Want To Retire Better Or Earlier? Try Location Arbitrage

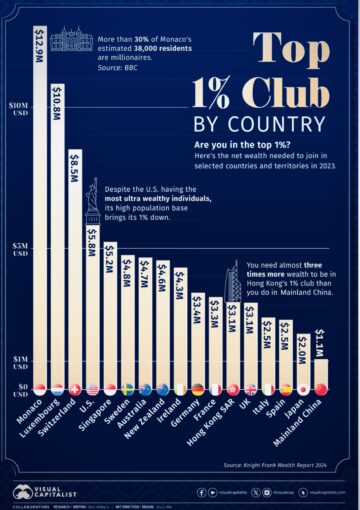

A recent publication by Knight Frank on the Top 1% Club piqued my interest. In my birth country Singapore, one needs US$5.2 million to make it vs US$2.5 million in Spain, where I spend almost 50% of my time now. It takes less than half the wealth to make it to the top 1% in Spain than in Singapore. This brings to mind the benefits of location arbitration.

For those who worry about retirement lifestyle or lament about not being able to retire, have you tried thinking outside the box? Or in this case, outside your home country…to open up a whole range of possibilities?

Location Arbitrage

So what is location arbitrage? It is when people relocate to countries or locations to reap cost benefits. By moving to a place where housing, healthcare, food and other essential services are more affordable, you can achieve similar or better lifestyle at a lower budget.

Popular Low-Cost Destinations

Several countries offer retirees the chance to live comfortably on less. And many of them have high expat communities, making it easier to socialise and adapt.

- Mexico (e.g., Mérida, Puerto Vallarta, San Miguel de Allende): Popular with American retirees due to its close proximity, affordable healthcare and a significantly lower cost of living. Average monthly expenses: US$1,500–US$2,500 for a couple.

- Costa Rica (e.g., San José, Guanacaste): Costa Rica is popular for its stable political environment, affordable healthcare and beautiful nature. Average monthly expenses for a couple range from $1,800–$2,500.

- Portugal (e.g., Algarve, Lisbon): Portugal is known for its high quality of life, great climate and a favourable tax regime for retirees. Its hugely successful golden visa, launched in 2012 attracted more than 12,000 applicants before it was radically revised in 2023. Average monthly living expenses is between $1,800–$2,500 for a couple.

- Spain (eg. Malaga, Valencia, Alicante): Famed for its culture, weather, cuisine and historical sights, Spain offers a variety of quality lifestyles at low cost. Average monthly expenses for a couple living in the city is between $2,200 to $3,000.

- Malaysia (eg. Kuala Lumpur, Penang, Johor Bahru): Blessed with stunning natural landscapes, modern amenities, excellent cuisine and good infrastructure, Malaysia has been attracting retirees through its Malaysia My 2nd Home (MM2H) programme. Average monthly expenses ranges from US$2,400-US$3,200 for a couple.

- Thailand (e.g., Chiang Mai, Hua Hin): Thailand has beautiful beaches, lush greeneries, friendly locals and great food amidst tropical settings at very low cost of living. It is a favourite for many retirees not just from Asia but also Western countries. Average monthly expenses is from $1,500–US$2,200 for a couple.

These 6 countries showcase the varied choices available for location arbitrage. I’m familiar with the last 4, having shortlisted and visited to assess their potential for 2nd home/retirement living. I had compared Portugal vs Spain and wrote about Malaysia’s MM2H visa before its latest revamp in Jun 2024.

Key Considerations

To location arbitrage successfully, first think how a country aligns with your needs, values, and lifestyle before diving into these key aspects:

1. Financial Advantages

The driving force behind location arbitration is lower costs so financial considerations are of utmost importance. Key components of living costs are:

- Housing – Property can be a fraction of where you are living now. In Ecuador (Cuenca), Thailand (Chiang Mai) and Malaysia (Penang), a two-bedroom apartment in the city center can cost as little as $500–$1,000/month.

Take time to know different neighbourhoods by renting before you buy. 1 way to do this is to scale down your current home to release funds for your target destination. By living in smaller spaces in more places you widen your perspectives and experience first hand what living is like in another country. Do this before applying for the retirement visa as property ownership may be 1 of the conditions.

- Healthcare – Many countries offer both public and private healthcare with very different coverage and costs. Besides costs, the waiting time for treatment is another consideration. For eg, most public healthcare has a longer waiting time so despite it being lower cost, you may want to pay for private healthcare for speedier treatment. Understanding the differences so you can selecting the best option for your situation in terms of level of care and cost.

- Transport – Research transportation costs: car ownership, petrol, taxi, bus, subway, parking etc so you know the options available to suit your preference and budget.

- Daily Expenses: Groceries, dining out and utilities can be significantly less. For eg, dining at a mid-range restaurant in Chiang Mai (Thailand) costs $5-7; in Penang (Malaysia) $10 and Málaga (Spain) $22.

2. Visa and Residency Requirements

Many countries offer residency-by-investment visa programs for retirees, such as Mexico’s Residente Permanente, Malaysia’s MM2H and Portugal’s and Spain’s Golden Visa. Most visas grant long-term multi-entry stay in exchange for direct investment in property or fixed deposits.

3. Healthcare Standard and Costs

Access to affordable and quality healthcare is crucial in retirement. Assess the healthcare systems in terms of your needs such as chronic conditions, special medication, preventive care, emergency services, hospital facilities and specialist care. This way you can better calibrate the service to your needs.

Quality of care is best assess through accreditation. For example, Mexico, Thailand and Malaysia are top medical tourism destinations, attesting to their treatment standard, affordable cost and after-care service.

Medical treatment costs can vary widely. For eg: hip replacement costs on average $30,000 in the US and in Singapore; $10,000-12,000 in Mexico and Spain.

Depending on the country, you may need private health insurance. Look for affordable plans that cater to expats. My private health insurance in Spain offers unlimited claim, no co-payment and a wide panel of clinics and hospitals to choose from at $120/month. Public plans are even cheaper. If you prefer international insurance providers, Cigna and Allianz are popular amongst expatriates.

Long-term care, assisted living or in-home care should be part of your due diligence and included in your longevity plan. In some country like Thailand, a full-time caregiver cost just $400-500 a month.

4. Language and Culture

Language and cultural barriers affect daily living, socialising and when arranging for essential services like healthcare and banking. Generally speaking, cities with large expat communities offer easier transition given the established infrastructure catering to foreigners.

5. Safety and Political Stability

Check out crime rates, political stability and how expats are treated. Most countries have areas that are considered safer than others so you will want to be in such neighbourhoods.

6. Taxation

Understand the tax implications in your home country as well as the destination country before moving. Check if there are tax treaties so you’re not taxed twice on income. Portugal, for example, offers tax exemptions for foreign retirees for a period.

Any Downsides?

While location arbitrage offers many benefits, it may not be suitable for everyone. Some risks to be aware of include:

- Currency fluctuations – Changes in exchange rates can potentially impact your retirement income and investments.

An ex-colleague bought a condominium 10 years ago in Malaysia at less than 40% of a similar home in Singapore, intending it as an investment and his retirement home eventually. Fast forward 10 years, any property appreciation has been nullified by the more than 30% slide of the Malaysian Ringgit against the Singapore dollar.

- Cultural Isolation: Adjusting to a new culture can be challenging, especially if the language barrier is significant or if the country’s customs differ widely from what you’re used to. For location arbitration to work, you need to have a positive mindset and develop a network of friends who share similar interest or cultural exposure as you. Consider also when you spouse is no longer around. Will you be able to cope on your own?

- Political and Regulatory Risk: Political climate and regulatory changes can change in an instance, affecting you negatively. When Malaysia changed its MM2H conditions drastically in 2021, many retirees plans and lives were upended and had to leave. In the end, the new changes were not applied retrospectively. These are risks to be mindful of when planning location arbitration.

Not for Everyone

While location arbitrage is a powerful strategy to stretch retirement dollars and increase living standard, it may not be for everyone. You need to understand yourself and be clear about your circumstance, preferences and retirement lifestyle. There will be trade-offs.

Will you miss your grandchildren and friends dearly? Do you see yourself happy in a place with a different culture, language and lifestyle? Are you attached to your community and social circle?

For those with an adventurous spirit and are adaptable, location arbitration can add excitement and diversity to your life, over and above financial savings.

Who knows, you may even make it to the coveted 1% club in the new country with the wealth you’ve built up in your home country.

Happy dreaming,

Savvy Maverick

(Main image: Sophie Lavabre-Barrow, Unsplash)

Disclaimer: The views expressed here are drawn from personal experiences and do not constitute financial advice in any way. Nothing published here nor should any data or content be relied upon for investment activities. Please do your own due diligence before making any financial decisions. Data and information cited from sources will not be updated after publication.