Are These Holding You Back From Investing?

Whether you plan to FIRE up or to Never Retire, planning for the eventuality when you no longer can or want to work is important. While many know investing is a core component of retirement and financial planning, some still shy from it. Why? Undertaken with prudence, investing is the accelerator to achieve financial goals, providing the means to do the things you want sooner, and better.

Holdbacks

Friends, relatives and ex-colleagues cite various reasons that hold them back from investing. These can manifest in different forms, affecting their willingness and aptitude towards investing. So most leave their hard-earned money in ‘safe’ deposit instead of potentially reaping higher returns. In a world inundated with complexities, investing ranks high amongst them, especially when one is a novice.

I too, started as a novice. I used to think buying a whole-life policy, an endowment plan and saving 25-30% of my disposable income constitute retirement planning. Yeah, right…duh. Even though I studied Economics, trust me, it has nothing to do with personal investing. Niks. Nada. Nyet. It provides some foundation to understand various financial concepts in personal investing, but not enough.

Below, I’ll explore some of the common reasons why people are apprehensive about investing, and some suggestions to overcome them.

Financial Literacy

For such an important life skill, it’s sad that managing money is not taught in school. Knowledge is the best defence, which is why I’m a proponent of FIRM over FIRE. And contrary to popular belief, you don’t need deep financial knowledge to start investing. What you need is a basic understanding of stocks (ETFs, REITs, Mutual Funds/Unit Trusts) or real estate investing. Start with these 2 and leave other asset classes for later.

Action: Plug this gap by educating yourself. Read investment books, articles, financial blogs or take online courses. A great book to start with is “The Little Book of Common Sense Investing” by John C. Bogle. Many online courses are free if you just want to understand basic concepts of investing and do not sign-up for in-depth or professional services. There are no lack of financial resources, but if you want some hand-holding, talk to a financial advisor

Loss Aversion

A study by Kahneman and Tversky found that people find losses twice as painful as gains. If you’re nodding uh-huh, then you understand the concept of ‘winning by not losing’. This can work to your disadvantage if you let it keep you from investing.

Action: Start investing with small amount to build up confidence, know-how and to understand your psychology towards money and investing. Some brokers offer paper trade so you can practice with actual delayed market data to test your readiness before using real money. A simple, hassle-free way to start is Dollar Cost Averaging to build a disciplined investing regime.

Lack of Disposable Income

A common belief is that you need a big sum of money to invest. Not true. What is true is that most successful investors started small, and you can start with as little $10 a month, with some brokerages offering zero-fee. Seek these out if starting with small amounts as fees and charges can add up to a big chunk especially with minimum fees.

If you live by the pay-cheque, then all the more important to change your spending habits and do something to break the cycle. The longer you procrastinate investing, the more you cannibalise your compounding timeline. Everything is relative – a little better today than yesterday is a good mantra to get out of the rut.

Action: If you prefer stocks, choose ETFs and brokerages that offer fractional share investing and Regular Investment Plans, a.k.a Systematic Investment Plan (which is Dollar Cost Averaging). If you’re a believer in bricks and stones, then REIT investing allows you to start at a fraction of a property price with immediate diversification and professional management thrown in.

Time Commitment

Another perception is that investing takes a lot of time and effort. It does not have to be so. Passive income come in different types, with varying degrees of effort. I get it. You have a stressful job, a family to take care of and you treasure your time with friends and your hobbies. Sure, life is more than investing and retirement planning.

Action: Opt for index funds, ETFs, REITs, a regular investment plan or a Robo- Advisor service. The latter can offer customised portfolio even handle portfolio management. This is what I would advise my younger self – let the experts and the market to do the work and get on with life.

Instant Gratification

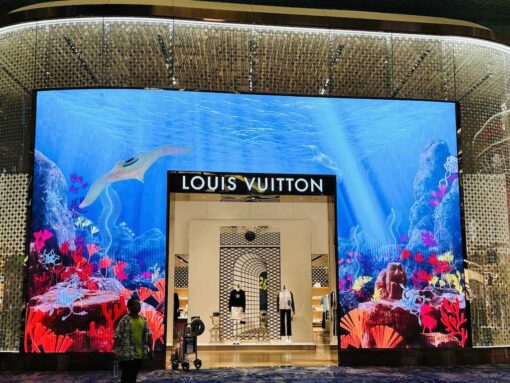

Social media and the mentality of keeping up with the Joneses are temptations for instant gratification. Do you really need the ‘It’ bag that your colleague was showing off on IG? With all the technology at our fingertips, immediate pleasure can be had with ease and convenience. But such social validation is short-lived, leaving long-term consequences and regrets. Instant gratification is to rob from your own future. Don’t let mindless spending delay your investing journey. Remember, your days become your life. Live consciously.

Action: Keep long-term goals in mind. Investment income is a great way to fund your desires with other people’s money. Instead of going to the exotic destination your colleague just posted on IG this school holiday, why not set up a challenge to fund it through dividend income? In addition to delaying gratification, it’s fun to gamify investing by setting short-term targets and rewards. This holiday could be a reward for reaching an investment milestone.

Another exercise I find truly useful to keep long-term goals in focus and to stay grounded is writing a will. The thinking process behind writing a will puts things into clear perspective, separating the wheat from chaff.

Know vs Do

Knowing investing is crucial to reach financial goals is one thing. Having the will and ability to start is another altogether. Whatever your reasons – lack of financial literacy, fear of loss, short of funds, no bandwidth to living too much in the moment – learn to overcome them.

Understand what holds you back and use some of these suggestions to start building a solid foundation for your retirement and financial future.

Getting started?,

Savvy Maverick

(Main image: Ante Hamersmit, Unsplash)

Disclosure: This post may contain affiliate links for which I may get commissions for purchases made through links in this post.

Disclaimer: The views expressed here are drawn from personal experiences and do not constitute financial advice in any way whatsoever. Nothing published here constitutes an investment recommendation, nor should any data or content be relied upon for investment activities. Please seek independent and thorough research before making any financial decisions, including consulting a qualified professional. Data and information cited from sources will not be updated after publication.