How Financial Minimalism Can Add Colours Back To Your Life

Marie Kondo’s bestseller “The Life-Changing Magic of Tidying Up: The Japanese Art of Decluttering and Organising” precipitated a global awareness and movement towards decluttering as simplicity gains widening appeal.

While I do not embrace minimalism in other areas of my life, I practise financial minimalism and it has been nothing but liberating, helping me solidify and better enjoy my life in retirement.

Most people finds dealing with money stressful: earning it, saving, spending, budgeting, investing, growing it…the strife for financial security. Financial minimalism is a disciplined way to focus on what truly matters, freeing up time and head space for more meaningful and purposeful pursuits in life.

Instead of limiting one’s lifestyle, financial minimalism actually expands it by flushing out distractions so one can concentrate on what truly brings joy and fulfilment. Sounds contradicting? Let’s dive in and see how it works.

Expenditure Management

The first step in financial cleansing is to get a hold on expenses. Be very mindful when buying something, make sure it adds to your life without subtracting from it. Weed out duplication, what is no longer necessary or for which you have no time for, eg: subscription to gym membership, multiple music and video streaming services, travel apps, magazines etc.

_________________________

69% of (US) households now subscribe to one or more video streaming subscription services and 41% of households subscribe to at least one music streaming services.

~ Deloitte

_________________________

List expenses for 3-4 months, be sure to include infrequent big-ticket expenditure such as vacation, medical check-up, car repair etc. Assign as “Must Have” or “Nice To Have” then start eliminating the latter. Minimise duplication by picking the most essential or wide-serving. Eliminating non-essential expenditure saves money, time and prevents junk from accumulating in your life. As you declutter your expenses, a sense of control and confidence will take hold, allowing you to tackle other aspects of life.

Go Paperless

Go paperless to avoid that ‘drowning under paperwork’ feeling. Opt for e-statements whenever possible: banks, credit card, bills and subscriptions. Besides being environmentally friendly, going digital maximises mobility, and makes for easy tracking and retrieval.

Bank Accounts

Reduce bank accounts to 1 or 2 at most. When I did this exercise, I had 4 different current accounts in Singapore alone! One started as an early saver program, 2 were opened to receive salary credits from different employers over the years and the 4th was tied to a mortgage that has since ended. I was spreading balances across all 4 accounts, tracking 4 sets of monthly statements.

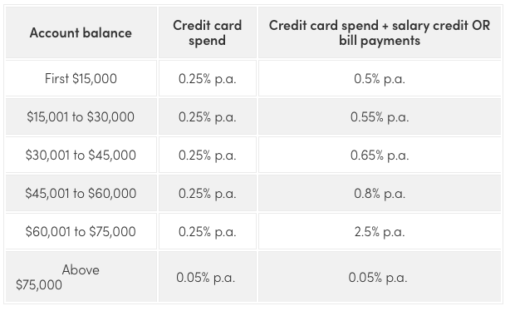

I have since reduced to 1 bank account – the UOB One Account that pays staggered interest up to S$75,000 (US$55,000) when certain criteria are met. This is also where I park my emergency fund as there is no restriction or penalty for withdrawals. Consolidate your bank account for a complete overview of your money, making it easier to manage.

Credit Cards

With the avalanche of credit cards giving attractive benefits such as air miles, cash-back, dining and shopping rewards, it is easy to succumb to multiple cards. Review of your biggest expenditures, assess the benefits that best appeal to you and reduce to 1, at most 2 cards. Spreading expenses over several credit cards makes it difficult to keep tap on expenses and can lead to overspending. It is proven that the more credit cards, the more likelihood of debt.

It is smarter to consolidate all debt ‘under one roof’ to negotiate better interest rate and repayment scheme. Having debts under different lenders will encourage debt rotation, an endless spiral. Collating under 1 lender captures your total owing, so you can start systematic pay-down.

Equity

Trading equity is easy nowadays via Apps and online platforms allowing one to buy/sell shares and ETFs at a finger tip. The ease of usage and aggressive promotion have led many to sign up for multiple brokerages each offering different fees, charting, reporting etc. Scale down to 1-2 that best serve your purpose and scope.

I use TD Ameritrade, which does not charge trading fee, for all US trades and Phillip Securities’ POEMS platform for trades in Singapore, Hong Kong and Taiwan. Using too many trading platforms and Apps leads to confusion as each has different processes and makes it difficult to compile total investment overview.

Real Estate

Investing in overseas properties, glamorous as it may sound, requires opening bank accounts to receive rent and pay dues. One needs to maintain a network of contractors, tax accountants, notary, lawyers and keeping abreast of economic and political fronts to safeguard the portfolio.

In real estate, the wider the scope the more work and effort in management, diluting focus and attention that may not justify the higher R.O.I. Additionally, currency risk can wipe out gains substantially. Scale down, think small, less stress.

It is partly due to this reason that we are scaling down our US portfolio which started early 2000 during the sub-prime mortgage crisis when investment return and exchange rates were extremely favourable.

Better still, why not opt for REITs or real estate crowdfunding (eg Fundrise) instead? Hassle-free, geographical and category diversification, tax efficient and give comparable returns.

Cryptocurrency

I started cryptocurrency trading with 2 platforms: 1 for crypto trading, the other for Bots. Many who are swept up by the frenzy signed on to multiple platforms each offering different currency selection and with slightly different features. However, keeping tap and trading over several platforms and Apps is confusing and counter-productive, requiring disproportionately more time and attention. Do not be swayed by fancy features or others’ opinions when venturing into new areas of investment. Conduct your research and select 1 that is most relevant to your needs.

Crowdfunding (Peer2Peer Lending)

Since 2017, I have added crowdfunding to my portfolio for more diversification through a Singapore platform. Due to the relatively good return, I began investing in other platforms in Holland and the US, both offering more mature and active crowdfunding space.

One can participate in deals via Apps making it easy peasy to invest. Again, as with all Apps and platforms, working with differing processes and features is confusing and can lead to error, making monitoring and tracking cumbersome. Interest rates are rather similar, so the only differences are platform fees, types of borrowers and default rates. Select 1 that meets your risk profile, investment preference and limit to 1 platform to enjoy portfolio diversification without introducing too much complication in your life.

Financial Minimalism Mindset

The financial minimalism mindset prioritises value over quantity, simplicity over variety. It eases fear, stress and overload, giving better clarity and control in an area that is a bedrock of life.

Choosing the best option means always working with the best-in-class solution to your goals and preferences, compacting time and effort. It frees up mind space and room for better energy flow, invigorating and maximising your life.

Be in the flow,

Savvy Maverick

Disclaimer: The views expressed here are drawn from my own experience and do not constitute financial advise in any way whatsoever. Nothing published here constitutes an investment recommendation, nor should any data or content be relied upon for any investment activity. It is strongly recommended that independent and thorough research is undertaken before making any financial decisions, including consulting a qualified professional.