Inflation Can Be A Friend Instead Of An Enemy

Happy Chinese New Year to all those celebrating! Hope the Year of the Tiger brings health, joy and many new opportunities!

You probably have heard of the saying: ‘Money is a great servant but a bad master’. I’d like to suggest a similar adage as additional food for thought:

Inflation is a great servant but a bad master.

If you understand the original saying about money by Francis Bacon, it will not be hard pressed to appreciate the statement about inflation. While it has been in hibernation pretty much the past decade or so, inflation is rearing its ugly head to assert its dominance that is affecting almost every aspect of our lives. It is impossible not to notice the price hikes in gas, food, transportation and other daily necessities.

Although it is possible to try and curb the impact of rising inflation by taking some prudent action, the fact remains that we are subject to its mercy because in a modern society, money is what makes the world goes round.

As long as one works for money with little or no pricing power – such as being an employee – then as the value of money depreciates it follows naturally that unless one’s salary is adjusted to compensate for inflation, one is effectively earning less in terms of purchasing power.

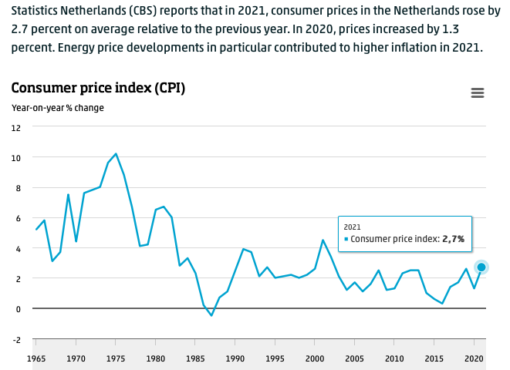

In the Netherlands, the CBS (Centraal Bureau voor de Statistiek) is the government agency tasked to track and calculate inflation and other national statistics. Every year it computes and issues official inflation statistics that are adopted for various purposes. Inflation in the Netherlands is 2.7% in 2021 as reported by CBS, the highest in almost a decade.

And according to CBS, average wage adjustment in 2021 was 2.1%. Even if salary is increased by 2.1%, against an inflation rate of 2.7%, one is still earning 0.7% less in real terms compared to last year. And if one is lucky enough to get an increment of 2.7%, one is just making par and merely keeping up with inflation, not actually earning more. As long as one is not in any position to adjust what one earns to combat the effect of inflation, one is effectively a servant to inflation, as well as money. And both are bad masters.

Now let’s look at the flip side to see how inflation can become a friend instead of an enemy. In other words, how can one become a master to inflation? Such an ideal situation grants the ability to automatically adjust earning to cushion the impact of inflation.

One of the best ways is to become a landlord to earn rental income.

Rental Income Adjusted By Inflation Index

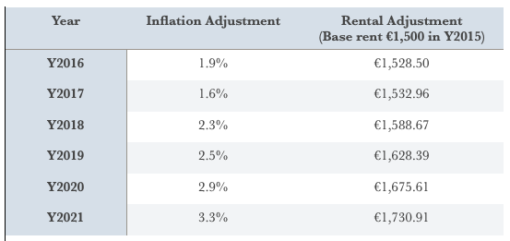

For 2021 the CBS inflation index to be used for rental adjustment is 3.3%, allowing rents to be increased anywhere up to this maximum percentage. I have included the historical inflation index figures over the past 6 years for better perspective:

The last column in the table shows the annual rental adjustment for 1 of my investment units with tenancy that started in 2015 at an initial rent of €1,500. With the release of the official CBS data, I have just issued the rental adjustment notification for 3.3% that will take effect from 1 February, with several more other leases to come throughout the course of the year. How sweet is that?

Decrease of Real Mortgage Value

In addition, the unit cited above was bought with a mortgage and the debt has just been ‘reduced’ by 2.7% in real terms, thanks to inflation, effectively shrinking the debt. Remember the effect of compounding? It works both ways: while it keeps on increasing one’s investment earnings it also keeps decreasing one’s debt through the phenomenon of inflation, working to every borrower’s advantage.

Increase in Property Value

Last but not the least, as inflation causes the prices of things to increase, prices of real estate are boosted by inflation year after year, effectively enlarging the gap between the value of the property and the mortgage amount. No wonder mortgage is considered a good debt!

So inflation serves landlords in the following ways:

-

-

- Rental rates are adjusted (at the very least partially) to off-set the inflation rate

- Devaluation of mortgage amount in real terms as the debt grows increasingly smaller

- Enhancement of property value over time

-

In Florida where we own a few investment property, there is no such practice of annual inflation indexing for tenanted properties. However, all leases are by law restricted to only 1 year and hence are required to be renewed annually, which allows for rental amount to be increased in line with inflation rate.

Similarly in Singapore, official inflation indexing does not exist but tenancy agreements tend to be for shorter duration between 1 to 2 years with an option to extend further subject to mutually agreed rental adjustment if desired.

So even if the country you’re investing in is not like the Netherlands where inflation indexing is legally applied to adjust rent annually, and more like the US and Singapore markets, inflation can be incorporated whenever leases are renewed, as long as the property is not under any rent-protection regulation. Hence, it is extremely important to invest in the right market segments that allow for inflationary rental increment. The ability to adjust rental to meet inflation is an important reason why rental property is my favourite income stream.

Dividend Stocks Can Be Inflation-Hedged Too

Another inflation-hedged income stream is good dividend-yielding stocks. Dividend income can be very powerful, accounting for as high as 40% of a stock’s return, according to a recent study by Fidelity.

Buying into companies that routinely raise their dividends pay-outs means investing into strong stable businesses with healthy cash flow positions and good profitability. The increasing dividend pay-outs provides good inflation hedge, guarding against the erosion of purchasing power over time.

The study further cited that “stocks that increase their dividends the most considerably outperformed the broad market on average”, which means the value of such companies’ stocks increases on the strength of their businesses, resulting in bigger total return.

These examples clearly show how beneficial and powerful inflation can be instead of the common enemy that everyone fears and hates. If you learn to invest safely in rental property and strong dividend-paying companies that keep increasing their dividend pay-out, you have tamed the inflation monster and become its master instead. It will then work to your advantage instead of detriment, and without much additional effort. Such is the beauty of inflation-hedged income.

The joy of being a master,

Savvy Maverick

(Facade of pre-war shophouses in Chinatown, Singapore. Image: Jack Hunter, Unsplash)

Disclaimer: The views expressed here are drawn from my own experience and do not constitute financial advise in any way whatsoever. Nothing published here constitutes an investment recommendation, nor should any data or content be relied upon for any investment activities. It is strongly recommended that independent and thorough research is undertaken before making any financial decisions, including consulting a qualified professional.