick

(Main image: Robert Anderson, Unsplash)

Disclaimer: The views expressed here are drawn from my own experiences and do not constitute financial advice in any way whatsoever. Nothing published here constitutes an investment recommendation, nor should any data or content be relied upon for any investment activities. It is strongly recommended that independent and thorough research be undertaken before making any financial decisions, including consulting a qualified professional.