Why ‘Winning By Not Losing’ Is A Powerful Strategy In Life

Do you always play to win over others? Yes, chant the competitive ones. Not at all cost, say the righteous ones. But wait, is there another type of winning? Weird as it may sound, sometimes winning by not losing can be had. Hear me out.

Game-Set-Match, Where is the Love?

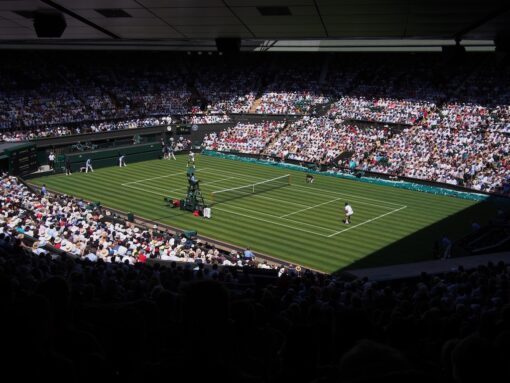

In most sports, the winner is usually the one who makes the least mistakes. Instead of doing spectacular high-risk manoeuvres, these winners play with the mentality of not losing. I am reminded of this this year’s Wimbledon Single Men’s final between Nick Kyrgios and Novak Djokovic.

The drama-charged final on Centre Court pitted Kyrgios against Djokovic. Kyrgios was unseeded for the tournament and qualified through a walkover as Rafael Nadal withdrew due to injury. Djokovic who was gunning for his 21st Grand Slam title. Despite being the underdog, or perhaps because of it, Kyrgios hit many magnificent shots. Have a look at the stats:

- Total Winning Shots: Kyrgios 62 vs Djokovic 46

- Number of Aces: Kyrgios 30 vs Djokovic 15

- First Serve In: Kyrgios 73% vs Djokovic 63%

During the first half hour, it looked like Kyrgios might cause an upset. But then this happened:

- Unforced Errors: Kyrgios 33 vs Djokovic 17

- Break Points Won: Kyrgios 17% vs Djokovic. 50%

Despite hitting more winning shots and aces, Kyrgios lost the championship in the end. He failed to hold on to and capitalise on his winning positions. Of course at this level of competitive sports, other factors are at play such as psychology, experience and determination. However, if Kyrgios had played to protect his opening win, perhaps the outcome could have been very different.

Approval Vote

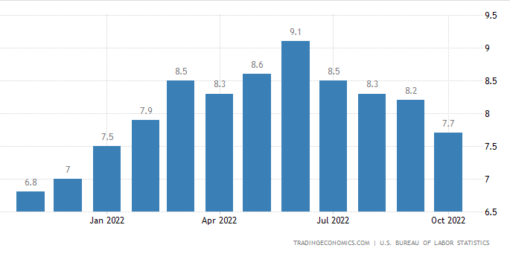

A more recent case of ‘winning by not losing’ was during the US mid-term election. Traditionally, mid-term elections are a referendum on the incumbent party’s performance. Democrats were expected to take a beating due to unhappiness over uncontrollable inflation, surging energy prices, high crime rate and escalating cost of living, amongst other grievances. A huge Republican red tsunami was projected, with Democrats likely to lose their majority in the House, and possibly also the Senate.

President Biden headed into the mid-term election with a negative rating, ie his disapproval was higher than his approval rating. It didn’t help that his predecessor Donald Trump has maintained a menacing presence throughout and many see the midterm elections as a Biden-Trump showdown.

When the results were tallied, the expected Republican red wave never materialised. Democrats managed to reverse historical trends and held on to the all-important Senate majority. They did, however, have to concede control of the House to the Republicans.

So what happened?

Even though Biden’s popularity rating was only 41%, the favourability rating of Donald Trump (who is seen as a proxy to the Republican Party) was even lower at 39%. President Biden won by not losing his thin margin of supporters. He held his ground, which was all it took to win. Everything is relative, isn’t it? You may not be the best or have the mostest, but if you fight to keep what you have, sometimes that is enough to win.

Investing

This concept of ‘winning by not losing’ is very apt when applied to investing. It is the principle adopted by many successful investors. Minimising loss or risk in investment is crucial in protecting investment capital.

If you lose 20%, you need to make 25% to recover.

If you lose 50% of the capital, you need to make 100% to recover.

If you lose 75%, you need to make 300% to recover. 300%…that is insurmountable, at least not in the short to medium term.

The math clearly highlights the importance of avoiding or at least minimising loss. For most investors, investing to avoid losses can be a winsome strategy. In other words, play safe, always protect your capital.

This is the exact idea behind 1 of the most well-known quotes in investment world:

“Rule number 1 is to never lose money; Rule number 2 is to never forget rule number 1” ~ Warren Buffet

1 way to apply this ‘win by not losing’ principle is not to try to out-do or time the market. If you chase alpha by investing in actively managed funds, over a 10-year period the chance of underperforming the S&P 500 is an astounding 90%. In other words, you would come out better simply by putting your money into a broad market passive index. The outcome is borne out by an active vs passive investment research conducted by S&P Dow Jones Indices. This is the exact piece of advice I would give to my 23-year-old self to build a path to better retirement.

Personal Anecdote

I like a game of Mahjong every once in a while, especially during the Chinese New Year period as it adds to the festivity. This game pits 4 players against each other by trying to build a winning hand. The winner collects from the other 3 losing parties.

With a high risk appetite, my strategy in the past was to hold out for the big wins, belittling the smaller easier wins. I used to figure that losing $5 10 times can be easily recouped by 1 huge win of $20 each from the other 3 players. Oftentimes, I would forego a smaller win of $5 just to take a chance on a bigger win. Even though the stakes are not high, the adrenalin and excitement that comes from taking such risk is invigorating. I get sweaty palms just thinking about it.

However, half the time I would end up losing.

My mum, on the other hand, plays with the ‘win by not losing’ mentality. She goes for quick easy wins, collecting ‘chips’ more than paying out usually. She will only go for the big hand when her tiles are superb and if she is on a winning streak. 80% of the time, she ends up winning.

They call it defensive strategy and I have adopted this ‘winning by not losing’ strategy to greatly improve my win-loss percentage 🙂 While I’m not promoting Mahjong here – though it is as intellectual as it is fun – it shows that ‘winning by not losing’ is a great gaming strategy.

For after all, isn’t life the most exciting game of all?

To successful living,

Savvy Maverick

(Main image: Angela Loria, Unsplash)

Disclaimer: The views expressed here are drawn from my own experiences and do not constitute financial advice in any way whatsoever. Nothing published here constitutes an investment recommendation, nor should any data or content be relied upon for any investment activities. It is strongly recommended that independent and thorough research be undertaken before making any financial decisions, including consulting a qualified professional.