The Reality Of Climate Change On Home Ownership

A friend shared a video on her FB that totally grabbed my attention. Despite reading and hearing about climate change, nothing prepared me seeing the effects of it, up close and personal. What makes it more real was that I had visited and played in the area.

Dream Home

Imagine owning a beautiful beach house with golden sunset view in a posh beach community. A home where precious family times are spent: building sandcastles on the beach, walk just 10meters to launch your kayak and memories of cosy BBQ dinners on the beach, the smell of charred seafood mixed with the salty air.

Then imagine the horror of watching your home being washed away by rising tides in a split moment of freak weather. Puff, your dream popped within a matter of minutes – a fairytale beginning with a nightmare ending. This was exactly what happened to this house, located at Hatteras, a barrier island off the beautiful coast of North Carolina. Click the link below the image to watch the video for yourself.

The loss for the owner must be incredibly painful, both in terms of monetary as well as emotional. Therein lies the threat of climate change to home ownership. Putting all of one’s eggs into a dream home that holds all of one’s aspirations, treasures and wealth is devastating when something happens to it. Especially when such happenings are natural disasters quite beyond one’s control: flood, hurricane, earthquake or forest fires.

A New Reality

We live in an increasingly fragile time where climate forces can turn against us in the blink of an eye, without giving much time to react. The signs are becoming more urgent and apparent. It is in this vein that my husband and I take into account mega trends when making investment direction and decisions.

Climate issue and rising costs of coastal property were the key reasons why we sold our US property holding. We started investing in the city of Fort Lauderdale in Florida way back in 2010, lured by its good return, reputation as a sunshine state and its resilient rental market.

However, over the years, we witnessed the effects of climate change in terms of the frequency and severity of hurricane season. Every year, the season starts earlier and ends later, with more powerful and destructive hurricanes. Because of severe damages to building structures and surrounding environment, both insurance costs and property taxes started creeping up.

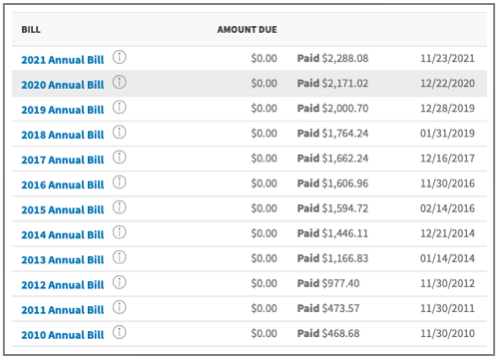

An example of the property taxes for 1 of our properties, downloaded from the tax portal:

The property tax has increased a whopping 4.88 times over 11 years of ownership. No rental increment can catch up with such cost escalation! Yes, the increase is due partly to the recovery of asset price post crisis but it is also driven by the higher repair and maintenance costs to community spaces from floods, windstorm and hurricanes damages.

The insurance costs fared not much better, having increased almost 2.5 times over the same period. We consider ourselves lucky to be able to sell the home for more than 3 times what we bought it for, so the adventure ended well for us.

For those who currently own property, do an honest assessment on how climate change may affect your current home and start taking steps to allay the danger or manage it if possible. You certainly do not want to be the one left holding the hot potato as climate change can have very huge impact on property value. Here are some prudent considerations beyond affordability and neighbourhood:

1. Elevation

The term ‘location, location, location’ hits the nail on its head in this aspect. A property on elevated land provides good guard against rising water level. In most cities or townships, flood zone elevation drawings or reports can be requested that show the impact of heavy rainfall or floods. And although sea view or beach front properties are highly desirable, make sure to do your due diligence. Sea view from a cliff apartment can work if it is located within a bay. Beach front is absolute no no. This is 1 area which can be visibly assessed and should be avoided.

Remember that homes are long-term consideration so even if the threat is not within your time-frame of owning it, do be aware that future buyers and their mortgage lenders will scrutinise its viability easily for another 20-30 years. Some mortgage lenders are rejecting loans for coastal property unless enforcement or some sort of ground elevation is being carried out. This will greatly limit the field of buyers and subsequently, the price.

2. Insulation

The recent rise in energy prices is a harbinger of things to come – it will be more costly to heat-up homes in winter months and cooling them in the heat of summer. Global warming is causing more extreme temperature changes, driving up cost of heating and cooling. Try to look for newer homes, which tend to be built with better insulation and more sustainable material.

For older properties, see if better insulation can be installed such as double-glazing of windows. It may be costly to undertake but the investment will pay back itself over the years to come. In most countries, energy labels are available so make sure to check this out before buying a property.

3. Accessibility

Because of environmental pollution, there will be increasing pressure to reduce car usage in favour of public transport or other means of more environmentally friendly options. Communities that are accessible by foot, bicycle or public transport will become more sought after, hence retaining their value better. Car ownership cost will likely be more expensive, which makes homes with great connectivity highly desirable.

4. Diversification

Spreading one’s eggs across more baskets cannot be more true than in home ownership. Instead of owning 1 big expensive dream home, which makes it susceptible to total destruction of value and hopes should disaster strike, why not own 2 smaller properties?

There is no better investment than in real estate so if one is able to diversify into a suitable 2nd property, it is a smart decision. Living in 2 different homes also allows one to maximise lifestyle with the possibility of generating investment income from partial rental when the home is not being used to subsidise ownership costs. Over time, home equity will build up, contributing to your wealth. Owning a 2nd residential property also allows one to capitalise and reap good profit when the market is high like in the past couple of years.

While I generally do not support buying vacation property, I made exception by buying into 2 property in Marbella, which has a vibrant international community supported by strong investment fundamentals with lesser risk of climate impact.

Internet and affordable travel has made it possible for people to visit and research buying a home overseas. There are also more visa’s that allow foreign ownership of property, some with great perks tied in such as the Golden Visa of Portugal and Spain. Owning 2 or more smaller homes to diversify risk and enjoy alternative lifestyle is highly attainable, especially in retirement and if one plans upfront for it. The proliferation of short-term or vacation rental also makes it attractive to own a second residential property.

No Regrets

Since disposing our US property portfolio, I have had moments of doubt and regret as the portfolio had provided good and stable return over the years. Despite the creeping costs on insurance, property taxes and repairs, rental yield ranged from 9 to 13.5%. And this excludes appreciation of the underlying asset, all the while giving us exposure to the strengthening US currency.

However, the video is a timely reminder of the bigger issue at play, affirming the decision we took is a step in the right direction. Climate change is for real, it is non-reversible and its impact can be devastating for the unprepared. Better to be safe and escape unscathed than risk pushing things too far, beyond point of no return.

Better safe than sorry,

Savvy Maverick

(Main image: Romain Gal, Unsplash)

Disclaimer: The views expressed here are drawn from my own experience and do not constitute financial advise in any way whatsoever. Nothing published here constitutes an investment recommendation, nor should any data or content be relied upon for any investment activities. It is strongly recommended that independent and thorough research is undertaken before making any financial decisions, including consulting a qualified professional.