Is Retirement Still Relevant Today?

The world is ageing. People are living and working longer. The nature of work – what, how and where – has changed and will change exponentially with the advent of modern technological such as 4th generation AI and beyond. Is retirement still relevant today, given a slew of new realities?

Reality Bites

Longevity, while a triumph for humanity, poses a huge challenge for society and at individual level.

“Human life expectancy has doubled between 1900 and 2000. Scientists predict that more than half of babies born in rich countries today will live to be 100.” ~ WEF

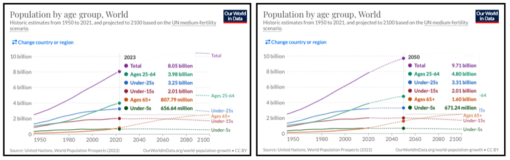

This year, those 65 years and older represents 10% of the world population. By the middle of the century in 2050, this cohort will balloon to 16.5%.

Add to this percentage those under 25 years who have yet to join the workforce, the percentage of population not working will be 50%. Can the world afford to have so many people not working, including those in their 60’s-70’s who are healthy, able and willing to contribute economically?

Why Work?

With the pervasiveness of nucleus families, retiring nowadays means having to deal with loneliness and inactivity…very bad for mental and physical health. Despite bitching about it – stress, office politics, unreasonable bosses, nasty colleagues – work adds aplenty to our lives: social interaction, purpose and fulfilment, sense of pride, income for a better lifestyle while building up a bigger pension.

Retire is to give up a lot of goodness. Because work has become such an integral part of our identity and modern life, retiring can be more detrimental than beneficial.

Granted, some simply cannot afford to retire and have to continue working to make ends meet. For this group, work is a necessity and not an option. But for many others, choosing work over retirement may be a better choice.

Retirement 2.0

Many friends within my circle are eschewing traditional retirement, preferring to work as long as they can. A good family friend Shaun who lives with his family in Melbourne Australia, studied to become a Prosecutor in his 50’s. This was in anticipation that he would have to retire from his physically demanding police officer role sooner while being a prosecutor can extend his work years by at least another 10 years.

The career switch means he keeps within the law enforcement network where he has built up great friendships. Such a portfolio career is a brilliant way to live and thrive in an increasingly multi-stage life due to longevity. He enjoys approximately 60 days of paid vacation each year, making it possible to have lavish extended vacations twice yearly.

In the past year alone, Shaun and his wife Anna visited me in Europe, cruised in Azerbaijan, rode hot-air balloons and soaked in hot springs in Turkey, and explored the volcanic coasts of Santorini in Greece. Isn’t it nice to have your cake and eat it too?

Another couple, let’s call them Brad and Angelina, are retiring on their terms. Brad chooses for semi-retirement, teaching design 2 days a week while leaving time to dabble in speculative design and art.

Angelina, on the other hand, is taking a 4-year part-time course on Traditional Chinese Medicine (TCM) with the intent to run her own TCM-cum-nutrition practice after leaving the corporate world. Brad is able to pursue his interest with a lightened work schedule while Angelina looks gleefully towards entrepreneurship in her 2nd act. Who knows, maybe more acts to follow?

And that, is Retirement 2.0 in action!

Economics

Considering that 100 is the new 80, retiring at 65 could mean another 35 years of life to be funded, as long as work years. If one is able to work, either full-time or on lightened load, it helps prepare for better later years and maintaining physical and mental fitness. This eases the pressure on pension systems that were not designed to cater to current life expectancy.

On the flip side, organisations gain too by encouraging employees to stay on beyond official retirement age:

-

- More stability and continuity

- Prevent loss of ‘corporate memory’ when employees retire

- Reflect diversity of customers and consumers, giving valuable perspective and understanding of the marketplace

- Mentors to younger workers

- Better decision making due to richer experience and life wisdom.

- Ease talent crunch arising from demographic inevitability of declining births. Technology and automation can only partially mitigate this gap but not fully.

Boomerang

I know of several retired friends and acquaintances who went right back to work within a year of retirement because they couldn’t fill the void left by leaving employment. A new breed of ‘boomerang employees’ except that instead of returning from a stint at another company, it’s a U-turn from finishing line. “Nothing to do at home’ was the comment by the husband of a friend when asked why he returned to work.

That underpins the importance of having continued purpose in life. Instead of just retiring from work, there must be something to retire to.

Retirement 2.0

As more enter retirement and start experimenting with it, Retirement 2.0 is taking shape, opening up many ways to retire, including never retire. There are ample well-known personalities who worked or are still working well beyond their 80’s:

- David Attenborough (1926) – world-renowned natural historian

- Iris Apfel (1921) – affable bespectacled fashion icon

- Queen Elizabeth II (1926) – was head of the British Empire until her demise at age 96

- Mahathir Mohamad (1925) – ex-Prime Minister of Malaysia ran for election in 2022 at 97

- Anthony Hopkins (1937) – appears in upcoming movie ‘Rebel Moon’

- And how about this? Half of US Congress members are 65 years and older! Enough said.

Work vs Life

As work and life increasingly merge, we should learn to fit work into life, and vice versa. So instead of being mutually exclusive, they become mutually inclusive and supportive.

Work enables us to fund enjoyment, fulfilment and growth in life, giving back in multiple ways. Why should something so beneficial end so abruptly at a stipulated age? Are we not living in an era of flexi-hours, parti-time work, job-sharing, telecommuting, remote working and…new possibilities?

Maybe it’s time for retired to stop meaning full withdrawal from work and instead about being retried in the trial of life. A chance to right the wrongs or missed opportunities in the past, but this time on own terms and guided by more experience, hindsight and wisdom.

Retried…never retired,

Savvy Maverick

(Main image: Anukrati Omar, Unsplash)

Disclaimer: The views expressed are drawn from personal experiences and do not constitute financial advice in any way whatsoever. Nothing published here constitutes an investment recommendation, nor should any data or content be relied upon for investment activities. Please seek independent and thorough research before making any financial decisions, including consulting a qualified professional. Data and information cited from sources will not be updated after publication.