Manage Risk Rather Than Maximise Yield For A Stress-free Retirement

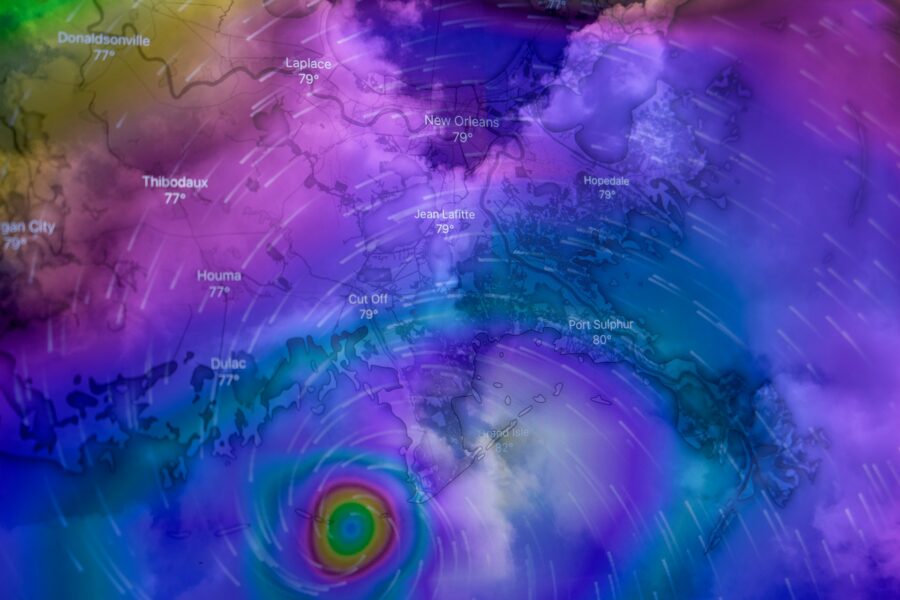

Climate change has amplified the frequency and intensity of extreme weather events. The horrific images of Hurricane Helene and Milton are heartbreaking, smashing home the reality of climate change and its effect on lives. Losing loved ones, your home, belongings and life as-you-knew-it is painful and devastating. And when it happens to someone in retirement, there’s neither time nor means to recover.

There are lessons to learn from these recent natural disasters to guide us make smarter decisions. No better time than now to take actions to safeguard retirement by integrating both immediate and long-term factors into investment and living decisions.

Location and Vulnerability to Natural Disasters

- Lesson: While coastal properties might seem attractive and command higher rent, they are susceptible to water damage. Many insurers reject to insure coastal properties and for those who do, they charge more to protect their profitability. In the end, higher rents may not compensate for higher risk. The same is true for areas prone to wildfires, heatwaves and droughts.

- Action: Focus on properties that are elevated or in areas that have implemented strong climate adaptation strategies such as firebreaks and disaster preparedness systems. Check municipal plans for adaptation strategies and invest only in areas with active resilience measures.

If you’re already invested in coastal property, you may want to take the decision to sell. Climate change should be a trigger for exit strategy. It was the main reason for the liquidation of our entire property portfolio in Fort Lauderdale, Florida. Despite good rental yield, we didn’t want the value of our properties to be impacted.

Paradise Lost

Rising sea level is a global phenomenon affecting all coastal areas, not just in America. The point was driven home when my husband and I visited our regular neighbourhood chiringuito last week:

It was the site of countless memorable breath-taking sunset dinners with visiting friends and family member, and a favourite photo spot for its stunning sunsets.

An inevitable surrender to the voracious lapping waves that were mere 2 meters away at our last visit 2 months ago. We knew it would end 1 day but the reality was still hard to swallow.

Insurance Protection

- Lesson: Comprehensive insurance coverage is essential to safeguard retirement real estate investments from unexpected disasters. Don’t underestimate insurance requirements in areas prone to flooding, wildfire or wind damage, which can lead to massive financial losses.

- Action: Ensure adequate and appropriate insurance coverage, and check that coverage limits are sufficient. Policies should be regularly reviewed and updated to reflect current risks.

Some countries already implemented rules to encourage investing with climate sustainability In the Netherlands, for instance, properties with good energy labels are offered higher mortgage or better rate, enlarging its market potential for rental and eventual sale.

Water Scarcity and Drought

- Impact: Water scarcity, driven by prolonged droughts and increased demand, is a growing concern in many parts of the world. Investing in regions affected by water shortages lead to higher utility costs, reduced property values and decline in livability.

- Lesson: Avoid areas where water scarcity is a long-term concern unless there are strong water management systems in place. Look for regions with reliable water sources and infrastructure designed to handle future water challenges.

Water scarcity is 1 reason my S.O and I are limiting our property investment in Costa del Sol. Notwithstanding its many benefits, this is a risk area we are mindful of. That’s why I am considering investing in a small business to still enjoy the lifestyle and other winsome aspects it offers. Buying a small business is also another way to diversify our portfolio.

Property Resilience and Building Standards

- Lesson: Investing in resilient properties that comply with local building standards can mitigate damage and future repair costs. Those who had invested in newer, well-constructed properties will be able to resume rental activities much sooner than those whose properties required extensive repairs.

- Action: Re-evaluate your portfolio to prioritise investment properties that are built with disaster resilience in mind. This may mean paying more upfront but will significantly reduce repair costs and income interruptions over the long run.

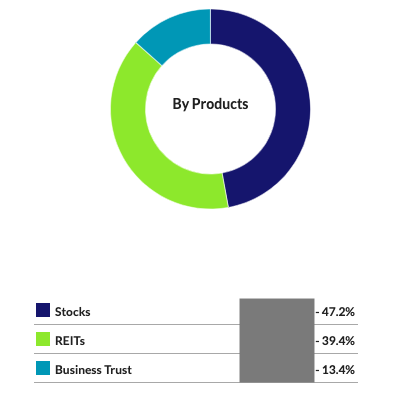

Diversification of Portfolio

- Lesson: Geographic diversification can help mitigate the risk of localised disasters impacting your real estate portfolio. This is why it is safer to invest in more than 1 rental property if you can afford it. Or expand into another asset class altogether for better risk management. Higher energy costs will affect ALL properties directly regardless where they are located. Stocks or bonds, for instance, will be less.

- Action: Diversification is key to managing risk. Consider spreading investments across multiple regions/countries to reduce the likelihood that a single event will impact your entire portfolio. Use tried and tested simple strategy to invest in stocks or bonds to strengthen the resilience of your portfolio.

Emergency Funds and Liquidity

- Lesson: Having access to liquidity is crucial to cover costs like repairs and loss of rental income post disaster, enabling faster recovery and return to normalcy.

- Action: Maintain an emergency fund sufficient to cover repairs, mortgage payments, or lost rental income during times of crisis. It helps cover disrupted retirement income and is a foundation personal financial ratio for better resilience against the unexpected.

Regulatory and Tax Changes

- Lesson: Governments are responding to climate change by introducing stricter building codes, zoning regulations and carbon taxes, which may affect property values and rental profitability.

- Action: Stay informed of evolving regulations that may impose additional costs for compliance or renovation. Policies around carbon emissions, flood zone designations and green building incentives may vary by location. Areas that are ahead of the curve in sustainability may offer better long-term value for real estate investors and provide income resilience at the same time.

Conclusion

Hurricanes Helene and Milton are timely reminders that risk management should be a greater consideration than yield maximisation, especially when planning for retirement income. Climate change affects many places, there will be winners and losers. Some areas will benefit from climate migration – those with moderate climates, good infrastructure and a lower risk of natural disasters – while others will bear the brunt of its destruction. It’s never too late to make changes.

Better late than sorry,

Savvy Maveric

(Main image: Brian McGowan, Unsplash)

Disclaimer: The views expressed here are drawn from personal experiences and do not constitute financial advice in any way. Nothing published here nor should any data or content be relied upon for investment activities. Please do your own due diligence before making any financial decisions. Data and information cited from sources will not be updated after publication.