The Irony Of Property Ownership

A recent episode started me mulling over the glaring irony of property ownership – that what we keep, we lose in the end. By holding on to a property, we actually forfeit it to someone else. How so?

This cannot be explained without referring to an episode that happened 2 years ago. A neighbour offered to sell her apartment but with 1 condition – that she be allowed to lease-back for as long as she wants to live there. It was appealing then as demand was heating up while supply was fast dwindling.

Fast forward 2 years on, another neighbour living in the same complex came to us with the same proposition. She has learnt from her neighbour – our tenant – about the lease-back arrangement. This sets me on a new thinking about property ownership.

Ownership

Do we really own our property?

Most people will agree that when a property is bought with mortgage, it is owned by the lending institution. As long as the mortgage is outstanding, the lender has rights over us, with the power to seize it over payment default or other breach of terms. So clearly until the mortgage is fully repaid, we do not own it even though on paper we are the title deed owner.

Now what about property owned outright, ie free of mortgage? Surely that belongs to the owner, right? Well…not as simple as it seems. Let me explain so you can appreciate the irony of property ownership.

Right Of Use

A property, whether mortgaged, owned outright, rented out for investment or self occupied, merely grants a right of use. The right to live in it, right to renovate, right to decorate, right to rent out, right to offer as collateral.

As long as we own the property, we get to enjoy these legally accorded rights. So what we own is merely the right to enjoy these privileges, by paying a lot for them. Some folks are even chained to their property, working a lifetime to pay off the mortgage.

We can take an equity loan to release the locked value, but that means introducing a mortgagor into the equation. As established above, the lender ‘owns’ the property, listing it as an asset on his balance sheet, earning monthly cashflow from borrowers.

Sell It

So how do you ensure that what you own belongs to you?

By selling t.

Sell at a later stage in life, after you’ve extracted the benefits from the right of use. This is the only way to ‘hold on’ to what you own. Keeping it means losing it to others.

This is what the 2 neighbours who proposed the lease-back scheme came to realise. With the sale proceeds, they can do whatever they want: pay for rent, go on cruises, travel, visit family and friends overseas, opt for better healthcare, a new set of teeth…And they choose to do so while still in good mental and physical state, so they can reap maximum benefits.

For those who belong to the ‘save the best for last‘ camp, selling the house provides a means to live it up in style during retirement, with prudence of course. They can start ticking off their bucket list, compiled over a lifetime, to capture as many experiences and memories while still able to.

Irony of Ownership

Ironic, isn’t it? That by keeping a property til the end, we end up losing it. That all we ever possess is the illusion of ownership.

So who owns the property? Our beneficiaries, who will lay claim to it when the fateful day comes. Or the lender if there is a mortgage. So every property we think we own, actually belongs to someone else. We buy the right of use and hand it over to someone who will survive us or those who lent us the money to buy it in the first place.

In other words, keeping it is giving it away. The only way to capture what we own is to sell it.

Contrarian Thinking

This is quite contrarian. Most people who own property aim to pay off the mortgage, live in it for as long as feasible, then bequeath it as part of wealth distribution.

But given that we live in a world of low fertility and childlessness, whether by circumstance or choice, is the time ripe for an alternative thinking about property ownership?

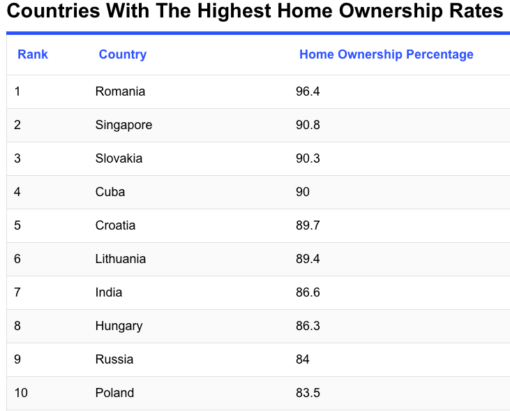

Take for example Singapore, my home country. It has the dubious honour of topping world childless rate at 23% and has amongst the highest home ownership rate at 90.8%. A change of thinking is not only sensible but necessary.

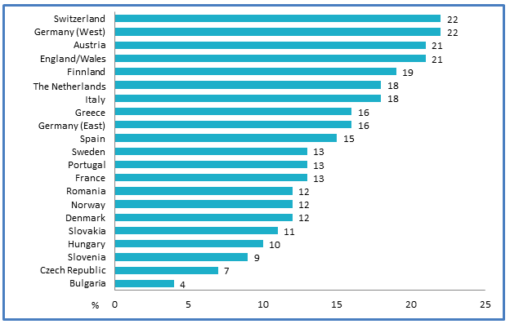

Similarly in Europe where I live now, countries have been grappling with low birth rates for decades, exacerbated by high percentage of ageing population. As at January 2022, more than a fifth of EU population was aged 65 and over. No wonder there is much talk about the impending big wave of wealth transfer.

Wealth Transfer

The question is, to whom is the wealth being transferred? The answer may be obvious for those who have a next generation to bequeath, but what about those who don’t? Or if your offsprings are doing much better than you?

Disposing property while alive is smart estate planning as cash is easier to distribute. Real estate has more rules, is indivisible, highly illiquid and more complicated especially if located overseas. This was 1 of our motivations in selling off our US properties, and we are in the midst of downsizing our portfolio in the Netherlands too.

Retirement Planning

For many though, their home is their only retirement plan, which means disproportionate attachment to it. The home is the only safety net they have, providing them the greatest sense of security. But yet, selling is the only way to sensibly capture a good retirement by unleashing the value trapped within it.

This aligns with another contrarian and rather new thinking – to ‘die with zero’. The idea is to liquidate assets into cash once the threshold to fund full retirement is reached, then to start spending down. For our pleasure and needs, to harvest the fruit of our own labour. For to die with excess wealth is a waste of our life force.

And if you are concern about outliving your money? Set aside part of the sale proceeds to buy a lifetime annuity with monthly payout and long-term care insurance. These will take care of expenses right to the end.

Now that it has been explained, does this irony of property ownership not remind you of a famous Patek Philippe ad tagline? Paraphrased here:

“Your never actually own

a Patek Philippeyour property. You merely look after it for the next generation”

So true, isn’t it?

Savvy Maverick

(Main image: Phil Hearing, Unsplash)

Disclaimer: The views expressed are drawn from personal experiences and do not constitute financial advice in any way whatsoever. Nothing published here constitutes an investment recommendation, nor should any data or content be relied upon for investment activities. Please seek independent and thorough research before making any financial decisions, including consulting a qualified professional. Data and information cited from sources will not be updated after publication.

2 thoughts

À very insightful article dear Savvy. Will order my Jaguar tomorrow.

In the end, once affordability has been established, it’s important to live well. Go for it, hope you get immeasurable pleasure from your Jaguar, Rob!

Savvy