Adapt In A Changing World For A Better Retirement

In an era of rapid change, staying adaptable isn’t just a skill, it’s a lifeline. This is especially true in retirement. From cutting-edge technology to shifting social norms, retirement today demands agility and a willingness to adapt in order to thrive. Or to survive.

Even the best laid plans need to be continuously adjusted to keep from veering off-course. Hence adaptability is more important than planning.

Over recent past 4-5 years, we have seen: interest rate and inflation spikes, rapid technology advancement, worsening climate changes, regulatory changes that affect us individually. Here are some examples of how I’ve adapted to these changes.

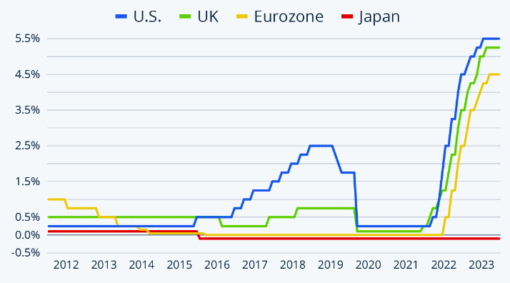

Interest Rate Spike

In early 2021, the economic landscape shifted within the blink of an eye when central banks started to raise interest rates. That would lead to direct impact on my retirement income, being largely derived from rental properties and dividend stocks.

At that time, quite a significant portion of my stock portfolio was invested in REITs, and they are sensitive to interest rates. So to protect my income stream, I reduced my REITs exposure, systematically selling over several months.

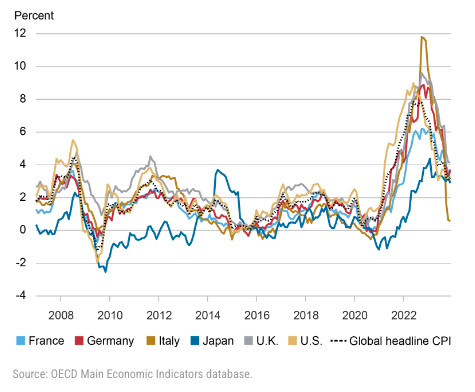

Inflation Spike

At the same time, inflation started to stir from its decade-long slumber too. The sale of REITs meant ending up with a cash holding.

Not wanting inflation to make a hearty meal of the cash, my S.O and I decided to allocate some into cryptocurrency. Cryptocurrencies were on the uptrend and we wanted to surf its crest first hand. We were lucky to ride to safety, make a profit before bailing out.

Regulatory Changes

1 of the reasons to sell an investment property is when regulatory changes render it unattractive. This was the case when the Dutch government introduced several new regulations and taxes in 2023 in a bid to address the housing crisis. The investment climate became very unfavourable to property investors, prompting us to downsize our portfolio.

As rental income constitute a large part of our retirement income, the sale was necessary to protect our living standard and not allow it to be compromised.

Climate Change

Global warming has been playing out in slow motion, with growing evidence to substantiate its destructive outcome. Since 2010, we had been building up a nice portfolio of rental properties in Fort Lauderdale, east coast of Florida.

Our properties were located between I95 and US-1, thinking there was enough buffer from the Atlantic sea. However, as hurricanes grew stronger each season, home insurance and property tax started to escalate, chipping away at ROI and our un-ease.

Despite the good cashflow, we decided to divest all our investment in Florida since exit conditions had been met. The sales were spread over a 3-year period, the last was sold in early 2022, allowing us to invest in Marbella, Spain.

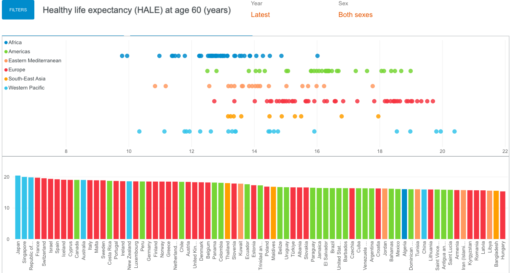

Longevity – Blessing or Curse?

Living longer is only 1 side of the story, the other aspect is the quality of that longevity. What’s the point of living longer if in ill-health, in pain or bed ridden? That’s why health-span, or healthy life expectancy as defined by WHO, is more relevant.

To put it bluntly – can we afford to live longer, individually and as a society? Funding 15 more years after retirement vs 25-30 years requires significantly different financials.

My S.O and I had planned to wind down our property portfolio by the end of this decade. We have since decided to keep some so we earn passive income for as long as practical. If 1 of us lives to 100 years, or both (God forbid ;-), we are at least financially taken care of. There is peace-of-mind knowing we will not outlive our money – reportedly the biggest fear among retirees.

It is in this same vein that we took up long term care insurance as part of our longevity plan.

Technology – The Good

Technology has brought productivity and convenience to my life: Zoom calls across countries, online banking, tax filing, flight and hotel booking. However, I never had affinity for wearables, doubting their efficacy and accuracy. They exploit the coolness of tech, relegating it to a fashion statement.

That was until a friend had a fall in her bathroom and was unconscious. When she came to, she was in excruciating pain as her lower body was paralysed, rendering her motionless and helpless. If not for her Apple Watch (water-resistant) through which she summoned help… the outcome could have been a lot worse.

Her story changed my attitude towards wearables, and I have been thinking about one. I hope my S.O gets the hint 🙂

Technology – The Bad

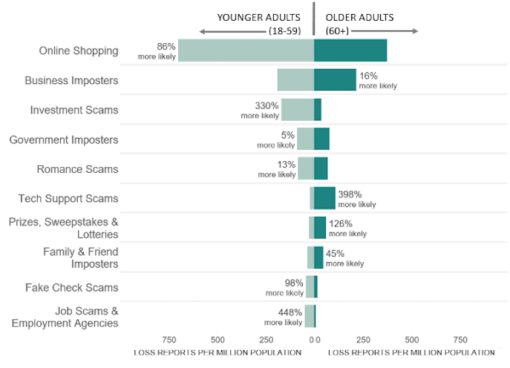

Technology is a double-edged sword. It greatly improves our lives but also brings unwanted development. Scams nowadays are so sophisticated that victims fall prone not because of greed or gullibility, but because of the blurring between real vs fake.

For example, the sad case of an elderly Singapore man who lost US$51,000 just for ordering a Peking duck by making a small S$5 deposit through an App. His phone was hacked and bank account raided, all for wanting to order a nice treat for his grandson.

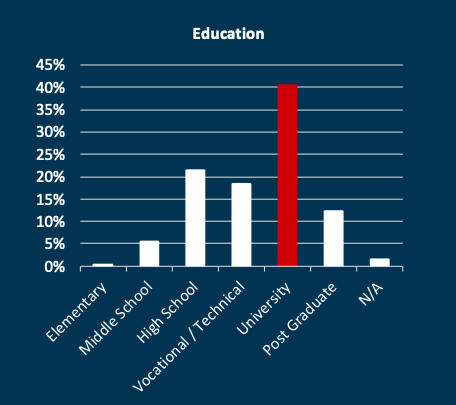

As borne out, scam victims are not just the elderly or the lesser educated:

After hearing from a couple of friends who were scammed, I decided to wise up and move my stand-by cash to fixed deposits. It’s a financial product that I rarely use. I like having access to my funds without being penalised for breaking a tenure commitment.

Although my emergency fund is now less accessible than in a current account, it is safer and a little more protected against scammers. Watching over what we’ve built is just as hard, as a Chinese saying goes:

创业难,守业更难

“Starting a business is hard; keeping it is even harder.” ~ Chinese proverb

Adapt…To Flourish

Retirement is a time to be extra vigilant to protect what we have built up. Not just from scammers but from many other fronts: economic, political, regulatory and even environmental.

Change is inevitable, but in retirement, it can be a catalyst to learn and see different perspectives, make new connections and re-discover possibilities. Retirement in the 21st century is not about retreating from life, it’s about adapting to thrive in a dynamic environment.

To better,

Savvy Maverick

(Main image: Javier Allegue Barros, Unsplash)

Disclaimer: The views expressed here are drawn from personal experiences and do not constitute financial advice in any way. Nothing published here nor should any data or content be relied upon for investment activities. Please do your own due diligence before making any financial decisions. Data and information cited from sources will not be updated after publication.