How To Start Investing With Limited Capital

Just like spring, the beauty of youth is its freshness, sense of adventure and willingness to explore. Life at this stage is one big adventure and learning process. Youth symbolises new beginnings, endless possibilities and uninhibitedness to try and learn new things. This is a winsome attitude that lends itself perfectly to investing.

A 23-year-old mentee came to us with an interesting proposition. He had spotted an investment opportunity but has limited capital to take part in it. He presented a plan to co-invest by borrowing 40% capital from us and with his savings making up the balance 10%, we would take part in the venture on 50-50 basis. He proposed to pay us interest rate of 6% per annum and 2% principal repayment every month. In the Netherlands, private individuals are allowed to lend money to 3rd parties but interest must be charged.

The investment object is a holiday chalet in a vacation park targetted at families with children. After taking into consideration maintenance and rental management costs, he arrived at an R.O.I of 13%+ per annum. This means he can still earn 5%+ after deducting borrowing costs, interest and principal repayment. And if the vacation park is granted full residential status – a small but possible likelihood – the value of the chalet will increase 300-400%. So he is eying both rental income and possible multi-fold appreciation. Kudos for his thought process.

Both me and my husband were struck by his creativity and determination. Even though only 23 years and just started work, he is already thinking about how to invest and grow wealth. Most young adults his age are focused singularly on doing well in their career to earn promotions, which is sadly not enough to become wealthy. And there are others who are more interested in being cool by buying cars and living a pretend lifestyle they can ill afford, mortgaging their future by taking on bad debt in the process.

Every Investor Started Small

Big things often have small beginnings ~ Unknown

While the financial success of respected investors are celebrated, most of them started small. Besides capital, other factors play an important part too, such as time, discipline, leverage, market condition and knowledge.

The 2 biggest factors that can best replace capital would be time and knowledge. Time is a given but even though everyone gets the same 24hours, 1440 minutes and 86,400 seconds in a day, some people extract more out of theirs than others by using their time more wisely. As with everything else, use it or lose it.

Financial literacy is like an arsenal of weapons and tools to gain unfair advantage, resulting in disproportion outcome and/or significantly reducing one’s risk. In this era of easy access to information and learning, it is a great disservice to not seek some basic level of investment knowledge. I am a F.I.R.M (Financial Intelligence Retire Magnificently) believer, which is how I could retire early and enjoy a bigger and better living. The route to F.I.R.E is best achieved through financial literacy.

Starting Small

I would invest a starting capital of $20,000 the following ways, drawing on the hindsight and experience gained over the past 20+ years.

Stocks Investing

I stand by the advice I would give to my 23-year-old self. Save and invest every month into a broad-market diversified low cost ETF or tracker fund like the SDPR. 2 easy ways to do this: through dollar-cost-averaging or value averaging, which you can read more about it here. This helps to build discipline, knowledge about investing and financial markets.

Start to learn simple analysis to build a watch list of growth stocks, doing paper trades to practise in the meantime while biding for more capital and the right market opportunity.

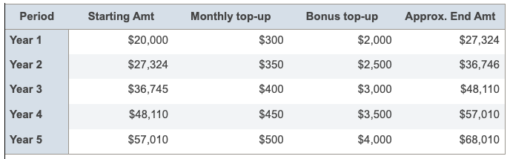

Taking a simplified average historical returns of 8% of the S&P 500*, with monthly top-up and annual addition from bonuses, $20,000 could grow in 5 years to such:

This table illustrates the power of a consistent investment and compounding of the stock market over time. Using the Rule of 72, it takes approximately 9 years to double the initial capital at a return rate of 8%, without further top-ups. Depending on the amount of regular top-ups, the doubling effect can be significantly magnified, as can be seen from the example above.

Real Estate

The biggest accelerator of wealth to me has always been real estate. Why? Because of the ability to use leverage, which when used sensibly, can magnify the returns many-fold. Leverage is the heavy lifting using other people’s money.

Depending on the affordability of property prices in your country, I would then buy a rental property if the invested funds are sufficient for downpayment. This is how I started my journey of wealth accumulation and early retirement.

Do not be discouraged if after 5 years of saving and investing in the stock markets, you are still unable to afford a rental property. Real estate in some markets can be exorbitant – Singapore, Hong Kong and Japan come to mind. There are now more ways to invest in real estate such as real estate crowdfunding, which pools funding from many investors to buy investment property. One can start from as little as $100 depending on the platform. Do check out if real estate crowdfunding are offered in your country as it is a good way to grow wealth.

Another way is to get creative like our 23-year-old mentee. Having done your homework and with the right determination, you will be able to find like-minded corroborators, friends or investors who are happy to supply capital while you do the legwork. Keep in mind also that in an environment of rising inflation, there are many cash-rich folks looking to invest their money. Win-win outcome for all parties.

Have you thought about tapping on the equity of the home you are currently staying in? If the property belongs your parents, are you able to convince them to take on a loan to release the equity built-up for new investment opportunity? They can collect a portion of the rental income as extra earning instead of letting the equity sit idle.

Say if the property is currently valued at $1million and the outstanding loan is $300,000 due to repayment made over the years and property appreciation. Assuming a loan-to-valuation of 60-70%, the bank may consider lending $300,000-$400,000 through the home equity since it is secured by the value of the underlying asset. Mortgage and refinancing loans offer one of the lowest interest rates in the market which makes it sensible to use such borrowing instead of other more costly options. You can then use the additional sum as downpayment for a rental property to generate additional income.

Options

For those interested and willing to learn about options trading strategies, they can offer great returns with limited risks compared to buying stocks direct. For example, Long Calls options allow one to use limited capital to gain control of the same amount of stocks at a fraction of the costs versus owning the stocks outright. Owning options do not earn dividend income (where applicable) but it is one of the most efficient ways to trade with limited capital. One can trade options with as little as $100 and grow that significantly with the right strategy, while limiting the loss should the trade turn against you. Returns can range in the 100%’s given the right strategy, judgement call and market conditions.

There are many courses and books that teach options trading. You must get the right training and practise before doing options trades. It remains one of the great skills to learn for building wealth.

Peer-to-Peer Lending

One of the new innovative financial products launched over past decade is peer-to-peer lending where a large number of investors pool their resources to loan to companies or individuals who cannot secure traditional bank loans.

I recommend lending to businesses rather than individuals to limit risks. Depending on the platform, risk profile and businesses of borrowing companies, interests can range from 6% to 18% for period as short as 3 months and up to 1 year. Needless to say, higher interests are associated with higher risks so make sure conduct careful screening and diligence.

When investing in such loans, choose for underlying security such as trade receivables bigger than the loan, pledged assets or personal guarantee of directors. Loan defaults can happen, from 1%-5% so do check out fact sheets thoroughly before investing. Many platforms offer Apps as well as Robo-help which make loan participation and tracking easy.

Investing in Yourself

Nothing beats fortifying your knowledge in the area of wealth accumulation. The more you learn, the lower your risk as you apply the right investment knowledge to different types of investments and market conditions. Take if from one of the most respected investment guru’s of all time:

The best investment you can make is in yourself ~ Warren Buffet

I started learning about options trading during the Covid period while being cooped up at home. I had more time and many courses started to move online. This makes it easy to learn from the most successful investors. Having said that, learning is only a small part of wealth creation, practicing and applying the knowledge learnt makes the world of a difference.

As Simon Sinek says:

Dream big, start small. But most of all, start

It doesn’t matter if you have little capital or knowledge, by choosing to get financially educated and starting on a small scale, you put yourself on the path to wealth. Everything is relative: if you can improve a little today than yesterday, better this month than the last, this year than the previous…every small step in the right direction counts.

To small but mighty beginnings,

Savvy Maverick

(Main image: Arno Smit, Unsplash)