The Paradox Of Choice – A Wealth Of Options Yet Poorer For It

The paradox of choice is ruining our lives.

Most of us equate choices = freedom = happiness. Choices give us control and the ability to shape our own destiny. But having choices can end up being perplexing and unsatisfactory instead.

Can you identify with this? You desperately need corianders to make guacamole and found the last bunch sitting forlornly on the supermarket shelf. Half wilted and some of the leaves are on the cusp of turning yellow. You grabbed it and made your way to the cashier, heaving a sigh of relief, thankful it’s your lucky day.

But when presented with half a dozen bunches, you start getting picky. You rejected 1 after another for not being fresh enough, not green enough or wilting. You left with an imperfect bunch, feeling shortchanged and dissatisfied, cursing under your breadth.

Familiar? More choices actually leads to more dissatisfaction and unhappiness.

Retirement

A case in point: early phase of retirement. Stopping work means having the time and choice to do whatever we want, whenever we wish and with whoever we care to invite. Ultimate freedom right? Yet many feel at a loss for having so much time and not knowing what to do with it.

To choose retirement is to give up the nice things embedded in work. Unlike in olden days, modern work provides many perks, benefits, emotional attachment and social engagement. Choose 1 and loose many – that in itself doesn’t sound good, does it?

That explains why there are more and more people opting for other variations of retirement, even going back to work. Quite sensible given that we live in an era where 100 is the new 80!

World of Investing

The world of investment offers bewildering choices:

- 43,248 listed companies worldwide in 2019 as recorded by The World Bank.

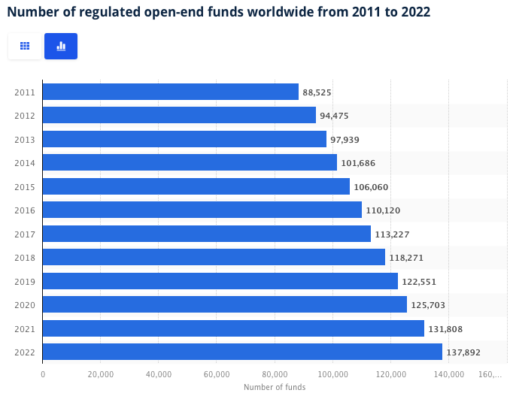

- 137,892 regulated open-end mutual funds in 2022 as recorded by Statista.

- 3.7million indexes globally as surveyed by IIA (Index Industry Association) in 2018.

A staggering number of choices indeed, where does 1 even start? Even though an advocate of F.I.R.M over F.I.R.E, I admit it is intimidating, especially for those who are not financially inclined. What a humongous mountain to climb!

No wonder many do not even bother to embark on the journey of investing, despite knowing its importance. Too much effort to learn, compare and research before a decision can be taken. Having said that, investing is a must and no longer an option.

If I was just starting out and clueless about investing, I would heed my own advice to my younger self. Invest monthly or quarterly in a proven market index like the S&P500 using Dollar Cost Averaging or Value Averaging, and then get on with life. There are too many things in life to enjoy and accomplish than learning investment strategies.

Don’t let lateness deter you for it is no hindrance to success, as long as you start. Action is more important than timing.

Personal Anecdote

While having some choices is liberating, too many is suffocating and paralysing. Take for example my situation.

I’m Singaporean, married to a Dutch and we’re both holders of ‘Malaysia My 2nd Home‘ (MM2H) retirement visa. While stricter rules were introduced in 2021, they do not apply retrospectively hence our visas remain attractive. We enjoy PR status in each of our adopted country so we can live in any of the 3 countries mentioned in addition to 27 others constituting the EU.

Plus more countries are offering retirement visa such as Indonesia, Thailand, The Philippines, New Zealand and even the tiny South Pacific island of Fiji, where English is widely spoken.

We’re not constrained by children nor work and between us, speak a total of 9 languages/dialects. Envious position with so many choices, right?

Truth Be Told

Buoyed by options, my S.O and I have been thinking about where we want to live in our later years. We know that the earlier we decide, the sooner we can settle, build a network and start integrating into the community. Yet 5 years on, we’re still undecided. Classic syndrome of choice overload.

The more choices, the more time and effort needed for deliberation and decision-making. Imagine having to research all these for each country we’re interested in: climate, safety, cleanliness, tax regime, social and cultural life, healthcare, international accessibility, domestic mobility, political stability, living standard and infrastructure for senior living.

All of them affect our well-being and happiness, hence warrant careful consideration. No one country is perfect hence trade-offs entail. Given the array of choices, a wrong decision is more painful because of more opportunity costs. Deciding 1 among 10 means letting go of 9; compared to passing over 2 when choosing 1 out of 3. The more choices, the stronger the bitter aftertaste of ‘the ones that got away’, so the higher the dissatisfaction.

Perfect Choice

In a world of infinite options, we are obsessed with the perfect choice. For surely among the hundreds and hundreds of options, we can find the 1 that meets ALL our desires.

Therein lies the paradox: more choices, more deliberation, more time, more expectation, more opportunity costs, more regrets, more dissatisfaction and endless woulda, coulda, shoulda.

From flights, music, ice cream flavours to dating Apps, we are spoilt for choice. The internet opens up a doorway to endless options from all over the world, dumping even more load on our already challenged bandwidth. Instead of being satisfied, we get worn out.

The way to deal with choice overload? Start by filtering out what you don’t want. From experience, this as an effective guiding approach when making choices, to stay true to your core values, beliefs and likes.

“Less is more only when more is too much” ~ Frank Lloyd Wright

More or less?

Savvy Maverick

(Main image: Jametlene Reskp, Unsplash)

Disclaimer: The views expressed here are drawn from my own experience and do not constitute financial advise in any way whatsoever. Nothing published here constitutes an investment recommendation, nor should any data or content be relied upon for any investment activities. It is strongly recommended that independent and thorough research is undertaken before making any financial decisions, including consulting a qualified professional.

2 thoughts

a luxury problem is a problem nonetheless 😁

So true, Ronald.

And luxury comes in many forms, equally subject to choice overload. Let’s hope we all learn to make smart choices.

Savvy