Why Investing In Multiple Rental Properties Is Better Than 1

Amongst passive income streams, rental properties require the most work: mortgage, renovation, maintenance, repairs, insurance, property taxes and keeping up with regulatory changes. It also carries vacancy risk and depreciation concern in a recession. Which is why many folks, despite their financial ability, are put off by investment properties, opting for stocks and shares or other alternatives.

However, investment property is the best asset classes from my personal experience. It is great for its stable cashflow, equity build-up, repeatability once you’ve gotten the knick for it and is the most tested and proven since time memorial. You will be amply compensated for the hassle.

Owning 1 rental property is already quite a handful, especially if you’re holding down a full-time job. But what if I say it’s much better to own 2 or more rental properties if you’re going down that wealth route? Double, triple the trouble? An oxymoron? Let me explain.

Risk Diversification

- Income Stability: With multiple properties, the risk of vacancy and the resulting loss of rental income is spread out. If one property is vacant, income from the other property or properties act as a safety net, offering better financial stability. This is 1 way to address vacancy risk.

- Diversification: Owning properties in different locations or types (residential vs shop or long-term vs holiday rental) protect against specific issues affecting property value or rental demand. Say if your first rental property is a holiday rental that is affected by newly-introduced rental restriction rules, your other long-term rental helps buy you time to reposition, with less financial hardship. This way, you have avoided a double-whammy compared to owning holiday rental properties.

Income Potential

- Higher Total Rental Income: Multiple rental properties means multiple streams of rental income, which can significantly increase total earnings speeding up your path to wealth or retirement.

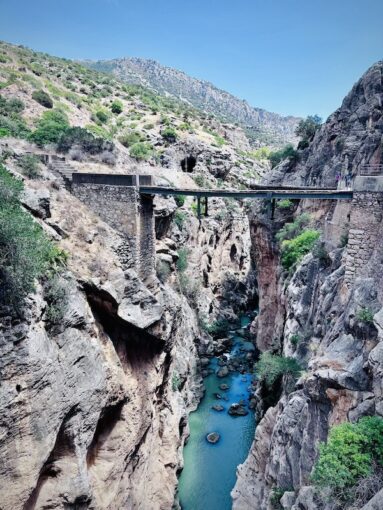

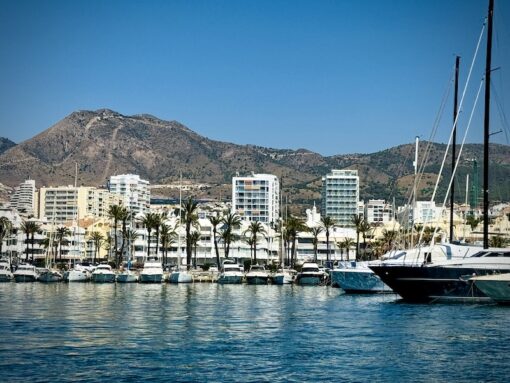

- Economies of Scale: Managing multiple properties can reduce per-unit management costs. For example, I use the same handyman for my long-term rental properties as well as for holiday rental properties in Marbella, although they are located in different cities. This way, I get preferential treatment whenever his service is needed and at a preferential rate for the volume of work he can get. So management costs are more efficient.

Enhanced Financing

- Leverage maximisation: The best thing about investing in properties is the ability to leverage your money. Instead of paying 40% downpayment for 1 property, you access more financing by buying 2 properties with 20% downpayment each (assuming equivalent in value for illustration sake). You get twice the income! How’s that for multiplying money?

- Improved Financing Options: Lenders might be more willing to offer better financing terms to investors with multiple properties due to perceived lower risk and higher income.

- Equity Growth: Multiple properties can accumulate equity faster, offering more opportunities for refinancing, cash-out options or using the equity to invest in additional properties. The latter is a smart way to invest in multiple properties as long as you do your sums in terms of financial exposure.

Tax Benefits

- Depreciation: Each property can be depreciated, providing tax deductions. With more properties, the cumulative depreciation deductions add up due to multiplication meaning more retained earnings.

- Expense Deductions: Many expenses associated with managing rental properties are tax-deductible, and with more properties, these deductions can add up. Depending on the expense, sometimes an expense for 1 property can be deducted from another for tax minimisation. You have more leeway to manoeuvre, that is the point I want to make.

Wealth Building

- Appreciation Potential: More properties mean more potential for capital appreciation over time, hastening your path to wealth.

- Retirement Planning: Multiple rental properties can provide a more stable and substantial source of passive income during retirement. Owning multiple rental properties also gives you the choice to retain the less problematic or the most yield, depending whether you prefer lesser hassle or income maximisation. With 1 rental property, it’s all or nothing.

Flexibility and Control

- Market Opportunities: With multiple properties, as an investor you can take advantage of various market opportunities, selling one property if the market is favourable while retaining others.

- Tenant Management: Managing multiple tenants can provide insights and experiences that help improve overall tenant relations and property management skills. Like everything else, the more practice you have, the better you get at the game.

Resilience Against Market Fluctuations

- Market Cycles: Different properties may experience market cycles differently. Having multiple properties can mitigate the impact of market fluctuations on your overall portfolio. Imagine owning 1 shop lot during Covid-19 pandemic where many small businesses were forced to shut their business, which was the fate of 1 of my shop tenants. However, having residential properties helped us weather the storm, with a small financial hit. The risk is higher with 1 property than owning 2 or more diversified properties.

Legacy Planning

- Wealth distribution: It is easier to bequeath an entire property to 1 beneficiary than having it shared amongst several beneficiaries. This can give rise to dispute, creating disagreement over how the property should be split or managed.

The parents of a good friend of mine who were business owners before they retired, built a portfolio of 7 properties, 1 to each of their 7 grandchildren upon the her mother’s demise, who outlived her father by 11 years. Each grandchild was free to do whatever they decide with it. How elegant is such a plan?

Safety In Numbers

Where investing in rental properties is concerned, I’d advocate for safety in numbers. While owning multiple rental properties requires more capital, management and effort, the benefits and protection they offer together far outweigh the challenges, offering greater income potential, risk diversification, and wealth-building opportunities.

It may sound like an oxymoron but sometimes, more of something is safer than 1. Much like owning 10-20 diversified stocks is a safer and better strategy than plowing all your money into 1 high-conviction stock. Owning rental properties follows the same principle.

Do make sure to cover your bases before investing. Do your due diligence or consult with qualified financial experts. Just as it is important to know which and what type of properties to buy, it is equally important to have an exit strategy and know when to sell an investment property. In a fast-changing world, adaptability is key. The wider your ammunition, the better to be able to survive…even thrive.

A numbers game,

Savvy Maverick

(Main image: Brian Garrity, Unsplash)

Disclaimer: The views expressed here are drawn from personal experiences and do not constitute financial advice in any way. Nothing published here nor should any data or content be relied upon for investment activities. Please do your own due diligence before making any financial decisions. Data and information cited from sources will not be updated after publication.