3 Additional Checkpoints For A Fully Prepared Retirement

The months prior to a planned retirement are so blissful. After all the years of saving, crunching numbers and now finally looking forward to spend all 24 hours on your terms. You’re probably walking around the office with a silly grin and dreamy look, waiting for the moment to stick up the middle finger by way of handing in the resignation letter.

– Retirement budget – Checked!

– Maximise pension options – Checked!

– Downsize/right-size home – Checked!

– Emergency fund – Checked!

– Book round-the-world trip – Checked!

– Tender letter on D-day – Final countdown!..tune of Europe’s song in your head 🙂

Wait a minute! There are 3 additional checkpoints that should be looked into. All 3 must be done before D-day. So I hope this reaches you in time. Let’s start with the most unconventional.

1. Mortgage Repayment

For years, I have been advocating to friends, colleagues and anyone who cares to listen, to NOT to pay off their mortgage before retirement. I always get that ‘what do you mean?’ look, complete with crinkled brows and bewildered look.

The logic is that by the time nearing retirement, there would be quite some home equity built up. A mortgage with embedded home equity is 1 of the most powerful and useful lifelines in one’s lifetime, not only in retirement. And here are the why’s:

- Paying off mortgage reduces your liquidity and is irreversible.

- It is almost impossible to get a mortgage once retired, without a stable income.

- Mortgage is a great tool against inflation, especially in current climate of high inflation.

- Mortgages offer 1 of the lowest interest rates compared to other loans.

- There are many ways to extract home equity without having to sell the property (eg: home equity line of credit, reverse mortgage).

- Take advantage of negative interest when inflation rate is higher than mortgage interest.

- Inflation is a friend to debt, shrinking its value over time.

- For rental income, it is inflation-adjusted making investment property 1 of the best inflation-hedged asset classes.

- Enjoy mortgage subsidy or tax benefits where applicable.

- Keep cash buffer for emergencies.

- Repaying mortgage means losing out on opportunity costs for other investments.

- Keep line of communication with lender bank open…one never knows.

This is contrarian and unconventional. In fact, it is safe to say that most consider being debt-free as a rite of passage to retirement. Chew on the reasons above and see if they make sense before you pay off your mortgage. The more years you plan to be in retirement, the more important these reasons become.

If peace of mind is what you’re after, then I suggest to pay off 80%-85% of your mortgage, retaining a residual 15%-20% so you can still enjoy the benefits cited.

2. Overdraft Facility (OD)

In an increasingly VUCA world, everything can be disrupted and anyone is susceptible to be affected by unforeseen events. Think sub-prime mortgage crisis, pandemic lock-down, Russia-Ukraine war, collapse of Silicon Valley Bank within a mere 48 hours. Catastrophes not within our control but at least to have the ammunition to fight it is immensely valuable.

Overdraft facility (OD) is 1 such weapon to have in every retiree’s war chest. Sure, money can’t solve everything but it can help cover emergencies in the short term, provides additional options and buy you time.

Personal ODs can be secured or unsecured, and are extended based on personal financial circumstance. An example of secured OD is a home equity line of credit while an unsecured OD is often based on income capacity.

The good things about OD are that there is no charge as long as the facility is not drawn upon though an annual fee may apply. But this can be waived depending on your relationship with the bank. Funds are easily accessed at the stroke of a pen or through online transfers. No questions asked, free to use as necessary.

The down side is that interest rates are extremely high (especially for unsecured credit) and total outstanding amount compounds quickly when the hefty interest is applied. Hence ODs should only be used for emergency or short-term borrowing.

3. Health and Medical Insurance

For those of us who are or have been salaried employees, we enjoy health and medical insurance either under mandatory employment law or employee benefits, in a group insurance plan. Such coverage takes care of medical expenses for in-hospital procedures, some even extending to pre-treatment such as diagnostic examination and post-treatment recovery care.

However, leaving employment means this coverage stops, along with other work benefits. And in many countries, portability from group health insurance to individual basis is not possible. This means one has to apply for a new policy, requiring health declaration and full medical examination, which can be a lengthy process.

Health and medical insurance is a must-have in retirement, surpassing even life insurance, which can be optional depending on personal circumstance.

In this age of medical cost inflation, no individual can afford to self-insure against medical expenses, especially in light of longevity, leaps in medical technology and chronic diseases requiring long-term care such as dementia. It can lead to financial ruin, not just for yourself but family members, if not properly managed.

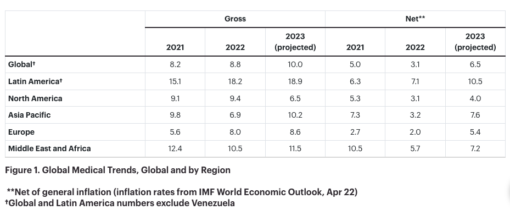

“In Latin America, the medical trend is projected to climb from18.2% to 18.9%, in Asia Pacific from 6.9% to 10.2%, and in the Middle East and Africa from 10.5% to 11.5%…Even Europe, in 2023, the cost increase is expected to jump significantly from 5.6% to 8.6%.”

– 2023 Global Medical Trends Survey by WTW (Willis Towers Watson).

Additional Checkpoints

And there you have it, 3 additional checkpoints under my Retirement Canvas. There are so many aspects to look into before retirement, sometimes the fine prints can be missed out, which are equally crucial.

So before crossing the t’s and dotting the i’s of your resignation letter, do yourself a favour and look into these 3 aspects. If the decision is ‘No’ after review, that is fine for only you know your own needs and circumstance. Better to be over-prepared than be caught in a fix.

To a blissful retirement,

Savvy Maverick

(Main image: Savvy Maverick)

Disclaimer: The views expressed here are drawn from my own experiences and do not constitute financial advice in any way whatsoever. Nothing published here constitutes an investment recommendation, nor should any data or content be relied upon for any investment activities. It is strongly recommended that independent and thorough research be undertaken before making any financial decisions, including consulting a qualified professional. Data and information cited from credited source are correct at date of publication and will not be updated thereafter.

2 thoughts

Very insightful

Then you’re well on your way to enjoy a blissful retirement, proost!:)

Savvy