Are Chinese Stocks Too Risky To Be Included In Retirement Portfolio?

Recent unprecedented and unforeseen crackdown by the Chinese government on some of its biggest technology and education companies caught the financial world by surprise. It is a sobering reminder of the inherent risk of investing in a market where the long arm of the government is overarching, tenacious and swift. Recall the 1,000-bed hospital that was built in just 10 days? No other country in the world would have been able to achieve that.

The abruptness and harshness of the regulatory actions wiped out billions in value from Chinese stocks listed in the US, China and Hong Kong. The shares of TAL Education, New Oriental Education & Tech Group and Gaotu Techedu – 3 Chinese tutoring companies listed on the NYSE – plummeted more than 90% from the start of the year.

From uber wealthy founders, to the biggest fund managers, financial institutions, investment banks, pension funds and regular investors – everyone with exposure to Chinese stocks felt the jitters and took some hit.

I too suffered ~10% loss in my Chinese portfolio from the recent spite of events, aptly dubbed ‘The Great Fall of China’. I am perturbed, even alarmed, by the string of events:

- Last minute halt of ANT Financial’s dual listing in Shanghai and Hong Kong.

- Forbidding of Didi’s ride hailing app from being downloaded in app stores.

- Blockage of Tencent’s billion dollar merger of game streamers Huya and Douyu.

- Requirement for Meituan to pay minimum wage and provide insurance for its drivers.

- Stipulating after-school tutoring services to be non-profit.

Being no expert on China, I fail to grasp the motivation and rationale behind the actions. I have decided, however, to allay my fear and unease by managing my emotions and sentiment as a long-term vested investor instead of making knee-jerk reactions.

Despite the crackdown, I remain a firm believer in China as a rising challenger to America’s might that will cause a shift in superpower from the western hemisphere to the east. I see strong fundamentals in some of the big tech companies and believe that as long as they play within government rules, they will be allowed to flourish.

Sharing my personal string of thoughts:

Growth

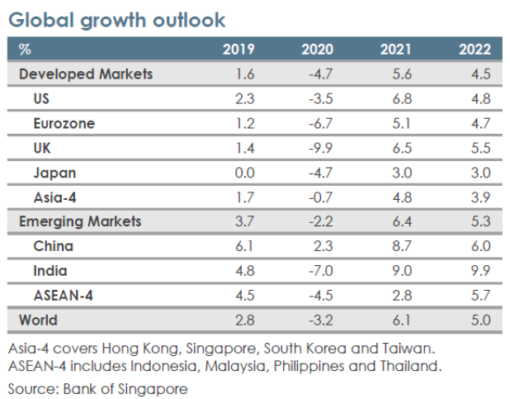

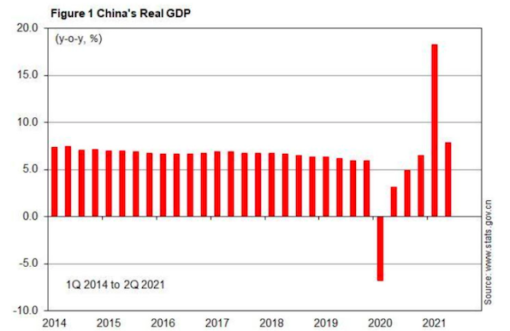

China has been the world’s second biggest economy in nominal GDP term since 2010, trailing only America. It has been the largest economy by Purchasing Power Parity (PPP) since 2014. It is only a matter of time that it will surpass America as the biggest economy by nominal GDP too, looking at its impressive track record over recent past decades.

Prosperity

The Chinese government is paternalistic and will continue to do what it can to improve the lot of its people. Since opening up in 1978 under the stewardship of Deng Xiaoping, it has aggressively pursued international trade and commerce, encouraged and supported the growth of private enterprises.

China has tasted the fruits of economic development and prosperity, lifted a big swath of its population out of poverty and created a huge middle class of urbanites and entrepreneurs. Why would it destroy home-grown unicorns which have become such a crucial part of the wealth creation eco-system? Not to mention access to foreign investment capital for continued prosperity?

Private Enterprises

While state-owned enterprises (SEO) still dominate, private companies now produce more than half of the GDP, constituting the majority of its exports and more importantly, job creation.

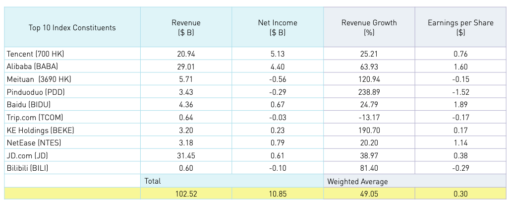

China needs to create 12 to 15 million new jobs annually to keep tap on its unemployment rate, which currently hovers around 5.5%. A record 9 million newly-minted graduates will join the job market this year, up from 8.7 million in Y2020. Unemployment among young graduates is disproportionately high at 13.1% compared to the national average. Tech giants the likes of Alibaba, Tencent, Meituan and Didi etc provide massive employment opportunities and are especially attractive to young graduates.

5-Year Plan Goals

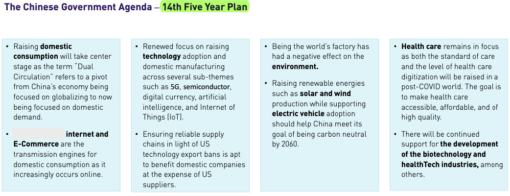

The Chinese Government uses 5-year plans to manage its economy. Past and recent goals included balanced growth, wealth distribution, increasing competitiveness by moving up the value chain with advanced manufacturing and focusing on growth through domestic demand. China’s top economic planning agency, the National Development and Reform Commission (NDRC), has declared that it will drive domestic consumption through e-commerce with an increased focus on technological spending.

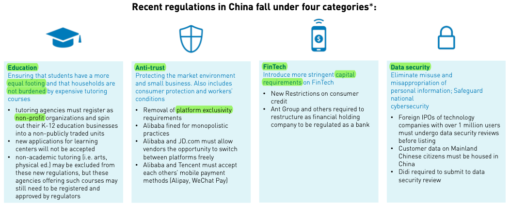

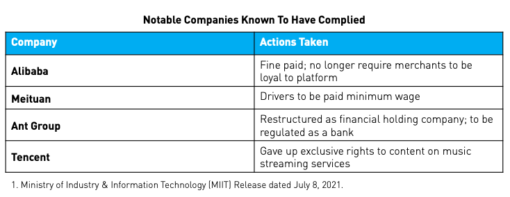

Technology being the big driver of growth, it is not surprising that tech companies come under tighter scrutiny, and is perhaps why the government wants to level the playing field to encourage more innovation by enforcing antitrust practice (Alibaba), reduce unfair competition (Tencent), mandate employee welfare (Meituan), ensure better data protection (Didi) and rein in child-rearing costs – which constitutes 25% of household expenses – by requiring after-school tutoring services to be non-profit (TAL, New Oriental, Gaotu).

Social Market Economy

Investing in a socialist market economy, which is how economists describe China, means the ruling government will always have an upper hand. China is unique in that dominant state-owned enterprises (SOEs) co-exist with market capitalism private companies, also known as privately owned enterprises (POEs).

Most POEs have close links with local government, are expected to support their policies and are subject to party influence, either directly or indirectly. Hence it is unrealistic for investors to impose full capitalist expectations on a social-market model. Governments around the world now realise that regulations have not kept up with technology and are taking measures to regulate big tech. China is no exception.

It is with such a mindset that I will manage my Chinese portfolio from now onwards, along with these rules:

Diversification – Due to limited bandwidth and access to accurate corporate data as a retail investor, I started investing in Chinese stocks through ETFs and thematic funds. This gives me instant diversification and risk reduction, leaving stock selection and portfolio management to those who can cover my blind spots.

One of my funds have exposure to TAL Education, which was impacted massively by the directive to become non-profit, but the position is less than 0.5% of the fund, constituting even lesser in my overall portfolio. This has been critical in protecting me from big losses so buying into funds and ETFs will continue to be my strategy for China market. Having said that, I will stay away from sector funds as the risk is magnified instead of minimised with sector bets.

Portfolio allocation – Limit to no more than 15%, significantly scaled down from original intent of 40% before the crackdown. Smaller allocation will help to protect from a meltdown as witnessed over recent months. Chinese stocks currently constitute less than 10% of my investment and I have been contemplating adding to it given current good valuation. For where else can one find such growth?

Adhering to these rules helps to safeguard my portfolio while still able to ride growth momentum, to keep calm during market turmoil and most importantly, to have a good night’s beauty sleep 🙂

Sweet dreams,

Savvy Maverick

Disclaimer: The views expressed here are my personal opinions drawn from my own experience, and do not constitute financial advice in any way whatsoever. Nothing published here constitutes an investment recommendation, nor should any data or content be relied upon for investment activities. Please conduct independent and thorough research before making any financial decisions, including consulting qualified professionals.