Starting Late Is No Hindrance to Success, Including Planning for Retirement

How’s this for myth-buster: the average age of successful start-up founders is 45, according to research by Harvard Business Review.

This puts to rest images of start-up founders being young college drop-outs barely out of teenage awkwardness hashing it out in their parents’ garage. Young founders the likes of Mark Zuckerberg (19), Michael Dell (19), Melanie Perkins (19), Hillary Yip (10)…are in fact, the outliers.

Even for young founders, success tend to come later, in the 40’s. Empirical data shows that late starters have better odds at success. Starting late is no hindrance to success, how comforting for those of us on the wrong side of 40 🙂

Young Guns?

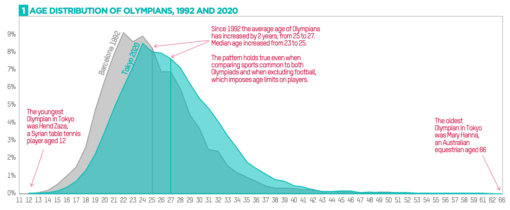

The same goes for sports champions. The media and fans get into a frenzy whenever a young upstart breaks the mould or clinches a medal:

- Hend Zaza from Syria, became the youngest participant at 12 at the Tokyo Olympics.

- Romanian gymnast Nadia Comăneci was 14 when she stood on the Olympics podium.

- Australian swimmer Ian Thorpe scooped up 5 Olympic medals at the tender age of 15.

- Tiger Woods became the youngest Masters winner and instant sensation at 21 years, in a sports dominated by men double his age, inspiring a whole new generation of golfers.

Such wins make for inspiring and compelling reads. They enforce our adoration and obsession with early achievement. These stories give the impression that success favours the young and bold. But the truth is quite the opposite.

A study by the Centre for Excellence in Population Ageing Research (CEPAR), shows the average age of Olympics participants has gone up, increasing by two years from 25 to 27. The median age also increased from 23 to 25.

And not just in sports and business, but across many industries, achievers are getting older. Look at Michelle Yeoh scooping up the Best Actress award at this year’s Oscars, at 60!

Success Factors

Why is starting late no hindrance to success? Here are the 3 factors:

- Experience – more years under one’s belt means a better sense of what works what not, hence better decision-making. Lessons from previous failures can be drawn upon to maximise chance at success. Having been there, done that, bought the t-shirt and made it through means earning the stripes of wisdom and knowledge. Knowing what to avoid, when to persevere, when to change course and how to solve problems are crucial in acrossing the finishing line.

“Experience provides short cut to success, eliminating trial and errors.”

- Resources – these can range from financial to technical know-how. It takes time to build resources but they are definite firepower. They open up options, lighting up more pathways and enabling better ways of doing things. Just like ammunition on battlefields.

- Contacts and network – a soft power that extends the sphere of influence beyond oneself. Through the years, we build more contacts in our network. These contacts work like a multiplier, increasing our effectiveness when called upon, both in professional and personal sphere.

Late Starter

It got me thinking if late starters have better success rate at retirement planning.

Though retirement planning has always been at the back of my mind, life, career and fun got in the way. I suspect this is true for many others – we know we should start earlier but somehow never get round to it. Until a major life milestone or situation shuffles it to the forefront.

For me, that was turning 40. Retirement planning was 1 of the big life decisions I make whenever a birthday that ends with a ‘0’ rolls around. And I believe retirement should be for better lifestyle because it represents harvest time for my earlier efforts, sort of saving the best for last.

Lean In on Years

By then, I’ve had 20 years of work experience, picked up valuable life knowledge and skills. I have accumulated sufficient savings to invest with impact, established contacts from Asia Pacific to US to Europe. I started investing for retirement in the midst of the Global Financial Crisis. Starting in Singapore and the Netherlands, tapping on home ground advantage, then expanding to US and Spain as opportunities arose.

My husband and I consulted our network on preferred neighbourhood, investment property to avoid, rental rules and regulations, taxes and tapped on referrals for property agents, insurers, accountants, handyman…the whole enchilada. Without their help, it would have taken much longer to research and build our portfolio.

Though at times doubtful if we are taking on too much risk, we have never been afraid or feel panicky because we know our depth and are clear about what we don’t want. With 3 recessions between us, we know rainbows emerge after rain showers. But only if we position ourselves to enjoy it.

To this very day, we still make use of leverage and geographic arbitrage to reap cost benefits. We remain single-minded and focused on retirement goals, and are not distracted by shiny objects. Reaching my goal 8 years after starting retirement planning is no small feat, helped tremendously by the GFC. It goes to show starting late is no hindrance to successful retirement planning.

2 Sides of Same Coin

Youth and experience are 2 sides of the same coin. When young, we lack experience but have time on our side to make mistakes, learn and compound small gains into big outcome.

On the flip side, with more years under the belt, we can draw on knowledge, resources, contacts and goodwill to turbo-charge our effort.

Get started! It’s never too late to embark on new endeavours, including retirement planning. What matters more is to start, commit to it and apply your knowledge, resources and contacts. Regardless which side of the coin we are, there are advantages to draw on to reach our goals.

The young have dogged determination and endless energy; the experienced possess perspective and strategy. All of which are precious.

Success favours the young late starters,

Savvy Maverick

(Main image: Jorge Fernández Salas, Unsplash)

Disclaimer: The views expressed are drawn from personal experiences and do not constitute financial advice in any way whatsoever. Nothing published here constitutes an investment recommendation, nor should any data or content be relied upon for investment activities. Please seek independent and thorough research before making any financial decisions, including consulting a qualified professional. Data and information cited from sources will not be updated after publication.