Scams – A Sad Reality Of The Digital Age

Is it just me or does it not seem that news nowadays is dominated by war atrocities, climate disasters and scams? Wars and natural disasters affect a huge number of people, with public outpouring of rage or support and various agencies scrambling to help.

Scams, on the other hand, affect individuals privately and many suffer in silence. No one else to blame except self. A sad reality of the digital age. Unfortunately, scams are here to stay. And many incidents go unreported out of fear, shame or futility.

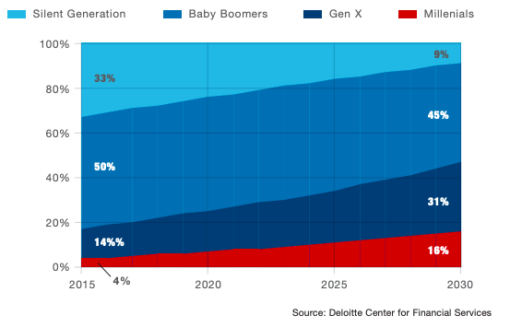

Technological advancement brings about many benefits, from direct messaging, online shopping to 24*7 banking at our fingertips. It has also led to an alarming rise in scams, with many elderly and retirees falling prey. This group also tends to lose the most, simply because they have more to lose. Baby boomers and those older control more than 50% of wealth, making them lucrative scam targets.

Scammed And Scarred

A friend C, in his late 70s and widowed, was embroiled in an elaborate inheritance scam lasting 1.5 years. The scammers took time to gain his trust by maintaining regular contact, then proceeded to coax him to transfer large sums of money. After each transfer, there would be new hurdle requiring more money to be sent in order to release the promised sum.

By the time he realised and reported to the police, it was too late. Nothing could be done as the scammers disappeared into the deep dark corners of the web, never to be heard of again.

A sorry statistic added to the growing pile of scam records. But to C, it is an irrecoverable situation, crashing his life into a bottomless pit. Within the blink of an eye, he lost everything, including self-confidence and self-respect. He even contemplated suicide at the lowest point but managed to pull through with the support of close friends, family and the hope of seeing his perpetrators brought to justice and punished.

Lucky

Another friend’s mobile phone was hacked and started receiving messages from his ‘bank’ about some account irregularity. As the number is familiar, he proceeded to click on the verification link sent. That click gave access of his bank account to the scammers.

His bank started suspecting something amiss after several big transfers were made to overseas parties. His bank account is used to receive monthly pension payment and for payment of living expenses. Initial attempts to reach him via his mobile failed of course since his phone was hacked. By the time the bank managed to reach him via email after 4-5 hours, a total of almost €120,000 had been transferred out of his account. Luckily in this instance, the bank accepted some responsibility and he managed to claw back the bulk of the amount, suffering a small net loss which he accepts for his own carelessness.

Smart and Smarter

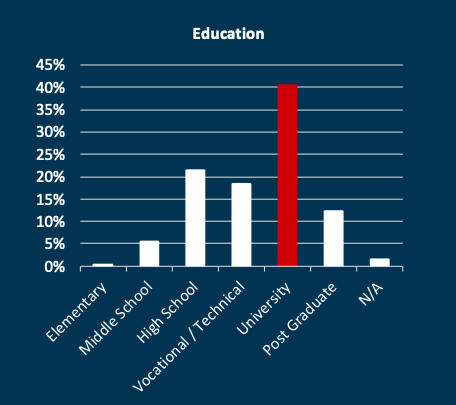

By all account C and the other friend are smart people, having worked as senior executives in MNCs. Both are upright, well-travelled, in great state of mind and wise in the ways of the world. How do people like them get scammed?

The fact is that with the help of technology, scammers and fraudsters are getting smarter. They can fake emails, bank accounts, mask phone numbers, concoct transactions, steal identities and produce convincing ‘records’. They operate in syndicates, corroborating on lies and tricks, preying on human weaknesses. A study by Cornell University found out that changes in the brain as we age make us more susceptible to being duped. This makes the elderly easy targets. How so?

Easy Targets

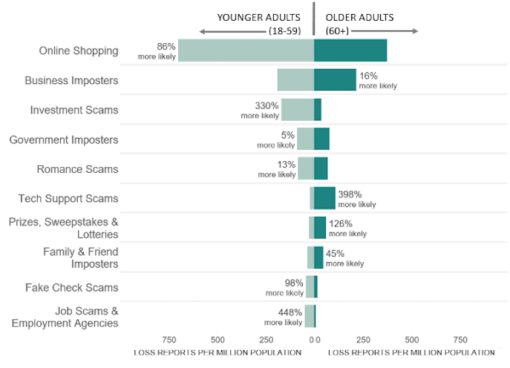

First and foremost, retirees have built up sizeable amount of money. Older folks tend to be less tech-savvy, more trusting of families, strangers and especially authorities. Many are lonely, willing and have the time to listen, making them vulnerable to approaches by strangers.

Data show that those 50 and older suffer the most losses in scams – a whopping US$3billion in 2021. And this is in the US alone. While similar global percentage is not known, it is likely this group ranks amongst the biggest losers worldwide too.

A worldwide survey conduced by non-profit organisation Global Anti Scam Alliance (Gasa) found a total US$1,026 trillion lost to scammers in 2022. Ouch! This is bigger than the entire GDP of my adopted home-country the Netherlands, and more than the GDP of 179 out of 196 countries!

Too Late

Being scammed is hurtful and jolting, for all victims regardless of age group. But it is most devastating for those 60 and older. For this group, there are few opportunities to make good the losses. And time – or lack thereof – to rebuild their lives. Losing one’s retirement savings, built up over a lifetime through painstaking sacrifices, is devastating and traumatic.

Protect Yourself

Here are some tips from the AARP Foundation on how to safeguard ourselves:

- Set privacy settings of social media accounts to be contacted only by people you know.

- Hang up suspicious phone calls, and call the family member in question back.

- Share with other family members or friends if you’re concern about a contact. Most scammers ask for secrecy and this should sound your alarms.

- Verify identity not by calling numbers provided by the caller but via official website. Do not trust FB/IG accounts as these can be easily faked.

- Don’t drop your guard because emails or phone numbers look familiar. Scammers can masks call numbers.

- Don’t volunteer information. Eg: if caller says ‘It’s me, grandpa!’, don’t say your grandchild’s name, wait for caller to say it.

- Do not let caller rush you into making a decision.

- Never send cash, wire money or information to bank accounts.

- Stay calm, don’t panic as that is exactly what scam artists want to get you to act urgently.

Money

Because of my friends incidents, I’ve advised my parents to put excess cash into Fixed Deposits, retaining only minimally needed in Current and Savings Accounts. While no fan of Fixed Deposits, this is 1 instant I approve of, as the money is safer there.

My Dad is quite engaged with his mobile phone. He likes to explore new Apps and gets many WhatsApps messages and forwarded links. I fear he would inadvertently click on 1 of those phishing links that may cause his bank accounts to be raided. I’ve shared both stories with my parents to make them understand and realise the peril of modern technology.

A Chinese saying goes :

“创业难,守业更难” ~ Chinese proverb

(Translation: To build a business is hard; guarding it is even harder)

While it means business, it applies just as fittingly to our life savings. Sometimes we win by not losing, as simple as that.

C is now in the process of looking for employment. Can you imagine someone approaching 80 and looking for work? He can’t think beyond next month, just living day-by-day, praying for the best but knows that his life will never be the same. What a heavy price to pay, for being trusting, gullible maybe, and for being all too human. No one deserves this.

Stay sharp,

Savvy Maverick

(Main image: Edoardo Maresca, Unsplash)

Disclaimer: The views expressed are drawn from personal experiences and do not constitute financial advice in any way whatsoever. Nothing published here constitutes an investment recommendation, nor should any data or content be relied upon for investment activities. Please seek independent and thorough research before making any financial decisions, including consulting a qualified professional. Data and information cited from sources will not be updated after publication.