A Cause For Renewed Excitement In Cryptocurrency

If you have made international funds transfer before, it is likely you have used the services of SWIFT (Society of Worldwide Interbank Financial Telecommunication). It is a messaging network that banks and financial institutions use to securely send and receive money transfer instructions.

SWIFT is jointly owned by more than 2,000 banks and financial institutions, including some of the largest in the world. It comes under oversight by the Bank of Belgium in partnership with the US Federal Reserve and the Bank of England. Since its founding in the 70’s, SWIFT has become the dominant financial messaging network used by banks and financial institutions for international remittances.

A momentous event is underway, creating ripples within the crypto and investor communities but largely obscured from the general public. This event will not only completely revamp how institutional cross-border fund transfers will be processed, it will also pave the way for cryptocurrencies to come into the mainstream domain.

SWIFT Revolution

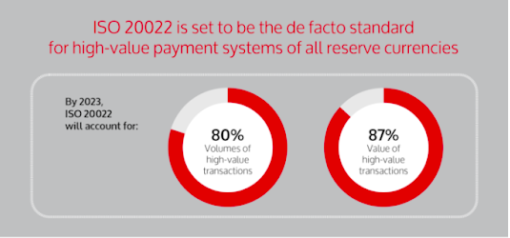

With effect from November 2022, banks and financial institutions around the world are set to transition from using SWIFT messages to a new standard – the ISO 20022 – for processing of cross-border payments and remittances. SWIFT itself is leading this change by replacing its antiquated and administratively cumbersome legacy messaging system with the global and open ISO 20022 language for payments.

Besides SWIFT, ISO 20022 is also fully backed by the Federal Reserve and the European Union. The EU is slated to go-live in November 2022 while the Federal Reserve has announced its transition as 1st quarter 2025.

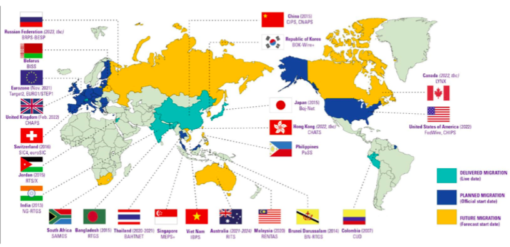

Currently, more than 70 countries have adopted or are testing-to-adopt ISO 20022, including my motherland Singapore 🙂

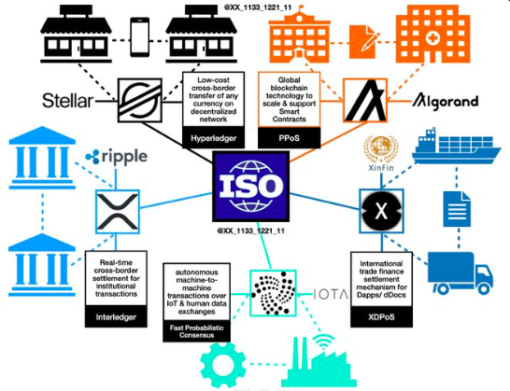

Switching to Distributed Ledger Technology that is the underlying framework powering ISO 20022 means the elimination of intermediaries. Transacting parties will be able to “speak the same language”, allowing international banks to connect directly with each other. Transactions are completed in a matter of seconds instead of days, at a fraction of current cost, are more secure against hacks and fraud as well as being fully traceable within a timestamped master ledger, a cornerstone of blockchain technology.

So how will this affect cryptocurrencies?

Excitement in Cryptocurrencies Again

There is a handful of cryptocurrencies that are compliant with the ISO 20022 standard. It is likely that demand for these compliant cryptocurrencies will skyrocket as ISO 20022 gets progressively adopted to become the global payment standard.

More cryptocurrencies are likely to become ISO 20022 compliant and be accepted into the framework, perhaps even for payment. If so, bank customers would be able to use centralised banks and a globally recognised transfer network to send decentralised crypto’s. More cryptocurrencies becoming compliant will surely open up a floodgate for crypto adoption. This development is the reason for my renewed excitement in cryptocurrency, which has been lackadaisical since the crash early this year.

I ventured into the crypto world the final few weeks of 2020, just in time to ride the crest to its peak when the crypto market hit US$3 trillion in value in November 2021. Armed with a simple strategy, my husband and I managed to reap decent profits from our trades and have managed to stay in the black at all times, up to this day.

However, our portfolio performance has been nothing but lacklustre since the crash. I hardly have the motivation for any crypto trade the whole of this year, but that is set to change.

A New Perspective

The transition by SWIFT to ISO 20022 protocol made me sit up as this development bodes well for the crypto industry. It is a move that will likely drive higher demand for compliant cryptocurrencies given the expected growth in global payment. The possibility of crypto and fiat currency existing in harmony on a global payment network will be a game changer.

“The global payments market is expected to grow from $511.87 billion in 2021 to $572.06 billion in 2022 at a compound annual growth rate (CAGR) of 11.8%. The market is expected to grow to $870.09 billion in 2026 at a CAGR of 11.1%.”

~ Research and Market

Demand for ISO-compliant cryptocurrencies will likely go up in line with the forecasted growth in global remittance. The adoption of ISO 20022 messaging standard also lays the foundation for more cryptocurrencies to be introduced into the framework, particularly Central Bank Digital Currencies (CBDCs) which are digital versions of fiat currencies. One example is China’s e-RMB, which takes the honour of being the 1st CBDC, was rolled out to foreigner attendees at the Winter Olympics in February this year. CBDCs are a natural development in the march towards cashless society and its introduction will bring more stability and credibility into the crypto world.

With this as in mind, I am reviewing my Crypto portfolio with added focus on ISO-compliant cryptocurrencies. The following are ISO-compliant cryptocurrencies and their function within the ISO 20022 ecosystem:

Ripple (XRP): XRP provides almost instantaneous settlements between banks and financial institutions and is designed for use by the banking sector. It is an official member of the ISO 20022 Standards Body.

Stellar (XLM): XLM is based on the same technology as XRP but processes settlement between central banks and is designed for the development of CBDCs. Like XRP, it is also a member of the ISO 20022 Standards Body.

XDC Network (XDC): XDC is a proof-of-stake blockchain providing digital asset network enterprises by combining public and private blockchains with interoperable smart contracts.

Algorand (ALGO): ALGO is a Layer-1 blockchain capable of process 1,300 transactions per second and its proof-of-stake methodology is by consensus. It is a member of the Digital Payments Institute (along with SWIFT, Mastercards and other payment organisations).

Iota (IOTA): IOTA is built for the Internet of Things (IoT) to process micro transactions with low resource requirements. Caters for machine-to-machine data autonomy and IoT data and cross border DigiD.

Revised Strategy

While in the past my crypto trades are designed to profit from the volatility, I am now looking at a different strategy. These ISO-compliant cryptocurrencies are part of the blockchain technology that will deliver the enhancement of messaging via SWIFT and are not used for payment itself.

It follows then that such use will have a repeatability feature that is important for a wealth building tool. Higher adoption will likely lead to more price stability and increment, for which a buy-and-hold strategy may be more appropriate than a buy-and-sell on price spikes.

So our crypto portfolio is being re-constructed to gear up for the adoption and growth of ISO 20022 via SWIFT. It would be interesting to see how the portfolio will perform once SWIFT transition to ISO 20022 protocol in November 2022, a mere 3 months away.

Getting ready,

Savvy Maverick

(Main image: Luis Desiro, Unsplash)

Disclaimer: The views expressed here are drawn from my own experiences and do not constitute financial advice in any way whatsoever. Nothing published here constitutes an investment recommendation, nor should any data or content be relied upon for any investment activities. It is strongly recommended that independent and thorough research be undertaken before making any financial decisions, including consulting a qualified professional.