Are You Prepared For A Recession? Check Your Financial Ratios!

The month of August 2024 opened with a pounding of major stock markets from Japan to London to New York, causing stocks to plummet. A harbinger of recession perhaps? Even though markets have recovered somewhat, question remains: are you prepared for a recession? 1 good way to find out is to check your financial ratios!

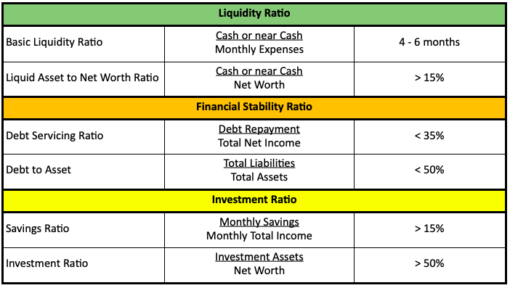

Financial Ratios

Financial ratios can reveal a lot about your financial health. And being aware is the first step to strengthen your position, not just for recession but life in general. The ratios expose areas for improvement and serves as a guide for prudent financial management and decision making.

These are several financial ratios and while all of them provide a measure on personal liquidity, stability and solvency, I like these 6 for their simplicity and clarity.

Liquidity Ratio

- Basic liquidity ratio (4-6 months): a.k.a Emergency Fund, this is the amount of money for monthly expenses and allow you to carry on life with some normalcy when income stream is disrupted.

Aim for 4-6 months to give time to re-calibrate and make plans for the new reality. Of course, the higher the amount, the bigger the safety net. But higher amount also mean too much cash stuck in low return products like savings and current accounts, FDs or money market funds.

- Liquid asset to net worth ratio (>15%): To compute this ratio, first ascertain your net worth:

Net worth = Total assets – Total Liabilities

In this aspect, maintaining a Schedule of Assets is useful to easily calculate your net worth. Then express your cash holding over your net worth for the liquid to net worth ratio. The higher this ratio, the more easily assets can be converted to cash, to meet unexpected medical expenses, for daily living (beyond your emergency cash) or to invest when opportunity knocks.

Financial Stability Ratios

- Debt servicing ratio (<35%): The amount of disposal income allocated to debt repayment eg mortgage (or rent), car loan, study loan etc. Even though rent is not a debt, it is a big ticket liability with 1-2 year commitment so include it to have a realistic idea of liability exposure.

- Debt to asset ratio (retirees <25%, <50%): This a proxy solvency indicator. A ratio approaching 50% means you should refrain from new borrowing until you’ve paid down other loans.

It is possible that this ratio is busted when a big loan is taken (eg mortgage) but then you should work towards paying down the principle to bring it down in as soon as practical, such as using year-end bonus to pay down mortgage.

A point to note though: while most prefer to be debt-free in retirement, I take a contrarian view. It is safer to keep a low mortgage in retirement to access the many benefits of a good debt. Having said that, make sure the debt to asset ratio does not exceed 25% in retirement years.

Financial Wellness Ratios

- Savings ratio (10% for retirees, >20%): The amount saved out of your total income. While retirees typically draw down savings rather than accumulate them, I recommend saving up to 10% retirement income to shore up confidence, for better peace-of-mind or an occasional extravagance.

While saving in itself is good, it should be invested beyond the emergency fund. Don’t let fears hold you back from investing.

- Investment ratio (>50%): The percentage of assets working to generate income or wealth. Because a residential property does not generate income, it should be excluded from this computation. This ratio should increase as you near retirement to ensure you can adequately fund your retirement living.

Much has been said about the 4% withdrawal rule for retirement living. New dynamics though, are rendering it flawed. Keep investing to generate cashflow, for that is the real king and 1 sure way to NOT outlive your money.

How To Be Recession Ready?

What if your ratios are not adequate to face a recession? Amongst the 6 ratios, these 3 are the most important to prepare for recession:

- Savings ratio

- Basic liquidity ration (emergency funds ratio)

- Debt servicing ratio

Here are some actions you can take now to improve these 3 ratios and hence, recession readiness.

Adjust budget – Review your budget to identify areas where you can cut costs and increase your savings ratio. A practical tip is to reduce discretionary spending and keep to expenses that are strictly necessary to keep building up your savings ratio.

Top-up emergency fund – Having a robust emergency fund is your first line of defence. Start by setting a goal to save 6 months’ worth of expenses, then work your way up to 12 months as the recession thunder rumbles. In preparing for recession, survival overrides yield maximisation.

Reduce debt – Focus on paying down high-interest debt such as credit card or overdraft. Prioritise retiring debt with the highest interest before moving to lower-interest debt. Overtime you will free up more income for other needs, reducing your financial stress.

Debt restructure – If you have built up equity in a house that is under mortgage, tap on that to pay off the higher-interest loans. Your debt is not reduced but your interest burden will be, accelerating your debt repayment. This is 1 of the reasons why I advocate keeping a low mortgage into retirement. So you can draw on low-interest borrowing when the need arises, for mortgages offer the lowest interest rates amongst all borrowings.

Another income stream – Add another income stream if you have the bandwidth. Be an Uber driver, take on a part-time job or convert a spare room for AirBnB rental. This beefs up your position in anticipation of a recession.

Preparedness

Personal financial ratios are invaluable tools to assess and strengthen your financial position. At every stage of life and not just when preparing for a recession. Whether you are just starting out in the workforce or have been retired for years, knowing your financial ratios leads to greater financial stability, preparedness, clarity and peace of mind.

Know your numbers,

Savvy Maverick

(Main image: Kekai Ahsam, Unsplash)

Disclaimer: The views expressed here are drawn from personal experiences and do not constitute financial advice in any way. Nothing published here nor should any data or content be relied upon for investment activities. Please do your own due diligence before making any financial decisions. Data and information cited from sources will not be updated after publication.