What I Would Tell My 23-Year-Old Self About Retirement Planning

A friend’s 23-year-old daughter visited Amsterdam from her work base in Paris and stayed over for 5 days. The vitality, idealism and preciousness of youth was invigorating and started me reminiscing about myself at that same age.

Fresh out of university and still wet behind the ears, how exciting to have a future panning out with a kaleidoscope of options, knowing that life will present countless opportunities, a definite zest for life and for the world at large. An age when everything is possible, with countless dreams to chase. Retirement is something so far out in the horizon that it does not figure in one’s radar.

But it should. Looking back, I wish somebody had imparted to me the one thing that would have made my retirement journey easier, more fun and rewarding.

So here’s a big little secret about retirement planning: start investing, as soon as you can! That is the single most crucial thing that has helped me built wealth and achieved retirement, and for a much richer lifestyle than during my work years.

There is nothing more powerful than the combination of time and compounding. String these 2 together and the outcome is magical. More than stock picking, financial analysis or valuation, just starting to invest early gives one a quantum leap and head start.

“Compound interest is the eighth wonder of the world” ~ Albert Einstein

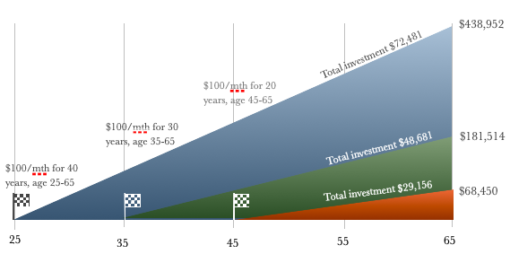

The power of compounding is best showcased using 3 investment timeframe from 20, 30 to 40 years starting from age 25, 35 and 45 up to retirement age of 65 years. For the sake of comparing apple-to-apple, the same investment principle applies: $100 per month adjusted for annual inflation at 2%, no withdrawal throughout the investment period and assuming an investment return of 8%:

See what a difference investment period makes!

For someone starting at age 45, the value of investment after 20 years is $68,450. Compare this to starting at age 35, the value is more than 2.5 times at $181,514, starting 10 years earlier.

And if one sets aside $100 monthly from the very first pay cheque and continue doing so until age 65, the end amount increases to a whopping $438,953, which is 7 times more than someone who started at age 45.

Moreover, take a look at the amount of compounded returns vs the amount deposited across the 3 investment periods. The longer the investment period, the bigger the compounding effect. Over a 40-year period, compounded earnings account for an eye-popping 83% of total return vs 17% of invested funds.

Where investment is concerned, 2 key factors rule:

- Capital – it goes without saying that the more financial resources one has, the easier it is to churn return. A 10% return on $10,000 gives $1,000 while on $1 million, that same return works out to $100,000. What people starting out in their 20s lack is capital, and there is a grain of truth in the saying that it takes (some) money to make money.

- Time – this is something that levels out the playing field for younger folks versus their richer older more established counterparts. Exploit it to your full advantage. So goes the saying that time in the market is more important than timing the market.

For younger folks, time IS your capital. Make full use of it!

Investing does not have to be complicated or time-consuming. One does not have to do anything spectacular or complicated. In fact, by being boring and average, one would have beaten 75% of all professional money managers.

By this, I mean investing in a saving plan that uses the dollar-cost averaging method to invest regularly into a broad-based index fund or ETF. This is the proverbial slow-and-steady wins the race.

Have you heard of this question – Would you prefer to have $1 million right now or a penny that doubles everyday for the next 30 days?

Most people would go for the $1 million, bird in hand, right. But guess what? The penny that doubles daily becomes $5.3million by the 30th day.

Incredible isn’t it? See how timing plays such a big role in the outcome. Just 5 days short at Day 25, the amount $167,772 is only a fraction of the 30-day outcome. The last 5 days contributed to the final outcome exponentially.

THAT is the power of time x compounding.

I had used 8% investment return in my earlier illustration, which some may think is unrealistic. For the record, over the past 30 years from 1990 to 2020, the S&P500 index has returned an inflation-adjusted return of 1,088% cumulatively or 8.13% annually. Its return in 2020 alone was 18.4% – a year where Covid pandemic wrought havoc in the world.

The S&P500 is probably the most important index representative and proxy to the US stock market. If one started investing $100/month into a S&P500 index fund 40 years ago, that would be worth more than $660,000 today. With little risk, sleepless nights or investment effort. You would be building wealth while navigating other things in life: career, relationship, hobby or raising a family.

By starting to invest early, one also starts to build confidence in money matters and learn to have bigger dreams when the pot starts to grow. At some point, enough capital will be accumulated to allow for bigger investment like real estate, which helped me made my first million.

The moment you start investing and seeing the returns, work will take on a different perspective. It becomes a means towards a larger purpose and other life goals. You will start to see the dreaded daily grind as a path to your north star instead of a spinning wheel. More importantly, a point will come when you can make choices to change for the better, boosted by your financial position.

Expenditure will also take on a different meaning: I started asking myself – should I buy this now or use investment returns (otherwise known as OPM) to fund it? Sort of ‘relayed gratification’ instead of ‘delayed‘ gratification’ 🙂 It gives bite-sized impetus and short-term motivation to investing, with tremendous satisfaction upon attainment and a reason to celebrate.

Even if you have no investment knowledge or are busy scrambling the corporate ladder or overwhelmed with parenting young kids, just do this 1 thing. Whatever the amount or life stage you’re at, start investing. Faithfully. Every month. It will profoundly change your life in 20 years and your future self will thank you for it.

So if I could go back to my 23-year-old self and say 1 thing, it would be: start investing! And keep at it.

“The most successful men in the end are those whose success is the result of steady accretion.” ~ Alexander Graham Bell

Rock steady,

Savvy Maveric

Disclaimer: The views expressed here are drawn from my own experience and do not constitute financial advise in any way whatsoever. Nothing published here constitutes an investment recommendation, nor should any data or content be relied upon for any investment activities. It is strongly recommended that independent and thorough research is undertaken before making any financial decisions, including consulting a qualified professional.