Why Choose Mortgage Financing If You Can Afford To Pay Cash For A Property?

Buying a property is 1 of life’s biggest decisions, as well as expenditures. It involves a kaleidoscope of emotions and is almost always life-changing. Real estate is the best path to wealth, increases well-being and broadens one’s perspectives. Once you master the formula, you can ‘rinse & repeat’ for similar outcome, making it a great wealth tool.

By the time one reaches retirement age, one has likely amassed enough savings to pay for a property in cash. While that might seem like the safest option, leveraging a mortgage offers several potential benefits that may be worth considering.

Cash and Liquidity

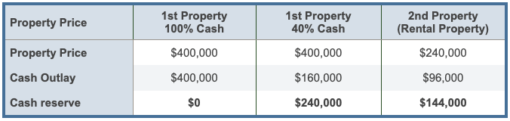

One primary reason to leverage a mortgage is to preserve cash and maintain liquidity. Financing a property with mortgage avoids tying up significant cash in an illiquid asset. The cash reserve provides financial cushion for unexpected expenses or for other investment.

For example: buying a $400,000 property with 40% cash/60% mortgage means releasing $240,000 to fund, say, a small rental property. This rental property can be paid for fully from the cash reserve or partially with 40%/60% mortgage like the first property. If the latter, there is $144,000 left as emergency funds.

Tapping on mortgage instead of paying full cash for the 1st property, you get to own a 2nd property and earn cashflow from rental income. Isn’t this greater peace of mind?

Higher Returns

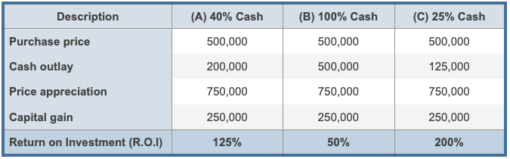

By using a mortgage, you amplify the returns through leverage. Let’s use an example to illustrate this, on a property costing $500,000 that appreciates in market value to $750,000 over time.

Case A: Buy with 40% down payment (ie cash $200,000) and a mortgage of $300,000.

Case B: Buy with full cash.

Case C: Buy with 25% down payment (ie cash $125,000) and a mortgage of $375,000.

The ROI on initial investment are such:

As can be seen, ROI is 2.5 times more buying with 40% cash/60% mortgage (Case A) vs paying full cash (Case B). And if even lesser cash is deployed, Case C where downpayment is only 25% with a mortgage of 75%, the ROI is even higher. Having said that, every debt carries risks so the amount of loan must be carefully considered against affordability. ROI should not be the only consideration.

If the preserved cash is re-invested, the ROI will be further enhanced. And that, is the beauty of leverage, a.k.a Other People’s Money.

Diversification

Diversification is a fundamental principle of prudent investing. Tying up a significant portion of savings in a single property or 1 asset class leads to concentration risk.

Using a mortgage to purchase property and allocating saved funds into other investments such as stocks, bonds or real estate investment trusts (REITs). This mitigates concentration risk while at the same time enhances the overall stability of the portfolio.

Estate Planning

Leveraging mortgage to purchase property can affect the distribution of assets and potential tax liabilities upon death.

For example, consider these 2 scenarios for a property bought with cash vs 50% mortgage and with a current market value of $500,000:

- Scenario 1: Property bought in cash is taxed at full market value, ie $500,000.

- Scenario 2: Property bought with 50% mortgage is taxed at market value less mortgage, ie $500,000 – $250,000 = $250,000

Beneficiaries under Scenario 2 are taxed lower while still allowing them to enjoy the benefits of property ownership such as rental income.

Inflation Hedge

Real estate is 1 of the best hedges against inflation. Property value and rental income rise over time due to inflationary pressures. By the same principle, fixed debt shrinks over time in real term. That’s why inflation is considered a friend of real estate.

Leveraging a mortgage allows one to capitalise on the potential appreciation and income-generating capabilities while reducing the impact of inflation. This is what makes mortgage a ‘good debt’.

Tax Benefits

Some countries, like America and the Netherlands, offer tax advantages associated with mortgage interest deductions for owner-occupied properties. By financing a property with a mortgage, you can potentially lower taxable income and reduce overall tax liability. So do check out if such tax benefits apply in your jurisdiction.

Opportunity Costs

Nothing beats having the dough to do as you please and taste the full flavour of life, especially when young. The older I get, the more I tend to think of wealth in non-financial terms. I’m a big believer in YOLO, living life by the mantra ‘Why not?’ And always seeking first experiences to keep from being jaded.

Some life experiences are simply not the same or difficult to undertake in later years. Extreme adventures or sports, backpacking, studying abroad…you get what I mean.

Why lock your life savings into an illiquid property and limit other life experiences? This is especially so if the property is not income generating. Doesn’t it make more sense to tap on mortgage and free up cash to embark on other adventures in life?

Mortgage In Retirement?

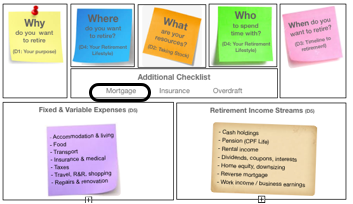

Most people prefer to pay off their mortgage before entering retirement but I hold a contrarian view. I believe that keeping at least 1 mortgage in retirement provides access to benefits that are helpful. For peace-of-mind and risk management, though, I would keep the mortgage amount low. This is 1 of the suggestions in my Retirement Canvas – to NOT fully pay off the mortgage on the property you call home.

Sure, a mortgage entails some risks, such as interest rate fluctuations and potential cash flow constraints. These risks, however, can be mitigated through sound planning like fixing the mortgage rate when low and reducing the borrowed amount for affordability.

You know yourself and your situation best. Having a mortgage debt does not sit well with many, especially in retirement. Think through the pros and cons of leveraging a mortgage, consult a financial advisor to fully understand the risks or any implication specific to your personal circumstance. Some moves are irreversible, like seeking a new mortgage after you quit work.

To good debt,

Savvy Maverick

(Main image: Savvy Maverick)

Disclaimer: The views expressed here are drawn from personal experiences and do not constitute financial advice.I’m not a licensed financial advisor. Nothing published here constitutes an investment recommendation, nor should any data or content be relied upon for investment activities. Please seek qualified financial advice and do your own due diligence before making any financial decisions. Data and information cited from sources will not be updated after publication.