How This 1 Financial Tool Has Boosted My Retirement

Autumn is here, tentative but surely asserting its right. This is the season often likened to retirement due to the symbolism of transition, maturity and reflection. As I reflect on my retirement, 1 unconventional tool has boosted it immensely. It gives greater peace-of-mind, allows me to take advantage of opportunities that would otherwise be foregone and to enjoy some tax savings. Curious?

An Overdraft (OD)

An overdraft is an extremely useful financial tool to cover short-term cash requirement, providing these benefits:

- Immediate Access to Funds – Having instant access to additional funds is especially helpful in unexpected situations where immediate cash is needed, like when you chanced upon your out-of-production dream car, buying you time to sell your current.

- Flexibility – It can be drawn upon when the need arises and repaid at your convenience without penalty, with no set monthly repayment except interest servicing.

- Avoid Liquidation of Assets – Instead of selling assets to raise funds, an overdraft acts as a short-term cash bridge, allowing you to hold onto assets or buy time for liquidation.

- Smooth Out Variable Income – Provides cover and acts as a buffer for delay in expected cashflow without needing major financial manoeuvres such as selling stocks or bonds.

- Take Advantage of Time-Sensitive Opportunities – enables you to take advantage of special, time-sensitive opportunities like a once-in-a-lifetime heavily discounted world cruise, without straining your retirement account knowing a sum of money is coming your way.

- No Fee and Low Interest in Some Cases: Some banks offer overdrafts with competitive interest rates, especially if secured by a property or tied to a retirement account. And an OD facility does not attract any fee when not drawn upon.

How I’ve Benefited From An Overdraft Facility

I’ve had my OD facility roughly 12 years after I started work. I’ve kept it to this very day, having only drawn on it a handful of times. And each of these occasions had boosted my life.

Renovating A Heritage House

My S.O and I bought a 15th century monument house mid 2019 in the east part of Holland, thinking it would be our forever home. We allocated a generous budget to have it completely gutted and with pipe installation, electrical works, insulation, new roof…the works.

In The Netherlands, restoration of designated heritage homes receives up to 40% subsidy for structural works, which we gladly incorporated into budget.

Then Covid-19 hit early 2020 and everything was delayed because of the global logistics backlog. The heritage subsidy for which we made claims for became a very drawn-out process. Employees were sick, went on long medical leave, there was chronic staff shortage and our claims got caught in the pile-up.

Our cash reserve dried up but we managed to tie over by drawing into the OD. And it came with a silver lining – lower interest rates due to the prolonged crisis. Imagine if we hadn’t had access to the OD. Works would have come to a complete stop pending release of subsidy funding.

What cost us in OD interest was more than made up for by the timely completion. We need not extend our lease and did not suffering a mental meltdown.

A Distressed Property

On another occasion, my S.O and I chanced upon a charming town house. It’s right in the heart of the historical part of Marbella, behind Plaza de Los Naranjos. That was right about the time we downsized our property portfolio in the Netherlands due to unfavourable regulations. We were looking with the aim to re-invest the proceeds upon completion of the sale of our Dutch properties.

The seller reduced his price substantially for a quick sale. His only requirement being that the transaction must complete by year end, which was a mere 3 weeks away. That ruled out buyers who need a mortgage and we became his preferred buyer.

Proceeds from the sale of our properties in the Netherlands would only be available starting mid February, in staggered manner as a few apartments were being sold. So to take advantage of this distressed sale, we used our emergency funds as well as the OD facility to for the amount needed. This property now has pride of place in our portfolio, generating a handsome ROI from rental.

Tax Savings

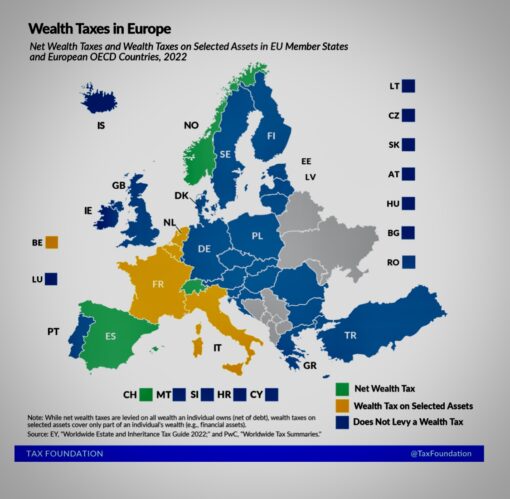

Some countries applies a wealth tax on assets such as bank accounts, stocks holding or difference between assessed property value vs mortgage amount. Such is the case in the Netherlands, where a wealth tax of 36% is applied on bank savings which are deemed to have made a ‘fictitious’ return of 1.03%, after a personal relieve of €57,000.

To use a simple illustration of €100,000 in a savings account. €43,000 (€100,000 – €57,000) is deemed to have made a return of €442.90 (€43,000 x 1.03%), incurring a wealth tax of €159,44 (€442.90 x 36%).

Using the OD facility to supplement our emergency funds means we can reduce our cash holding without compromising access to funds, and saving on tax payment.

Safety Net

Granted, OD is a double-edged sword that must be used with prudence. It’s not for speculation or long-term funds coverage as interest costs can be prohibitive. It should only be for short-term bridging purpose, with certainty of incoming cash inflows.

But when used strategically, it’s a great safety net that allows you to spring higher to pluck the juicy fruit without hitting dirt. It can boost confidence and peace-of-mind when life throws a curve ball.

That’s Life

Some things in life are irreversible. Applying for an OD is 1 of them. Without a regular income, it is almost impossible unless secured by an asset like a property. And if you’re like most people who plan to pay-off your mortgage before retirement, this collateral will not be available.

This is 1 of the main reasons I advocate not to fully pay off your mortgage too. By all means, reduce the loan amount to a level you’re comfortable with the monthly repayment in retirement. Keeping this lifeline to funds open can add to your retirement like it has to mine. So for those who are still not too late, it may be worthwhile adding this useful tool to your retirement arsenal.

Life is unpredictable. Better be prepared than be spooked. And talking about spook…Happy Halloween 🙂

Be prepared instead of scared,

Savvy Maverick

(Main image: Karin Kim, Unsplash)

Disclaimer: The views expressed here are drawn from my own experiences and do not constitute financial advice in any way whatsoever. Nothing published here constitutes an investment recommendation, nor should any data or content be relied upon for any investment activities. It is strongly recommended that independent and thorough research be undertaken before making any financial decisions, including consulting a qualified professional.