Better To Invest In Stocks Or Real Estate Right Now?

Is it better to invest in stocks or real estate right now? Probably a favourite question for anyone with an ounce of investment gene in their make-up. This question is especially relevant to me and my husband as we start to receive proceeds from downsizing our portfolio in the Netherlands.

While we enjoy the simplification of our lives from the smaller portfolio, what do we do with the cash-on-hand? For us, 3 options to consider: re-invest in property outside of the Netherlands, put into stock markets or hold cash for the time being, and wait for clearer market signals.

Market Signals

At the end of October, both S&P 500 index and Singapore STI index dropped 10% from their respective 52-week highs. In 1 week, both have bounced back, attesting to the volatility of the markets.

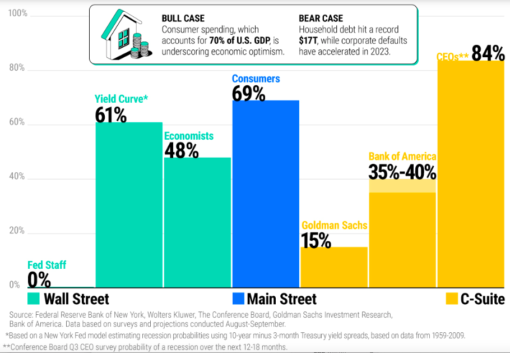

My investment sentiment in stocks has been dented by recent as well as ongoing events. The newly erupted Israel-Hamas war, the Russian-Ukraine war, sustained high interest rates accelerating corporate defaults and continued US-China tension. Recession seems to be lurking in the shadow.

Having cash-on-hand waiting for the shoe to drop may be sensible, but staying on the sideline somehow feels like missing out on the action. It’s like tuning out all the noises by switching off the TV, to be replaced by a hollow silence and a feeling of ‘now what?’.

So, on the pretext of staying invested and keeping our ‘time in the market’, we’ve decided to dive right back in. Which brings us back to the original question: should we invest in stocks or real estate given the current market and our particular situation?

Stock Appeal

My approach to stock investing continues to evolve in line with my personal growth as an investor and changing priorities. When I first started, I would seek alpha by devoting time to pick stocks, thinking I can do better than the professionals. Luckily I’m no longer under such disillusion of my limited knowledge, access to information and unsophisticated tools.

A study by the S&P Dow Jones Indices did not find a single mutual fund out of 2,132 that managed to outperform the S&P over a 5- year period. My attitude now is to invest along with the market by buying into broad based low-cost tracker funds.

So for me, compared to real estate, investing in stock index funds is:

-

- Less hassle requiring minimal time and effort

- High liquidity and ease of trade with short T+3 settlement

- Diversification with relatively low amount of investment

- Frequent and timely report on portfolio value and fund performance

- Regular cashflow if investing in dividend or income stocks

- Ease of management through Apps and online platform

- Ease for legacy planning

Market Jitters

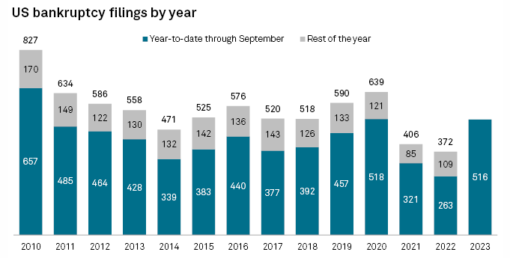

However, the economic landscape has become highly fragile and volatile, stoked by high interest and labour shortage. More companies have filed for bankruptcy this year. Think the banking debacle of Silicon Valley Bank and Signature Bank in February this year, Bed Bath & Beyond in April. Sara Lee, the iconic Australian frozen dessert maker went into voluntary administration in October. And Wework, once valued at US$47 billion, has filed for Chapter 11 bankruptcy protection in US and Canada this month. Falling fast & furious…

S&P Global Market Intelligence reported a total of 516 corporate bankruptcies in the US YTD September this year. This 3-quarter figure is already higher than the full year total for 2021 and 2022. And what is more worrying is the accelerating pace of bankruptcy: 62 in September vs 56 in August.

This is 1 big reason why I move away from individual stock holding to broad-based market index funds or ETFs the likes of SPDR S&P 500 ETF (SPY) or Vanguard’s VTSAX, VTI or VOO.

In addition to diversification (VTSAX has 3500+ component stocks), expense ratios are low with good track records. Companies that are no longer strong are either naturally purged from the index or have their impact muted by the sheer size of component stocks.

Stone Hedge

Real estate, on the other hand, requires more time and hands-on effort. Amongst the various streams of passive income, owning an investment property is the least hands-off. This is true even when you appoint a management firm. This is because decisions still need to be taken on lease renewal, tenant selection, replacement of appliances, attending AGMs etc.

However, from personal experience, real estate is unbeatable in terms of leverage ability, as an inflation hedge and a cash flow fountain that sprouts consistently and stronger as the years go by.

A good solution is REITs as it takes away the property management hassle while still offering the advantages of owning bricks and stones. However, the current high interest environment is not conducive for the performance of most REITs. It’s no-go sector as long s interest rates stay high.

Final Verdict

In the end, we choose for cash flow for the simple but crucial reasons that it is immediate, ongoing, certain and useful, especially in an environment of increasing likelihood of recession. Stocks may be less hassle and more liquid, but the only way to cash in is to sell when the prices go up, which is uncertain both in timeline and quantum.

From our personal experience, bricks and mortar have proven to be able to withstand the huff and puff of recessionary winds. And we decided to increase our stake in a market that continues to defy expectations – Marbella. In addition to its strong economy compared to other cities in Europe, the new Digital Nomad Visa in Spain is proving to be a huge draw for those who can work remotely. Many are flocking to the sunshine coast of Europe for the sunshine, high quality and yet affordable living.

As I write this, we’ve just gotten news that our bid for a townhouse in the Casco Antiguo (Old Town) Marbella has been accepted. The famous Plaza de los Naranjos is just round the corner with a never-ending stream of tourists, local visitors and residents whole year round, in a lively enclave and charming. Yeehaa, the flush of buying a property never wears out!

Rock solid,

Savvy Maverick

(Main image: Suhash Viluri, Unsplash)

Disclaimer: The views expressed are drawn from personal experiences and do not constitute financial advice in any way whatsoever. Nothing published here constitutes an investment recommendation, nor should any data or content be relied upon for investment activities. Please seek independent and thorough research before making any financial decisions, including consulting a qualified professional. Data and information cited from sources will not be updated after publication.