Why Long-Term Care Is An Essential Part Of Retirement Planning

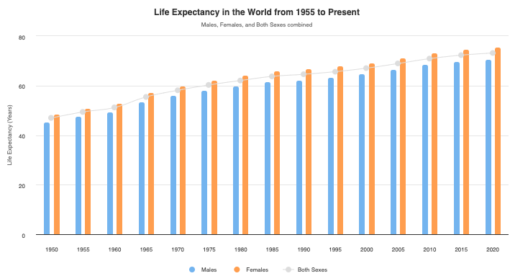

We’re living longer…hurray! Females in developed countries can expect to live to 85 years and their male counterparts 80 years. Global life expectancy has more than doubled from 30 years in 1800 to 73 years in 2017. 100 is fast becoming the new 80, what a feat!

Living Proof

My own grandmother lived to the ripe old age of 103 years. I remember when the family celebrated this milestone at a Chinese restaurant in 2017, many strangers came up to offer their well-wishes and shook her hands, including kitchen and wait staff, restaurant manager and several other diners. Many have never met a living centenarian and some even handed her red packets. Such is the lure of longevity.

But the sad fact is that many of these longer years will be spent in poor health, especially from the effects of modern lifestyle.

Longer But Poorer Health

“Globally, lives have gotten longer but not healthier.” ~ McKinsey Health Institute

Advancement in medical technology means more survivors will live with chronic condition, disability or disorder…and for many years. From medication, rehabilitation, home care to assisted living facility, these costs can easily run into hundreds of thousands annually. How can we afford it to cover these, especially in retirement?

That’s why long-term care is an essential part of retirement planning.

The Need To Plan For Long-Term Care

Planning for long-term care cannot be over-emphasised in light of higher life expectancy, more diseases becoming chronic instead of acute, increasing cost of custodial care and the inadequacy of medical and health insurance, which cover only treatment costs.

The most obvious needs:

- Protect our savings and assets from being wiped out

- Enable a certain quality of life while coping with the illness, disability or impairment

- Lessen financial and care burden on our family

Failing to plan means having to pay out-of-pocket or saddling on the shoulders of family. Imagine that in addition to the physical and emotional toil caring for us, they have to bear the financial burden too. Even if what is planned for does not cover all expenses, every bit helps in time of adversity.

Take the case of my centennial grandmother, who was relatively healthy and worked until age 89. In the final years as her dementia worsened, my aunt had to quit her job in addition to hiring a live-in helper to manage her care. A double whammy of increased expenses and reduced income, not to mention the physical and emotional stress.

So how can we cover for long-term care? The following are what I have researched for myself and my husband and are by no means complete. These financial products are complex and vary by insurers and location so please do your own research or seek professional advice if you’d like to know more about any of them.

Long-Term Care (LTC) Insurance

LTC insurance provides for post-treatment care and assistance, either at home or at long-term care facility. It kicks in when 2 or 3 (depending on insurer) Activities of Daily Living cannot be carried out independently, or when cognitive impairment is detected. Some even cover home modifications to make staying at home easier.

Drawbacks include:

- Hefty premium that increases over time, rendering it unaffordable at later stage when most needed. Cancellation means all prior payments will be forfeited.

- ‘Use-it-or-lose-it’ basis makes striking the right balance between sufficiency and wastage prudent since no residual value will be paid out if unused.

- To qualify, one must be in good health without onset of medical conditions or dependency. Stats show that the likelihood of claims increases every year past 65 and substantially after 70.

Life Insurance with Long-Term Care Riders

Life insurance with long-term care rider address the issue of rising premium, wastage and are easier to qualify for. Policy value will be paid out in advance, either partial or in entirety, once long-term care is substantiated.

Drawbacks:

- Not inflation adjusted, hence significant shortfall if policy is taken decades before claim.

- Payment is limited to amount of death benefit which may fall short of long-term care costs.

- Reduces inheritance to beneficiaries by corresponding cash value paid-out.

Deferred Lifetime Annuity

A deferred annuity is 1 where purchase is made in lump-sum or over a period with pay-out at a specified future date. The pay-out can be lump-sun or in instalment. It is less stringent on health criteria so a viable option for those with pre-existing conditions. Pay-out is triggered when specified date is reached, and not tied to qualifying health conditions.

Drawbacks: until the pay-out date is reached, the funds invested cannot be accessed without hefty penalty. Most annuities are not inflation hedged.

Reverse Mortgage

Reverse mortgage is a cash loan drawn on home equity in exchange for lump-sum or monthly pay-out by lender while still entitled to live in the said home. This option is suitable for those who are asset-rich-cash poor and plan to age-in-place.

Pay-outs are issued without qualifying conditions or restrictions on how the money is spent. Loan amount is usually up to a percentage of home value eg 70%, and repayment is made when the home is sold. Good thing is that seniors are protected and cannot be forced out of their home even if payout exceeds the loan amount.

Drawbacks: they are not readily available, complex, highly regulated and reduces the inheritance to heirs as lender has priority on sale proceeds.

Government Schemes

As the world grapple with ageing population, many governments have come up with public plans addressing long-term care costs. Do check out your public plans before going private as they tend to be more affordable, catering to the masses.

Own Responsibility

Long-term care is our own responsibility and we should let the burden be passed on to family members. With longevity a global phenomenon, it is prudent to include long-term care in retirement planning. Some friends are already taking initiative with creative solutions like co-housing with the idea to share long-term care costs.

Without planning, there will be no choice by to pay for long-term care expenses out-of-pocket. This can be exorbitant, destroy your legacy plan and be very stressful at a stage in life when one can ill afford. Even starting late may not be a hindrance, what is more important is to finding out more so you know what is available and appropriate for you and your significant other.

While I’ve not made up my mind, I’ve ruled out reverse mortgage and life insurance riders. My current term life is a better fit for me and it doesn’t make sense to switch now. If unsure which suits you, try eliminating what you don’t want to narrow your choices.

So make sure long-term care is part of your retirement planning, even if your mindset is to never-retire. This will protect your assets, legacy and dignity, while at the same time relieve loved ones of financial burden when caring for us in old age.

Take control,

Savvy Maverick

(Main image: Documerica, Unsplash)

Disclaimer: The views expressed are drawn from personal experiences and do not constitute financial advice in any way whatsoever. Nothing published here constitutes an investment recommendation, nor should any data or content be relied upon for investment activities. Please seek independent and thorough research before making any financial decisions, including consulting a qualified professional. Data and information cited from sources will not be updated after publication.