The Importance of Exit Strategy For Every Plan

Making plans before embarking on endeavours is much lauded and often applied in practice, with clear benefits like structuring of thoughts, clarity of goals and blueprint to guide the action. The very act of making plans forces one to think thoroughly:

- Why is the undertaking important or necessary?

- What are the resources needed in terms of financial, time or knowledge?

- What is the most efficient or suitable way to proceed?

- What are the consequences or outcome if the endeavour is not undertaken?

- How will my situation change if successful?

Well and good.

But what happens after jumping into the deep end? How should you get out of it? When is the right time to quit, while on a high? That is the essence of an exit strategy, an important aspect that is often overlooked, and sometimes to great detriment.

What is An Exit Strategy?

As defined by Wikipedia:

Exit strategy is a means of leaving one’s current situation, either after a predetermined objective has been achieved, or as a strategy to mitigate failure.

Having an exit strategy is not only pertinent but crucial as it gives a clearer vision on what success looks like and what to aim for within a timeline. It keeps you on track while stipulating required action when things go awry. In other words, it keeps you grounded, yet alert.

An exit strategy quantifies the value of your actions, and it can be other-than financial such as emotional or aspirational. It prepares you mentally for the end point and prevent emotions or impulse from clouding decision-making. Most importantly, it keeps you out of trouble or stagnation, as it forces a glimpse into ‘what next’ beyond the undertaking.

Exit strategies are especially important for financial investments, be it real estate, stocks or other asset classes. You should always have an exit strategy in mind before executing a transaction as it helps to lock in profits, and in some cases, cut losses. Simply put, exit strategy for an investment should be taken when:

- the level of target return has been reached or exceeded, ie mission accomplished

- the circumstance for the investment no longer holds true or makes sense

- there is a better alternative, whether in terms of R.O.I or purpose

An exit strategy does not mean selling off the investment once the specified circumstances have been met. It acts as a trigger to review if the position is worth holding on to, pared down or disposed of altogether.

Buy-and-Hold Strategy No Longer Viable

In the current world, buy-and-hold is no longer a good strategy due to the speed at which change is taking place. Technology, IoT, geo-politics, environmental factors etc are compressing economic cycles, affecting market and exacerbating volatility.

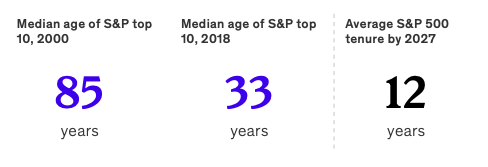

Separate studies by Statista and McKinsey have shown that the average lifespan of companies listed on the S&P500 has been declining from 32 years in 1965 to 21 years in 2020. By 2027 – barely 5 years from now – 75% of companies currently quoted on the S&P500 would have disappeared.

In 2017, a total of 26 companies were replaced in the S&P500 index, representing a turnover percentage of 5.2%. Extrapolating this means about 50% of S&P500 companies will change in the coming 10 years. Isn’t it frightful if you hold some of these companies in your portfolio without having any exit strategy?

While average corporate lifespan shrinks, individual life expectancy is growing. 50% of newborns in the new millennium are expected to live to 100 years or older. This means longer period of work and more years in retirement. Both of which means some prudent personal financial planning and investing is necessary, so appreciating the importance of exit strategy is crucial.

My husband and I make it a point to have an exit strategy for every investment. This has helped limit our downside losses while ensuring we take profit before it dissipates.

As I write this, Russian troops are piling into Ukraine and getting into position. The US has just closed its embassy in Kiev and issued advisory for its citizens to evacuate. The threat of war seems imminent. There will be shocks to markets when that happens.

When news of the Russian action first surfaced, we immediately listed all our remaining US property for sale. While we have been divesting our US property portfolio due to climate concerns and having achieved our profit criteria, we opted to stagger the sale to minimise capital gains tax. However, with the current tension in Kiev, we decided to take profit while it is still on the table.

Similarly, we’re keeping a close watch on our stock portfolio, paring down some positions to lock in profits and hold cash for re-deployment later.

A Lesson Learnt

I learnt the consequences of not having an exit strategy the hard way. In one of my earliest trades on the Singapore bourse, I bought a well-regarded income stock with the mentality of buy-and-hold long term. It did well, issuing dividends twice yearly and the stock price grew slowly but steadily. The calm before the storm was eerie, giving a false sense of security.

Then it became one of those businesses affected by creative destruction, disrupted by new innovation. I held on to the belief that it was one of those too-strong-to-fall, too-big-to-fail Goliaths. At 1 point I was sitting on 31% paper loss, but am now at minus 22% as I have been repairing my position.

An exit strategy would have prompted me to sell once profit target has been reached or re-assess its potential when threats started to show. As its stock price started to fall, I failed to enact any stop loss, resulting in my current predicament.

This incident reinforces my belief that some amount of active management is required for a portfolio of individually selected stocks. If that is not your cuppa tea, then buying into a broad-market index or ETF would be better and less risky. As cited earlier, 26 companies were replaced from the S&P500 index in 2017. This means when you buy into 1 of its index funds, your portfolio would have changed to reflect this replacement automatically.

From conversations with friends and acquaintances, it surprises me the number of people who would spend significant amount of time and effort assessing the viability of an investment before executing a trade yet have no exit strategy whatsoever. They operate under the principle of ‘as long as I’m making money, I will hold on to it.’ But how much return is good enough? When is it time to call it quits? What happens if prices start plunging, and steep?

Exit Strategy for Other Aspects in Life

Besides financial realm, exit strategy is also useful in other areas of life:

Career: when should you leave your current role or company? Are there aspects of your role that is causing you much stress, affecting your health or family life? Are there opportunities out there that fit your ambition or life goals better? An exit strategy makes you more aware of your ‘market price’ for promotion, salary negotiation or to seek greener pastures.

Relationships: Is there a toxic friendship or relationship holding you back from a better or happier self? When is it time to say ‘adios’ and allow for better things to come into your life?

Everything comes to an end, that is a fact of life. Doesn’t it make sense to retain an upper hand on the end game? An exit strategy allows you to do just that: keeps you on your toes, lets you harvest the fruit while avoiding the thorns.

Play safe, stay smart.

Savvy Maverick

(Main image: Luis Alfonso Orellana, Unsplash)

Disclaimer: The views expressed here are drawn from my own experience and do not constitute financial advise in any way whatsoever. Nothing published here constitutes an investment recommendation, nor should any data or content be relied upon for any investment activities. It is strongly recommended that independent and thorough research is undertaken before making any financial decisions, including consulting a qualified professional.