What To Invest In After Sale Of Investment Property?

Property prices have been busting record-breaking highs the past 2-3 years. This has led many to sell and lock in profit. And that was exactly what my husband and I have decided too. Our decision was also hastened by new tax and housing regulations of the Dutch government.

Amongst the many reasons to sell an investment property, regulatory changes ranks as a top reason. With impending funds flowing in from multiple sale, a different challenge presents itself. What to do with the proceeds from the sale of our investment property?

What To Invest In?

Contrary to experts’ forecasts, the expected recession is nowhere in sight. Inflation seems under control, job markets is resilient, consumers are travelling and spending. The market indicator, S&P 500 benchmark, has returned an impressive 17% YTD. Sentiment is tilting towards the view that recession will not happen this year.

Clearly market timing doesn’t work as those who exited the market waiting to jump in when recession hits missed the uptick this year. The proceeds from our sale is quite substantial, so I want to re-invest instead of staying on the sideline waiting for the other shoe to drop. But what to invest in?

Real Estate

As our favourite asset class, this is the first consideration. But since deciding to downsize our property portfolio, it is no longer a preferred solution. Both my S.O and I look forward to an easier phase in life. Owning real estate directly requires some degree of time and effort even though it ranks best in cash flow and ROI. Real estate is also 1 of the best inflation-hedged assets.

Real estate currently constitutes almost 80% of my portfolio but will reduce once downsizing is complete. This means substantial funds will flow in for allocation to other investments.

Stocks

Stocks is attractive because its high liquidity, ease of entry and ‘passiveness’ in management, reasonable ROI and cashflow if one invests in income stocks. Following the Rule of 100, my stock holding has quite some room to increase so income stocks will get half allocation from the sale proceeds.

I prefer to invest for cashflow in view of the reduced rental income once the property portfolio is fully downsized and to fortify against a recession. Though growth stocks can generate cashflow, it requires selling some shares hence reducing equity stake. Dividends, on the other hand, is both income and cashflow without any dilution.

Stocks Are Riskier

Having said that, stocks are riskier than real estate and bonds. Companies can and do go bust, even reputable ones as demonstrated by Enron, Revlon, Toy R Us and Lehman Brothers. Values of bankrupt companies can plunge to zero and equity holders have little recourse, being at the bottom of debt seniority.

So for someone who has stopped work, it’s prudent to limit income from stocks to variable expenses and not fixed expenses. For an idea as to what constitute fixed vs variable expenses in retirement, you can get an idea from my Retirement Canvas.

This still leaves a substantial amount to be invested to prevent inflation from gobbling up the hard-earned gains.

Bonds

Bonds constitute the other attractive asset class for many investors, due to their fixed returns and better principal protection compared to stocks. Bond holders rank above share holders in debt seniority.

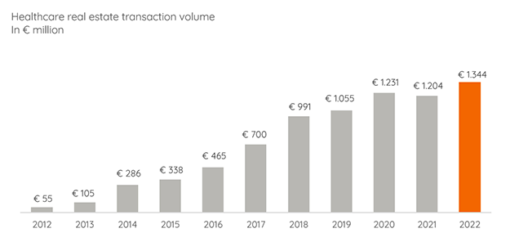

An interesting Dutch corporate bond fund caught my attention recently. It hits the sweet spot of investing along a megatrend, that of a greying society. Dutch healthcare real estate market is huge with total square meters outnumbering retail and office space combined, growing from €55m in 2012 to more than €1b in 2022.

Healthcare real estate refers to properties catering to businesses and companies operating in the healthcare industry. Examples include hospitals, polyclinics and clinics, physiotherapists, pharmacies, rehabilitation centers and serviced senior apartments, to name some examples.

Healthcare Real Estate Bond Fund

This healthcare real estate bond fund acquires commercial properties for multi-year leases to healthcare operators within a centralised complex, as well as serviced apartments for senior living. The fund pays quarterly interest with profit sharing for bond-holders upon its exit strategy, which is the sale of the properties in its portfolio between 7th to 10th year.

The fund attracts me being an alternative to stocks, provides stable cashflow, no management needed plus a gain on the invested capital from profit-share after asset disposal. It caters to a growing trend and is recession resilient, demonstrated by the growth even during years hit by the global pandemic, ie 2020 – 2022.

I also like the fact that bondholders are indirectly secured by claim on the underlying assets, which are financed at 50% loan-to-valuation with annual principal repayment, translating to higher value when eventually sold.

So I will apportion a percentage to this fund and hold the rest as cash, while looking out for other investment opportunities. Always good to have fire power, especially when a recession hits, which is now project to be in 2024…but who knows? Whatever the case, I intend to stay invested since not doing so is no longer an option.

Die Hard Fan

As can be seen, I’m a die-hard fan of real estate, if not directly then indirectly. For what other assets offer such good returns, hedge against inflation and is such solid collateral?

“The best investment on earth is earth” ~ Louis J. Glickman

True blue earthling,

Savvy Maverick

(Main image: 18th century Amsterdam canal houses. Image: Savvy Maverick)

Disclaimer: The views expressed are drawn from personal experiences and do not constitute financial advice in any way whatsoever. Nothing published here constitutes an investment recommendation, nor should any data or content be relied upon for investment activities. Please seek independent and thorough research before making any financial decisions, including consulting a qualified professional. Data and information cited from sources will not be updated after publication.