Personal Lessons I’m Drawing From This Bank Crisis

It’s been impossible to escape news of the collapse of SVB, Signature Bank, near-collapse of First Republic Bank and takeover of Credit Suisse by its rival UBS of late.

In the aftermath, I’m drawing some valuable personal lessons from it. Dare I even use the term ‘aftermath’? The wheels are spinning and the tarmac still smoking from the emergency brakes the FED and other market participants had to apply to avert a global crash. The air is filled with a burnt aroma and ashes are still swirling restlessly in the air.

Social Media Age

What is scary this round is the speed at which events unfolded. The entire SVB saga took all of 48 hours to play out before the lights dimmed. Its demise hastened by social media, as aptly observed

“This was the first Twitter fuelled bank run” acknowledged Patrick McHenry, Chairman of U.S. House Financial Services Committee.

“We are entering a new era of a social media-driven run on banks” quipped Soloman Lax, CEO of online lender Revenued who was ex-investment banker and VC.

Tweets by concerned (or alarmist?) VCs caused an outflow of US$42billion in 1 day at SVB. No bank could have survived such a run. No action could have matched the speed, or reach, of the internet.

Speed And Interconnectedness

The world is moving at the speed of microprocessors, interconnected to such a complexity that makes accurate prediction impossible. Changes are happening by the second, broadcasted on social media platforms by the minute and acted upon en masse almost instantaneously.

No one party, not even big government agencies or global bodies with access to zettabytes of data and forecasting models can accurately forecast the outcome of a decision or action. Could the FED have foreseen a bank run from its aggressive rate hikes? Perhaps…

There are no lack of opinions and dissection of what went wrong, failure of regulatory oversight, fear of further contagion and the inevitable finger-pointing. Beyond the obvious ‘which bank(s) will be next?’, what about non-banking companies?

After all technology and social media weave through every company leaving none untouched in modern society. A run can happen to any organisation, not only banks.

Recall TerraUSD, which dived from US$87 to just US$0.0005 within a week, from May 5th – 13th 2022. Its sister coin Luna, similarly plunged from investor panic, causing collapse of both cryptocurrencies, supposedly safer being pegged to the US dollar.

And the bankruptcy of FTX, the 3rd largest crypto exchange before its implosion, was no less dramatic. Its founder and crypto poster-boy Sam Bankman-Fried, whose net worth at 1 point stood at US$26 billion, went from crypto hero to zero in a matter of 10 days.

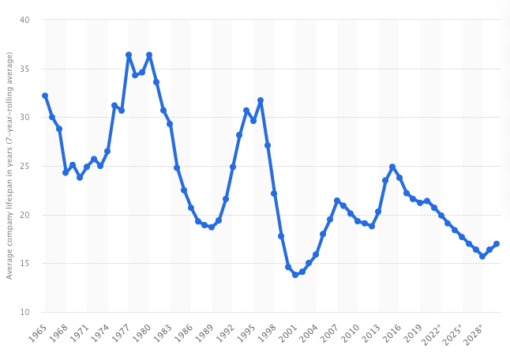

Corporate Survival

Some scary stats: a McKinsey study reported the average lifespan of companies listed on the S&P 500 in 1958 was 61 years. This became 18 years in 2016 and it’s expected that by 2027, 75% of companies quoted on S&P500 would no longer exist. 1 obvious reason why buy-and-hold strategy for stocks is no longer viable.

Think Borders, Tower Records, JC Crew, Toy R Us, Blockbuster, Alitalia…to name just a few.

Even Google – whose market position was considered somewhat untouchable – came under threat recently. The relatively young upstart ChatGPT, an AI-powered chatbot, poses a challenge to Google’s prowess as a search engine. It offers human-like, direct and concise responses to queries instead of spewing millions of matches.

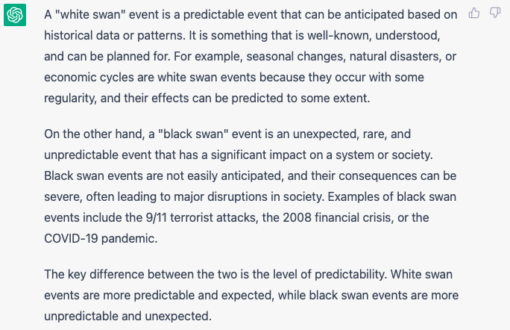

Have a look at its response to my query: “What is the difference between a white swan and black swan event?”.

Quality over quantity. In our modern hurried world, time-saving is everything. No wonder Google felt threatened, to the point that co-founders Larry Page and Sergey Brin, who left the day-to-day running of the business in 2019, were invited back to help with its AI projects.

Another instance: Meta, which changed its name in October 2022 to reflect its focus then, is pivoting towards AI, after billions of losses in the wilderness that is metaverse.

Neither size, pedigree nor branding offer shelter from the harsh reality of corporate survival.

Lesson #1

So what lessons am I drawing from these events? The strongest message is that long-term planning is obsolete. Because as soon as such plans are laid on paper, they are outdated. What good would a 5-year strategic plan be in the case of Meta? On the contrary, it could even be detrimental by sticking to it. Long term = rigidity.

Way better to use long-term goals to formulate short-term initiatives or actions to achieve them.

Short-term Initiatives

The moment I start thinking short-term, initiatives become clearer, more succinct and actionable. They are easier to track and can be quickly adjusted if things go off course. This is akin to applying the power of everyday to compound small actions into big outcome over time.

For passive income, no longer will I buy a stock for growth potential. I will gradually re-allocate funds to dividend-paying stocks. Much prefer to get paid along the way than wait for market or fundamentals to deliver a profit, which can take years. Maybe never.

In real estate, no more those requiring major renovation before we can flip or rent out. Only properties needing minor touch-ups so cash flow can be earned in the shortest possible time. Cash flow is, and will always be, the real deal. Not least during times of uncertainties.

Rather than wait for Lunar New Year to do annual spring cleaning, I will review and discard possessions quarterly. Regular de-cluttering also helps keep my physical estate updated.

Learn something new every month. I set ChatGPT as my goal this month, and am having so much fun with it! The learning need not to be anything grand like the Metaverse. It can be as simple as attending a webinar on will-writing or learn to use new feature on the banking app.

Lesson #2

The more I get into short-term mindset, the more I see its beauty. Everything and every situation changes. The most profitable company, the best job or the worse period in life. They all come to pass, always sooner than one expects.

No point in taking life too seriously. Live it with a light-hearted take. When something bad happens, rant about it, have a cry, throw a tantrum if that helps but get over and move on. Why hold on to anger or sadness?

Short-term mentality encourages living in the moment, much like adopting the mindset of ‘why not?’ and ‘why not now?’. To live in the moment is to live vividly. After all, each moment is all we have and own.

“The best way to take care of the future is to take care of the present moment” ~ Thich Nhât Hanh

Short is indeed sweet,

Savvy Maverick

(Main image: Venti Views, Unsplash)

Disclaimer: The views expressed here are drawn from my own experiences and do not constitute financial advice in any way whatsoever. Nothing published here constitutes an investment recommendation, nor should any data or content be relied upon for any investment activities. It is strongly recommended that independent and thorough research be undertaken before making any financial decisions, including consulting a qualified professional. Data and information cited from credited source are correct at date of publication and will not be updated thereafter.