When Is The Right Time To Sell An Investment Property?

Buying an investment property is a deliberate decision undertaken after much consideration and research. Totally appropriate and sensible given the quantum of purchase that can run into millions of dollars in some markets. While the advantages of buying an investment property is well extolled and documented, the same cannot be said about selling.

Given that real estate has appreciated considerably the past 2 – 3 years, is it time to capture profit? Or will prices defy gravity and go even higher? There’s a Dutch saying:

Één snelle gulden is beter dan één langzame rijksdaalder.

(Translation: A fast dime is better than a slow dollar)

Is there a right time to sell an investment property? Here are some situations when the time is ripe to sell:

1. Investment Premise

A change in any of the conditions that led to the purchase of the unit originally definitely warrants a re-evaluation of the investment in entirety. Let this be a trigger to review if the investment case still holds true. Changes in investment premise include:

- Rules and regulations affecting investment ROI rendering it less attractive compared to other opportunities. This can be taxes, rental restriction, change in property usage or re-zoning.

- Climate change is causing devastating effects on property. As I write this, Vietnam is bracing for Typhoon Noru and Hurricane Ian is sending millions fleeing from their home in Florida after blacking out Cuba. This was the main, though not the only, driver for the divestment of our US property portfolio. Climate change has driven up property tax, condo costs, insurance premiums, repair and maintenance costs. Think about selling before serious devaluation sets in. Protect your capital.

- Major upcoming repair and maintenance requiring substantial investment and attention that you can ill afford. Such costs erode ROI, affecting the attractiveness of the investment so re-assess and consider divesting where justified.

2. Profit Capture

The point about investing is to generate profit, ie buy and sell at a higher price or for cash flow. The longer real estate is held, the higher its value becomes. Time is the biggest fan of real estate, and inflation its best friend.

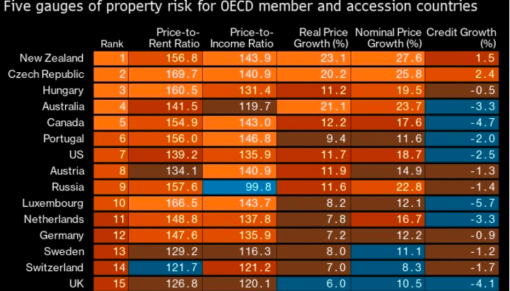

However, property goes through peaks and troughs due to economic, political or other reasons. A recent Bloomberg report shows that the most inflated property markets have started to deflate.

Without selling, it is only ‘paper’ profit ie Monopoly money, and when market dips or recession comes, this paper profit will dissipate – poof! Strike while the iron is hot and reap real profit. There will be another change to buy again as real estate goes through cycles, making it 1 of the best repeatable wealth building tools.

According to the WSJ, private equity giant Blackstone has amassed a war chest of $50 billion waiting for opportunistic buys when the market crashes. Perhaps take a leaf from these institutional players if your market is still strong?

3. Mortgage Term

Any change to mortgage term signals a review of the investment viability as this has direct impact on ROI. Changes include interest revision or when mortgage term is due to expire, especially in an increasing interest environment like now. Better sell than to wait until you cannot afford the mortgage and be forced to sell deep in recession.

4. Portfolio Diversification

Diversification protects against downside risks as different assets respond differently to market events, even within the same asset class. A case in point: during the pandemic, offices, hotels and shopping centres took massive hit while data centres, hospitals and home prices experienced uptick instead. Total opposite outcome to the same event.

If your portfolio is concentrated in 1 segment, it is prudent to sell and diversify as soon as practical.

5. Personal Circumstance

As we go through different life stages, our needs and focus change. You may have relocated to another country or city for work, need to care for aging parents or planning to retire soon to explore the world. These situations deserve a review if continued ownership of the property still makes sense.

Investment property, while providing the best passive income, demands the most attention. If it starts limiting your lifestyle, then it is time to consider selling. There are other ways to gain exposure to real estate with lesser time and effort.

6. Management Committee / Home Owners Association

The health and functioning of the property management committee or home owners’ association can affect the investment’s viability. Some situations or changes to house rules can be detrimental. For example, misappropriation of funds by committee or association members, persistent low owners reserve or poor maintenance and upkeep are definite red flags. Hostile AGMs, fraud investigation, law suits and deterioration of property value are not what you want to be drawn into.

7. Estate Planning

When doing legacy planning, it is advisable to streamline and simplify portfolio holding for easier and smooth execution of your will. The last thing you want is for the executor to be ‘executed’ by the complexity of your portfolio!

It is worth noting that globally, local tax regulations where the property is based overrule nationality of the deceased or where the will is administered.

This was a contributing factor leading to streamlining of our portfolio. The pandemic highlighted how difficult it can be to cross borders and a portfolio spanning several countries not only increases complications but also the costs and time in administering.

8. Hygiene Factors

Interestingly enough, hygiene factors can also be ‘sell’ trigger. Although indirect and not affecting ROI, they make the investment more challenging, such as unreasonable neighbours, community politics or the loss of a critical contact.

When our US broker and trusted agent opted for early retirement to travel the world in a camper van, we knew our adventure in the US was drawing to a close. She made a killing in the property market past 3 years and has been our ears, eyes and feet on the ground.

After The Decision To Sell

Once the decision has been made to sell, here are some tips to maximise the outcome.

- Engage a reputable broker familiar with the area and market, who can write a persuasive listing and tap into a personal network of potential buyers.

- Develop an appropriate sale and pricing strategy. Much smarter to list at 475,000 instead of 500,000 if search band is from 300,000 to 499,999. I like to add a Chinese prosperity twist to our listing, e.g 488,888 to attract attention. Remember the higher the price, the smaller the market due to lower affordability. Listing at lower price can attract more viewings and may lead to a bidding war. This is why a good broker is critical in devising a winsome strategy.

- Selling in vacant possession or with tenancy requires totally different preparation and approach. Some markets uphold tenants’ right over owners. Selling with tenancy requires cooperation from current tenant(s). To encourage this, consolidate viewings on weekends to minimise disruption to them.

- A professional photographer will enable your listing to stand out amongst competition, garnering more ‘hits’. Experienced photographers can stage the photography by making the unit more cosy with plants, make it seems bigger than it is and include mood shots.

- Consider offering the first right of refusal to the incumbent tenant(s). This guarantees a fast and hassle-free sale, saving time and costs on broker fee, listing, photography and viewings. Win-win.

- Never accept the first offer, always negotiate even if your target price is met. Buyers tend to offer lower than what they are prepared to pay and often expect sellers to negotiate. So don’t leave money on the table.

- Last but not least, celebrate the sale once completed and give yourself a pat on the back. I maintain a list of desired purchases and must-do experiences which gets ticked off whenever a sale is concluded. Such use of OPM is what makes investing fun, rewarding and all the more sweeter.

Home sweet home indeed,

Savvy Maverick

(Main image: Spacejoy, Unsplash)

Disclaimer: The views expressed here are drawn from my own experiences and do not constitute financial advice in any way whatsoever. Nothing published here constitutes an investment recommendation, nor should any data or content be relied upon for any investment activities. It is strongly recommended that independent and thorough research be undertaken before making any financial decisions, including consulting a qualified professional.