Why Investing Is No Longer An Option

Investing is no longer an option. Why?

Have you noticed how much prices have escalated? Most countries have experienced soaring prices, affecting everything: food, energy, clothing, daily necessities, entertainment, eating out. And the biggest hikes seem to be reserved for the most hefty expenses: accommodation, transport and travel

Inflation Everywhere

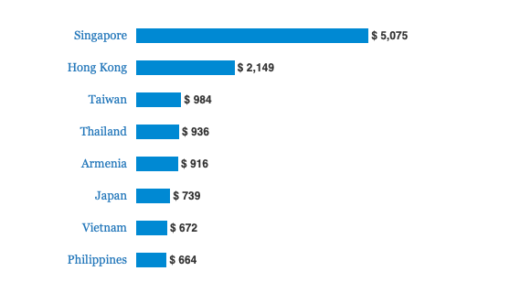

In my home country Singapore rental has surpassed that of Hong Kong, traditionally considered the most expensive city in Asia, causing some expats who can no longer afford rent to leave.

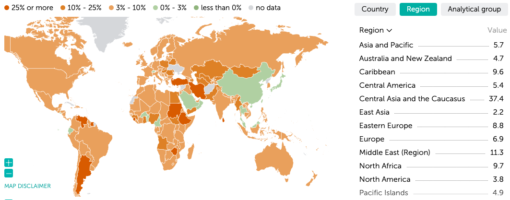

The IMF recorded global inflation at 6.5% in 2022 with many countries crossing into double digits. Click here and hover your mouse over each country to see inflation rate.

Inflation is ravaging us left, right and centre. There is no escaping it. The International Labour Organisation (ILO) noted in its flagship annual publication:

“Evidence fo 2022 suggests that rising inflation is causing real wage growth to dip into negative figures in many countries”

~ ILO, Global Wage Report 2022-2023

Against an inflation rate of 5%, even if you have had a 3% pay increment, your real income is actually 2% lesser. You have suffered a pay reduction in real term, gobbled up by inflation like a cookie monster.

This is exactly why it is important to adjust rental income for inflation whenever you are able to. An adjustment of 2% may sound negligible but compounded over the years – real estate typically being long-term play – has significant impact.

High inflation rate is 1 of the biggest risks in retirement planning, besides longevity and healthcare costs. It is also 1 of the reasons why the 4% withdrawal rule is outdated.

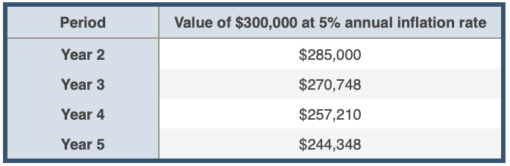

If you have $300,000 in retirement savings at the start of this year, the value against an annual inflation rate of 5% is such:

High Interest Rates

With interest rates hitting new highs of late, fixed deposits and even savings accounts are paying high interests, resulting in many happy savers. Coming from a decade of low interest hovering at 1% to more than 3% sounds like a dream come true. Hooray, finally some decent interest to be earned. But wait a minute, everything is relative, isn’t it?

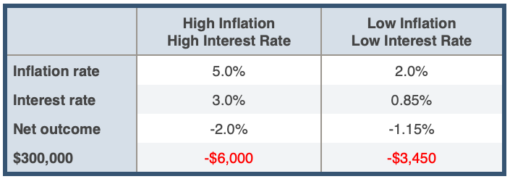

In the current situation, despite interest rates increasing to record levels compared to the past 10 years or so, they are no match for the even higher inflation rate. In fact, a lower inflation and lower interest rate combination works out better:

For a sum of $300,000 this means a loss of $6,000 in a high inflation high interest rate case vs $3,450 in a low inflation low interest rate scenario, as shown in the example above. While on surface the interest earned is more, it is in fact negative interest. You are paying the bank to keep your money.

No Better Option

That’s why investing is no longer an option. If you want to prevent your hard-earned and diligently saved money from being eaten up by inflation. Invest in assets that help you fight the negative effects of inflation so that the value of your money is preserved. What are examples of such assets?

- Rental property: This is my all-time favourite asset class as besides being inflation-hedged, it also generates steady cash flow. Cash flow is the ultimate king, especially during economic uncertainty and for those in retirement. In fact, if the rental property has a mortgage, then inflation becomes a friend instead of an enemy.

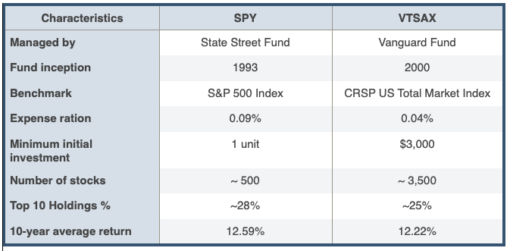

- Broad-based market index funds or ETFs: Stock markets always trend up over mid-to-long term. Investing into broad market indexes or ETFs enables you to ride this trend with little hassle and very low-cost. My favourites are SPY and VTSAX. Here’s a quick snapshot of each so you can do further research to shortlist what is appropriate for yourself:

- Real Estate Investment Trusts (REITs): REITs’ dividend payouts tend to increase in line with inflation due to rental adjustment. However, the degree of increment depends on the type of REITs as well as the WALE. REITs pays regular dividends, translating into regular cash flow. Do take note that REITs are highly exposed and sensitive to interest rates so please do your own in-depth research to select the right ones.

- Income or Dividend stocks: Much like REITs, these stocks tend to keep par with inflation hikes. Companies with strong dividend track record usually command market leadership positions and are hence price makers. They are able to pass on increment in costs to consumers or customers. There are even companies that increases their pay-out ratio, cementing their position as dividend aristocrats.

- Gold: Regarded as a traditional hedge against inflation, you can choose to invest in physical gold or opt for a gold ETF such as the SPDR Gold Shares ETF (GLD). Investing in gold does not generate cash flow unlike rental property, REITs and dividend stocks.

Invest Or Loose Out

Given the current high inflation environment, which is likely to remain so in the foreseeable future, investing is no longer an option, if you want to protect the value of your money.

While putting money in Fixed Deposits seems to offer the comfort that your principal is protected, this is an illusion. The value of your money actually erodes whenever inflation rate is higher than the interest rate of the fixed deposit.

Even if you have no idea about investing, start learning to protect what you have. And contrary to popular belief, investing does not have to be complicated or requires lots of time and effort. Here are 2 simple and effective ways to start investing.

We all have a busy life and other priorities than to pour over financial statements or constantly follow the stock markets. Keep it simple and straightforward by investing in proven broad market tools so you can get on with your life. With the comfort that your financial resources and wealth are protected from the the claws of inflation.

Get even,

Savvy Maverick

(Main image: Mazura R.)

Disclaimer: The views expressed here are drawn from my own experiences and do not constitute financial advice in any way whatsoever. Nothing published here constitutes an investment recommendation, nor should any data or content be relied upon for any investment activities. It is strongly recommended that independent and thorough research be undertaken before making any financial decisions, including consulting a qualified professional.