Why Net Worth Is Not A Good Indicator Of True Wealth

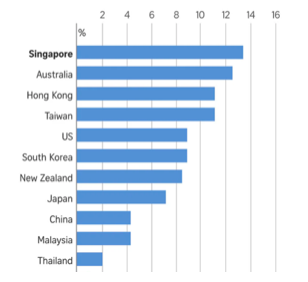

A recent wealth report cited by several financial publications caught my eyes and tickled my mind. The HSBC report projects that by the year 2030, Singapore will have the highest proportion of millionaires in its midst, at 13.4% or 700,000 in absolute number. This means 1 out of every 8 Singaporeans would be a millionaire by then.

This ratio is the highest amongst Asia-Pacific economies, overtaking current leader Australia (12.5%), as well as the United States (8.8%) and China (4.4%). An impressive accolade for a small nation with no natural resources!

Definition of Wealth (Net Worth)

The report was compiled by tallying cash holdings, investment in stocks and bonds as well as real estate holdings, including owner-occupied properties minus outstanding mortgages. This definition is pretty much the standard definition of wealth, also known as net worth:

Wealth = Total market value of assets – Total liabilities owed = Net Wort

While definitely a notable and proud-worthy achievement for such a young nation like Singapore, it does bag the question of what it means to be a millionaire. What does it mean to be wealthy?

Wealth From Self-Occupied Home Ownership

Singapore has 1 of the highest home ownership in the world at 88.9%, thanks largely to its hugely successful public housing programme, under the governance of the HDB (Housing & Development Board). HDB properties account for almost 4/5th of home ownership 2021, 78.3% to be exact.

A 90sqm 3-bedroom HDB apartment can cost more than a $1million Singapore dollars (US$700,000) for highly sought-after central districts. Being a small island with acute land scarcity, real estate in Singapore consistently ranks amongst the most expensive in the world in few decades.

With such high home ownership, exorbitant property prices and enforced prudent level of debt, the high proportion of millionaires in Singapore is not surprising. The bulk of most Singaporeans’ wealth would come from their primary live-in property. Hence, most Singaporeans would be just ‘paper’ millionaires.

Asset Rich Cash Poor

‘Paper’ millionaire because the wealth that is tied to one’s residential home, even if the mortgage is low or fully paid off, cannot be easily accessed. One’s home cannot be converted quickly into cash when needed. Such wealth cannot be used to pay bills, put food on the table or cover daily expenses if one is retrenched. Even though it provides comfortable shelter, it is illiquid. To unlock the value of the asset, it needs to be sold. This is why cash flow is king during an emergency, time is of the essence.

So having a high net worth cannot be relied on to solve life’s immediate issues and crises. One can still fall into hard times even with lot wealth on record.

This is a classic case of being asset rich cash poor. Assets that are not liquid cannot be accessed to fund spending. Hence, someone with a big house who drives a luxury car, goes on exotic far-away vacations and wears brand-name clothes can experience financial stress if they are cash poor.

This brings to mind the H.E.N.R.Ys.

H.E.N.R.Y

High Earners Not Rich Yet, a term first coined by Shawn Tully in a 2003 Fortune magazine article and later popularised by Melkorka Licea in a New York Post.

HENRYs are typically millennials with high paying 6-figure jobs who prioritise lifestyle and hip possessions over other aspects of life. Tending towards immediate gratification and living the best experiences, they are obsessed with the latest trends, must-haves and must-dos. Not surprisingly, most have low net worth, some even living from pay cheque to pay cheque.

HENRYs live in fear of losing their jobs as their lifestyle would then be in jeopardy. What makes it worse is that their acquisitions tend to be depreciating in value such as flashy cars, designer fashion and bags…possessions that do not tally as up assets. Wealth can be so illusionary.

Wealth is Illusionary

Wealth is a snap-shot at a point in time and is only meaningful for milestone tracking. It is a good measure to track one’s aspirations and for goal-setting. It can change whenever there are price movements in the value of assets. The more volatile the markets in which the assets lie, the more volatile one’s net worth becomes.

Take a simple example of someone whose entire wealth is made up of 1,000 Tesla stocks. Applying the wealth definition results in the following wealth positions over the past year:

-

- Net worth as at 26 Aug 2021 = US$ 701,160 (aspiring millionaire)

- Net worth as at 5 Nov 2021 = US$1,222,090 (millionaire at last, yeah!)

- Net worth as at 13 Jun 2022 = US$ 647,210 (has-been millionaire)

Imagine being shot to millionaire status and then loosing it all within a year due to market volatility and the lack of portfolio diversity. While this is an extreme example, it clearly illustrates how volatile the standard measurement of wealth is. This is especially true for the marginally wealthy, hence net worth should not be taken as a true or only marker of financial success. So what is a better yardstick for wealth?

Better Determinant Of Wealth

Cash flow is a better determinant of wealth. Unlike net worth which is a static snap-shot, it is a continuity and a flow. Cash flow is life-sustaining while wealth is simply a scorecard of what one owns. This is 1 of the reasons why I’m a big advocate for buying to rent and renting to stay. This winsome strategy delivers on both fronts: wealth AND cash flow at the same time.

It is no wonder why banks are often mildly interested in net worth but totally obsessed with cash flow. The reason is simple – repayments are issued from cash flow, not from net worth. This is the reason why Sabadell, mortgage lender for our Spanish property, was only concerned about our monthly and annual cashflows and did not consider much about our net worth. Cash flow also demonstrates financial prudence and the money habits of a person.

In the business world too, cash flow is prized over balance sheet. A business with strong balance sheet can run aground due to weak cash flow due to lack of liquidity for operational coverage or to ride the vagaries of the markets. Profitability is not cash, just as sales recorded are not actual until money is collected.

Highly profitable businesses with low cash flow tend to rely on debt to fund operations and are not able to take advantage of opportunities when they arise. This greatly compromises their positions. According to a study by Business Insider, 82% of small businesses shutter due to poor cash flow management.

Cash Flow is True Wealth

Cash flow, 2 little words but very mighty. Managed property, it can transform your life and catapults you to financial freedom. Cash flow is what is left of earnings after all expenditures. Having positive cash flow monthly and investing it wisely is a sure-fire way to wealth.

It pays bills, covers living expenses and can be drawn on for emergencies. It gives peace of mind knowing you are fully covered and need not be a slave to money.

Cash flow is the path to true wealth and true wealth is having the financial means and security to decide how to spend one’s time and to pursue one’s dreams. A high net worth without the freedom to do as one pleases is only half the equation. Ideally, both engines should be firing. Cash flow should be invested to acquire assets to build wealth. Rinse and repeat. After enough cycles, even if investing with limited capital, true wealth will follow.

That is why the fascination with creating passive income, which is cash flow that gives the power to do as one likes, otherwise known as…ultimate freedom!

So don’t be blindsided by paper wealth. Go for the real deal and aim for cash flow – the building blocks of true wealth.

Be in the flow,

Savvy Maverick

(Main image – Singapore’s iconic Marina Bay Sands, Savvy Maverick)

Disclaimer: The views expressed here are drawn from my own experiences and do not constitute financial advice in any way whatsoever. Nothing published here constitutes an investment recommendation, nor should any data or content be relied upon for any investment activities. It is strongly recommended that independent and thorough research be undertaken before making any financial decisions, including consulting a qualified professional.