What’s The Difference Between A Financial Plan And A Retirement Plan?

In a recent conversation with a friend who was asking about retirement tips, she made a comment that piqued my interest. “I know some financial planning but I know nuts about retirement planning.”

What’s The Difference?

Come to think about it, is there any difference? To me, a financial plan and a retirement plan are different ends of the same stick. They address different stages in life where our needs are different. We start with a financial plan and it runs seamlessly into a retirement plan as life rumbles on.

Every financial and non-financial decision will come to bear in retirement years. The things we’ve done, or not done, will have its day of reckoning in retirement. How we live our days become our lives.

The house we buy, how much we save, how we budget, invest and grow our wealth, who we spend time with, our health routine. Every one of them has an effect in retirement – either positive or negative – whether we know it or not.

Money Wise

Financial planning starts from the very first notion about money management. The awareness and the act to manage money is the starting point to a financial and hence, retirement plan.

- Buying a new vs used car

- Taking a loan to study overseas

- Assuming a hefty debt to buy a larger-than-needed property

- Splurging bonuses on exotic vacations vs investing or saving for raining days

Every aspect of how we earn, save, spend and budget is financial planning in action. And by extrapolation, retirement planning. Isn’t the goal of every financial plan a blissful and care-free retirement?

Time Horizon

A financial plan addresses the earlier periods in life during active income-earning years when life is at its full throttle. A retirement plan, on the other hand, focuses on the period after gainful employment, at a time when life’s rhythm slows.

The concerns in retirement is lesser since major life milestones have been reached or are over. Such as education, career, getting married, raising a family, buying the first house etc. There’s less to juggle, and with a narrower focus.

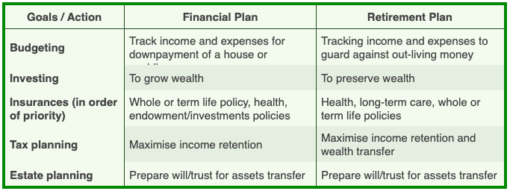

Similar Goals Different Focus

The goals between a financial and a retirement plan are similar, but with a different focus.

Resources

The resources of a financial plan are earned or business income, savings and investments. A retirement plan draws on pensions, social security, annuities, endowment plans and possibly investment income.

Risk Management

For financial plans, whole or term life insurance policy features prominently. This is to protect dependents against the loss of income in case of mishaps during prime income producing years. A big concern in risk management is to ensure that dependents are sufficiently looked after should something untoward happens to you as bread-winner.

In a retirement plan, risk takes on the form of spending or out-living your savings, healthcare costs and inflation. Health and long-term care insurance take centre stage as these costs can wipe out your retirement chest.

Investments, if undertaken, will become more conservative as preserving wealth supersedes growing your wealth. In fact, my husband and I think more about how best to spend down our wealth since we do not need to leave an inheritance, being childless.

Continuum

Every decision we take in life not only has an immediate impact but also repercussions in the future. It either adds to or takes away from our future. And due to compounding effect over time, outcomes are magnified, the good the bad and the ugly.

A financial plan is a continuum, just like life is. It adjusts to every stage of life, culminating in a retirement plan.

Income Strategies

The biggest dread for most of us is outliving our money. Having some income stream in retirement is a way to guard against such predicament. So income strategies apply both to financial as well as retirement plan, though for the latter, the shift may be against inflation.

During financial planning stage, a big part of income will come from employment or self-employment. There is more leeway and runway to explore different strategies and dabble in riskier asset classes like cryptocurrencies or other alternatives.

In a retirement plan, the focus shifts from wealth acquisition to wealth preservation. The essence is to protect what have been built up over the years. This naturally leads to a more risk adverse posture and investing in less risky assets.

Financial Plan vs Retirement Plan

I’ve never had a financial AND a retirement plan. My financial plan naturally evolves into my retirement plan when I started looking at the period post work. So if you have a financial plan, know that it will become a retirement plan because:

Financial plan = retirement plan = life plan.

Viva la vida,

Savvy Maverick

(Main image: Tulips in full bloom, Savvy Maverick)

Disclaimer: The views expressed here are drawn from personal experiences and do not constitute financial advice in any way. Nothing published here nor should any data or content be relied upon for investment activities. Please do your own due diligence before making any financial decisions. Data and information cited from sources will not be updated after publication.