Buying A 2nd Home? Read This First

If you’re thinking about buying a 2nd home, read on for the whole 9 yards.

The idea of a 2nd home often brings about warm fuzzy feelings because of rose-tinted glasses we view it with. Nostalgia, fun time frolicking by the pool, gathering for a BBQ dinner sun-burnt but utterly happy. Buying a 2nd home is an extension of lifestyle…or is it?

Why A 2nd Home?

Reasons for a 2nd home are aplenty and can be as different as night and day:

- Holiday home at a favourite destination

- Pied-à-terre to reduce commute for work, relationship or be closer to family members

- Get-away for hobbies like golfing, surfing, skiing

- Seasonal escape for winter or summer seasons

- Retirement preparation for better affordability or improved lifestyle

- Change of environment from primary residence

- Investment while at the same time making use of it

- Bequest to the next generation

Regardless of the reason, a 2nd home should add to emotional or physical well-being, convenience or financially. Otherwise, it defeats the purpose of owning 1.

Reality

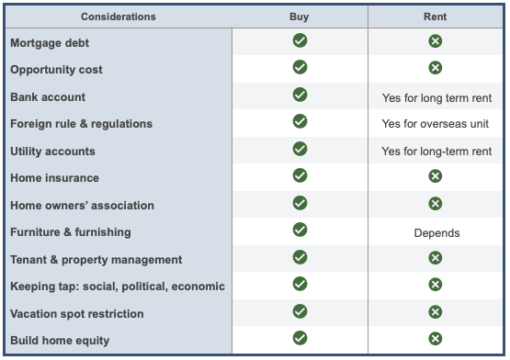

The reality is that owning a 2nd home comes with a full slate of responsibilities that you should be aware and prepared for:

- Mortgage debt – You’re committing to long-term debt if buying with a mortgage. While some mitigate by renting out when not using themselves, the income is hardly able to cover the costs of ownership. A mortgage also subjects you to the vagaries of interest rates, which can spike multi-fold as the past 1.5 years have shown.

- Opportunity cost – No matter the type of property, a 2nd home ties up significant sum of money. Money that you can invest for higher R.O.I., and with lesser hassle.

- Bank account – If the property is in another country, a local bank account is required for expenses and rental collection, if applicable. Additional currency risk exists if a different currency is involved.

- Foreign rules and language – Foreign ownership means dealing with foreign laws, regulations and language, which can be very different from what you’re used to.

Like what I learnt buying Spanish property: Buyers assume outstanding debts including overdue utilities, home owners association dues and unpaid mortgage instalments. Legal documents and all transactions are in Spanish. Where English translation is provided, it is strictly for understanding and not recognised legally. And I nearly fainted when I learnt about banking hours in Spain: 9am – 2pm!

- Utility accounts – Before you can enjoy the property, there are the mundane tasks of choosing utility providers and opening accounts for electricity, water, gas and internet.

- Home insurance – Modern life is never complete without insurance, and home insurance is a must. Coverage and premium vary widely so make sure to research or get recommendation for reputable insurers. I can’t stress enough the importance of this.

1 of our properties had leakage within 2 months of ownership. It caused flooding and dampened walls in our neighbour underneath, requiring urgent repairs. Luckily, our home insurance covered all repairs, including collateral damages. Our only cost was a bottle of wine for the trouble and hassle caused to our neighbour.

- Taxes – This isnother non-negotiable aspect of modern living. From property, municipal, sewage to rubbish collection and rental income tax (if applicable), these need to be factored into ownership costs.

- Maintenance and renovation – This runs the gamut from replacement of worn-out parts to major works like repainting, dealing with termite infestation or hurricane damage. It is especially onerous if the property is on the path of wreckage due to climate change. Financial expenses aside, you need to consider ability and bandwidth for such upkeep.

- Home Owners’ Association (HoA) – While this applies only to condominiums, it is why I prefer apartments over houses when investing in another city or country. HoA’s enforce standard and care of communal properties, uphold community rules and act as ‘eyes and ears’ for absent owners. Make sure to enquire about HoA health, especially financial reserve, as part of due diligence.

- Furniture and furnishing – Ahhh…the nice part. While decorating is fun, it takes up disproportionate time and effort for distant properties because of unfamiliarity. From 1st hand experience, this can be a drag. You end up with additional sets of sofa, bed, bedsheets, cutlery, crockery, utensils, vacuum cleaner, coffee machine, TVs…everything that makes a home a home. Not a problem until you sell. There is a reason why decluttering is such a rage nowadays. Have you heard the saying ‘the things you own end up owning you’?…Scarily true.

- Shutting down a property – a big chore in itself. Garden set needs to be covered up or taken indoors, water supply turned off (prevent flooding), alarm activated and appliances unhooked (fire hazards) before lock-up is complete. Not forgetting to entrust a neighbour with a set of keys for emergency access. And guess what? When you come back, the full enchilada happens in reverse order, plus cleaning and scrubbing before you can start enjoying.

- Property management – You can choose to DIY or appoint a property management agency. For the former, you need to commit time and effort, which can be challenging for a faraway property. If the latter, there will be added financial cost and some co-ordination.

- Keeping tap – Being a significant investment, you will want to keep tap on developments in the neighbourhood, local rules and regulations, economic and political situations. This is the aspect I feel most relieved from when my husband and I decided to downsize our property portfolio. Do you have the interest or bandwidth? Or would you rather be chasing birdies and eagles on a golf course instead of checking on such news.

Better Alternative

A 2nd home is a commitment for many years, including vacationing at the same spot year-in year-out if that was the original idea. Don’t you want to explore different environments and create new experiences? Is a 2nd home crimping your lifestyle instead of expanding it?

Surely it can’t be all or nothing? Fortunately, a good alternative exist – that is to rent! Short-term renting allows the same enjoyment without the burden and hassle of ownership.

Living in the time of a sharing economy brings options, variety, quality at affordable rates, ease and flexibility to the fore. Even if affordability is no issue, what about time and bandwidth, which are increasingly scarce resources?

Renting is a great way of wading into the shallow end of pool vs diving into the deep. It allows try-outs without hefty costs and long-term commitment. What if that special feeling wears off after 2 years, a change of job or life situation requiring a new plan?

The way I see it, there are overwhelming reasons to rent unless the objective is investment, retirement or bequeath. Then the costs and hassles become part and parcel of achieving the objective, overriding the negatives. For all other purposes, renting is a smarter and more sensible option, don’t you agree?

Make smart moves,

Savvy Maverick

(Main image: Bali, Indonesia, Savvy Maverick)

Disclaimer: The views expressed are drawn from personal experiences and do not constitute financial advice in any way whatsoever. Nothing published here constitutes an investment recommendation, nor should any data or content be relied upon for investment activities. Please seek independent and thorough research before making any financial decisions, including consulting a qualified professional. Data and information cited from sources will not be updated after publication.