From Employee To Entrepreneur: Be A Business Owner In Retirement?

After the initial euphoria, many retirees are confronted with “now what?”. The retirement of past no longer fits our vitality, health, longevity and aspirations. Going from full throttle to idleness overnight is not good for us mentally, emotionally or physically.

Younger fitter retirees want to stay engaged, contribute and do something purposeful. Among the many ways of modern retirement, business ownership might just be the spark to reinvigorate your 2nd act.

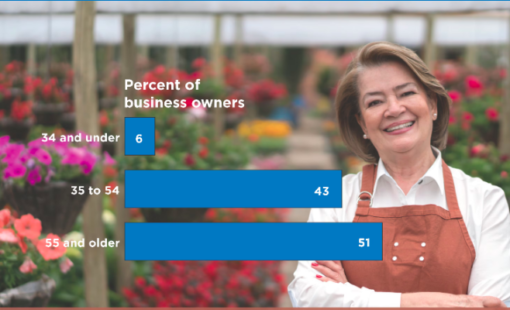

And statistics bear out in your favour.

A Fitting Solution

Buying an existing business can be a fitting solution. You can choose the type of business you wish to own based on the business size, nature, time commitment, income level that aligns with your lifestyle preference. Become your own boss and try your hand at entrepreneurship.

“There are around 400 million small businesses worldwide, accounting for 90% of businesses globally.The world needs to create more than 600 million within 10 years to absorb the new workforce.”~ World Bank

What’s more fitting and meaningful than tapping on your expertise and experience to provide economic means for yourself and others, while fulfilling your personal goals?

You would be in good company too, with 23% of business owners simply not ready to retire.

Why Buy A Business?

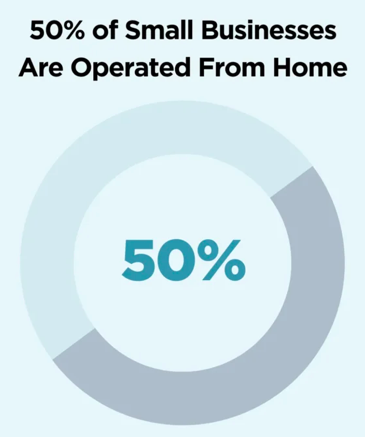

An existing business is more sensible and safer than starting your own. Besides being profitable from day 1, it has many other advantages that can fit your retirement goals, including working from home if that’s 1 of your wishes.

Established Cash Flow

An existing business means access to cashflow based on a proven business model with track record and customers base. You hit the ground running and the decision to ramp it up or tone it down stays with you.

No Re-inventing The Wheel

You skip the teething phase of starting-up: market viability, building customer base, launching, brand building, setting up operational processes etc. You can focus on managing and growing it from get go.

Customer Base

Customers are valuable assets of any business and their loyalty translate into lower marketing costs. You can tap on existing customers to get trusted feedback or ideas on how to invigorate or improve the business.

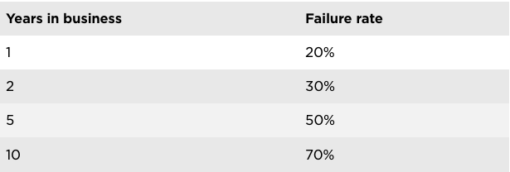

Higher Chance of Success

Given the sobering realities of business survivorship, the more established the business, the higher your chances of success. Benefit from its proven formula, clientele and demand for its offerings.

Suppliers and Staff

Buying a business means tapping into existing relationships with vendors, business partners or inheriting a team of staff. This makes for smoother and quicker transition. You can also enjoy good credit terms given the history of business relationship.

Income Diversification

A business enables you to diversify your retirement income as its returns are not directly tied to stock or real estate markets.

Better Financing Options

Lenders are more willing to lend to existing businesses with proven revenue stream, income track record and balance sheets details. A strong business reputation and good customer base mean may more favourable borrowing terms.

What To Consideration Before Buying?

First, ascertain your retirement goals. Some questions to ask yourself:

- Are you looking for passive income, a new challenge or simply a way to stay engaged?

- What fulfilment will you get from a business that cannot be derived from volunteering, free-lancing or part-time work?

- What expertise, experience and strengths do you have?

- How much can you invest financially? Are you willing to take on debt to borrow?

- How much time/effort can you invest without compromising other interests or obligations?

- Can you see yourself transition successfully from an employee to a business owner?

- What other support can you draw on?

The business you choose should align with your retirement goals for the best likelihood of success and emotional rewards.

What To Look Out For In A Business?

Due Diligence

Do thorough due diligence to learn as much as you can about the business, its industry and market. Talk to those in the same trade, customers, find out industry challenges and those specific to the business. What enhancement can you bring to it?

Engage professionals like lawyers and accountants to ensure the business has no hidden debt, litigation, tax or licensing issues. Be aware of susceptibility to technological disruption or changes in consumer trends.

Financials

Have a qualified professional assess the financial health such as sales data, income statement, balance sheet, cashflow etc. How long it will take to recoup your investment and if it fits your time horizon?

Reason For Sale

Find out why the business is up for sale: Retirement? Health reason? Change of pace? How much time do the owners put into the business and does it fit your goals and lifestyle preference? You want purposeful engagement and to supplement your retirement income, not enslavement.

Valuation

Physical assets, sales numbers, profitability, a company’s brand and reputation are all factors to determine the valuation of the business. The balance sheet offers valuable insight but there can be other considerations too, so best to engage professional help before parting with your retirement savings. Factor in worst-case scenario to understand the impact to your long-term financial security.

Succession Planning

Before you commit, make sure you have an exit strategy. You don’t want to jump into a running car and not know how to stop. Can you sell or pass it on easily when you’re ready to step away. Have some idea on the timeline as well.

Management Effort

All businesses require management effort, even micro ones. Do you have back-up when you go on vacation or meet to attend to personal matters? Be honest and realistic about the time and energy you want to commit.

Industry Knowledge

Although new markets are enticing, your best bet for success is what you’re familiar with or have good understanding through personal interest. It means less management time and effort since you already have some basic grounding.

Where to find businesses to buy?

Persuaded by the idea of buying and owning a business? Where do you start?

Research online platforms like BizBuySell (US) and BFS (Europe) and Deal Stream (Asia). Local real estate agencies are good sources, business associations, transfer agencies and traditional word-of-mouth. Google ‘businesses to buy, location’ and chances are, you will find some listings. Smaller businesses tend to be found in local or community listings than national ones.

What better time to make the switch from employee to entrepreneur? With years of experience (hindsight), backed by capital, strong network of contacts, zest for adventure and time to commit, you are at a prime to run a business.

“91% of small business owners are happy” ~ Homebase

To success and happiness,

Savvy Maverick

(Main image: Mike Petrucci, Unsplash)

Disclaimer: The views expressed here are drawn from personal experiences and do not constitute financial advice in any way. Nothing published here nor should any data or content be relied upon for investment activities. Please do your own due diligence before making any financial decisions. Data and information cited from sources will not be updated after publication.