2 Simple Strategies To Start Investing

The year has opened with a barrage of news that can be cause investors to go jittery and anxious: unabated rise in inflation, surge in Omicron infections, threat of Russian invasion in Ukraine, resumption of missile testing by the North Korean regime and an almost certain rate hike by US Fed in Q1, followed by another 2 later in the year. Many expect a market corrections, especially in the US after more than a decade of galloping.

If you decided to start investing for retirement this year – congratulations! Should you jump in or wait for market correction? What should you invest in? How do you even begin?

First of all, define your investment goals. Investing without clear goals is akin to navigating a bumpy terrain without a compass.

My over-arching philosophy, especially in investment, is to KISS – Keep It Simple and Straightforward as I prioritise maximising experiences and enjoying life instead of constantly having to work on my investment. I have neither interest or inclination for Elliot Wave framework or tracking 200 EMA (Exponential Moving Average) movements, preferring simple and straightforward strategies. And if low-cost well-diversified broad-market funds can deliver my target return, why would I put effort and take on more risk picking individual stocks that require more time and active management?

Invest not to beat the market; invest to the beat of the market so you can dance your way to retirement. ~ Savvy Maverick

I do not invest to beat the market, I invest with a relative mindset, ie try and improve my position relative to the previous year, quarter or month. If you are earning 0.5% interest on fixed deposits, which is negative interest by the way, then you are already better off by investing in a REIT ETF or S&P 500 index that delivers 4% or more in returns. Investing to beat the market is stressful and can be de-motivating. Invest to improve upon your current position means you strive to do better than now, building wealth in baby steps. Small but steady.

2 easy and hassle-free ways to invest for beginners are Dollar Cost Averaging and Value Averaging. Both are easy to execute and will help you to reach your financial goals, as long as you stay realistic and let time manifest the results.

Dollar Cost Averaging (DCA)

This requires setting aside a fixed amount of money (say $200, $500 or $1000) to be invested regularly on a monthly or quarterly basis. Longer interval between investments will result in less pronounced effects since you would miss riding the market movements. You can either enrol in an investment plan or buy the security yourself. The advantage of an investment plan is that it is automated and you can invest with as little as $100. You invest regularly regardless of market highs or lows. No market timing but consistency and less stress.

Value Average (VA)

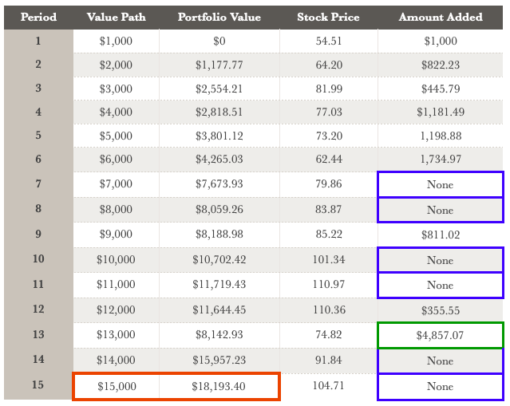

Value averaging requires the value of the investment portfolio to be fixed on a monthly, quarterly or yearly basis, requiring the amount that is being invested regularly to fluctuate instead. For example, starting with $1000 and a goal to grow the investment portfolio by $1,000 monthly over the next 10 years. The increase of $1000 per month in portfolio value is known as the value path that will guide investment activities over the specified timeframe.

If the portfolio makes 5% return in the 1st period, you need to invest only $950 instead of $1,000 to reach the next value path of $2000. When portfolio value exceeds the value path at any point, the strategy requires selling off the excess to keep to the integrity of the value path. This is like taking profits off the table, allowing you to draw from this stash when the portfolio value falls more than $1000 below the defined value path.

For me, I tweak this rule a little by keeping the profits in the portfolio instead of tempering down to meet the value path and by doing this, I let the invested amount continue making good return. No top-ups needed in periods when my gains are more than enough to meet the difference between actual portfolio value and set value path, see blue boxes in Table below:

So there you have it, 2 easy-to-understand and simple-to-execute strategies that work not just for beginners but also for investors who prefer to keep things simple.

DCA vs VA – Which is Better?

Both strategies are easy to implement and work via discipline, consistency and keeping our emotions and the tendency to market time at bay. It is designed to be habit-forming and to take the fuss out of investment. The moment you start and commit to it, you are already embarking on your path to retirement.

Both abide by the “buy more when cheaper” rule as more of stocks or fund units are bought when their prices are cheaper and lesser when prices are higher. Between the 2 strategies, VA’s effect in this aspect is more pronounced as its very construct requires buying more to meet the value path without the limit as prescribed under DCA. This allows VA strategy to takes more advantage of market dips.

DCA is simpler and stress-free. You can pre-determine a fixed ratio and invest systematically until the next portfolio review. If you sign up for a DCA investment programme, the only effort is the initial decision on investment amount, investment interval and the instruments, then you can just sit back and let cruise control kick in. The existence of many DCA investment programmes that accept small investment amount also makes it easier to start. Cashflow management is also easier since the investment amount is fixed. It is highly suited to folks who want a laid-back approach to investing.

VA, on the other hand, requires a little more management and tracking as one must know the portfolio value at every interval in order to make the required action to close the gaps. However, with all the apps and software available, that is not difficult. Additionally, by leaving portfolio gains in the portfolio enables me to maximise return, thus more likely to translate into higher portfolio value at the end period.

VA starts with the target portfolio value in mind so the end point is already known, which makes it very suitable for retirement planning. Say if you wish to retire with $1million in portfolio value, deploying VA is more likely to reach this goal than DCA since the latter allows end value of the portfolio to fluctuate. However, it is also possible that the amount needed to close the gap between actual portfolio value and the value path can be challenging if market dips are significant, see Period 13 in Table 1 above. It may affect your cashflow or require you to dig into other sources of funds, though this is supposed to be mediated by the lesser top-up or realised profits in more profitable periods.

Personally, I prefer VA over DCA simply because I am a goal-oriented person and VA starts with the end in mind, giving me absolute clarity and better control as I can top-up along the way to make sure I reach the end goal. The end portfolio value can also exceed my target, see Period 15 in Table 1.

The very nature of stock markets is fluctuation and volatility so to market-time is futile, stressful and can be detrimental to investment and wealth goals. Once investment goals are set, with a long term investment horizon and using proven strategies like DCA or VA, you will be able to make steadfast progress on your retirement goals, and hopefully exceed it.

To investment success!

Savvy Maverick

(Main image: Nabit Photos, Unsplash)

Disclaimer: The views expressed here are drawn from my own experience and do not constitute financial advise in any way whatsoever. Nothing published here constitutes an investment recommendation, nor should any data or content be relied upon for any investment activities. It is strongly recommended that independent and thorough research is undertaken before making any financial decisions, including consulting a qualified professional.

4 thoughts

I love reading an article that can make men and women think. Also, many thanks for permitting me to comment!

Hi Marc,

Nice that you find the strategies thought-provoking. Let me know how it pans out if you try either of them out. Good luck!

You’re so cool! I don’t think I have read something like this before. So wonderful to discover somebody with a few original thoughts on this issue. Really.. thank you for starting this up. This website is something that is required on the web, someone with some originality!

Hi Lilli,

Love your candid feedback! Great that you find the post useful.

Do continue to check in for new content!

Cheers,

Savvy