Why Is Real Estate Typically Not Included In Retirement Portfolios?

Retirement portfolios are often recommended to be in stocks, bonds and cash. I often wonder why real estate is excluded when it aligns better with the needs of retirees?

In my humble view, not only should real estate be a part of retirement portfolio, it should command a lion share. My personal portfolio is heavily skewed towards real estate with stocks for diversification, currency exposure and due to limited bandwidth.

Investing in real estate accelerated my path to retirement, is proven for building wealth and excellent in preserving it. Hear me out as to why real estate deserves to be in retirement portfolio.

1. Stable and Predictable Cash Flow

- Rental Income: Real estate provides regular monthly rental income, providing a predictable source of cash flow in retirement. Cash flow is king in every life stage but especially in retirement.

- Stocks: Stock dividends can vary. In times of economic downturn or corporate crisis, dividends can be reduced or stopped, like during the global pandemic. Imagine what this is like if you depend on dividends for retirement living.

2. Inflation Hedge

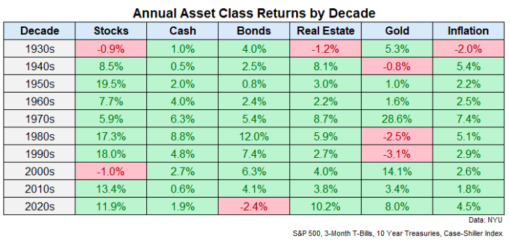

Real Estate: Our biggest threat in retirement is inflation. Property values and rents tend to rise in response to inflation much faster than stocks, reinstating precious purchasing power for retirees.

Stocks: Despite its volatility, stocks are less consistent and takes longer to adjust to inflation. A lot depends on the underlying company and if invested across broad market segments, effects can be cancelled out thus prolonging inflation adjustment.

3. Control

Real Estate: Owning property put you in the driver’s seat with absolute control – location, tenant selection, rent, renovation, when to sell etc. All these help to maximise income and increases the long-term value. In times of crisis, property owners have more time to react and more options , especially if they own more than 1 investment property.

Stocks: Retail investors have little to no control over the companies they invest in. Sure, shareholders can vote but ultimately the management runs the show, driving its agenda.

4. Return on Investment

Real Estate: Historical data often shows stocks having highest returns over other asset classes, including real estate.

While comparing to other asset classes is straightforward, there’s no fair way to compare returns between stocks and real estate because of the latter’s uniqueness. Real estate can be leveraged through mortgage to magnify its returns, rendering general market returns inaccurate.

For e.g.: Putting $100,000 downpayment for a $400,000 property to earn $1,500 monthly rental income generates an ROI of 18%. Even after factoring expenses, ROI will still be in double digits. When the property appreciates to $500,000, ROI against original $100,000 investment is 100%!

Stocks: The same $100,000 invested in dividend stocks that generate average 4% in dividends will only make $4,000 a year.

5. Tangible Asset

Real Estate: Real estate is a physical, tangible asset. Most retirees appreciate the security of owning a property that has intrinsic value that will not go to zero.

Stocks: Stocks value, on the other hand, can drop quickly and dramatically without forewarning. Shareholders of bankrupted companies like Lehman Brothers, WeWork, Blockbuster, Borders lost most, if not all, of their investment. Retirees cannot afford such drastic drop in portfolio value.

6. Leverage

Real Estate: The biggest advantage in real estate is leverage, enabling ownership at a fraction of the cost. This leverage amplifies returns, as seen from the example above, making it a great wealth builder.

Stocks: While margin trading exists for stock investing, it is riskier and can result in significant losses during market downturns. This is not a sensible risk for anyone, least of all retirees.

7. Volatility

Real Estate: Property values move more slowly than the stock market, hence more stable in value. Rental income is also ‘protected’ during lease period, giving owners time to react and respond to adverse market conditions.

Stocks: Stock markets are volatile with dramatic price swings in reaction to development. This is discomforting to retirees who rely on portfolio withdrawals for income. Retirees who needed to sell shares during the global pandemic had to accept losses as markets saw sharp declines in early 2020. This could have potentially long-lasting impact on a retirement portfolio.

8. Tax Advantages

Real Estate: Many countries offer deductions for mortgage interest, depreciation, maintenance costs and other expenses, reducing taxable income.

Stocks: While capital gains and dividend income tax may be lower (or none in the case of Hong Kong, Malaysia and Singapore) or enjoy favourable tax treatment, they don’t offer the same level of tax deductions as real estate.

9. Collateral

Real Estate: Real estate can be pledged as collateral at arguably the lowest interest rates for loans. This is 1 reason why I advocate not to fully pay down your mortgage when entering retirement. Depending on the equity, the quantum of borrowing can be significant to fund major life events.

Stocks: While stocks can also be offered as collaterals for loans, the quantum is lower and interests rates are higher. If used, it is for short-term bridging or emergency use, not long-term.

10. Imperfect Market

Real Estate: Real estate market is inefficient due to asymmetries and unequal access to information. Buyers and sellers are not always well-informed, so it is possible to find great deals. It allows for location arbitration so you can spread over more locations due to better affordability.

Stocks: Stock markets move at the speed of internet with many buyers and sellers accessing the same information. This efficiency renders it harder to gain an edge.

Downside Of Real Estate?

Of the many reasons against real estate, 2 stand out and deserve to be addressed.

- Lack of liquidity means real estate cannot easily convert to cash. Selling a property takes months, even years and involves many parties and higher costs.

I would argue that while the property itself is illiquid, one can access funds by tapping into its equity. The good thing is you don’t need to sell the property to get this fund so you can continue to enjoy its income. This is not possible when stocks are sold to raise funds.

Being illiquid can also be an advantage as buying and selling is less dictated by emotions. Time can moderate sentiments, preventing hasty actions that do more harm than good.

- Time and effort is the other often-cited reason against holding real estate in retirement.

This aspect of property ownership keeps one engaged, not just within property boundary but also the wider community. It’s a great way to learn and keep abreast and cultivating a network of contacts, providing purpose with concrete outcome. With time on hand, I can’t think of a better stage in life to own real estate than in retirement.

Should the responsibilities become too much, you can appoint a property management company to handle the portfolio for a fee. While this reduces the ROI, maximising return is no longer the goal in retirement.

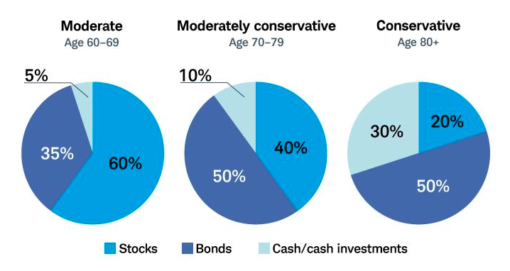

Ideal Retirement Portfolio

There is no ideal retirement portfolio that suits everyone. A diversified approach is the best way by combining real estate, stocks, bonds and cash. Real estate provides better down-side protection while stocks lead up-side potential.

It is well worth considering real estate in your retirement portfolio to strike the right balance between stability, returns and protection against inflation..

Best way forward,

Savvy Maverick

(Main image: Jakub Zerdzicki, Unsplash)

Disclaimer: The views expressed here are drawn from personal experiences and do not constitute financial advice in any way. Nothing published here nor should any data or content be relied upon for investment activities. Please do your own due diligence before making any financial decisions. Data and information cited from sources will not be updated after publication.