Retirement Is Becoming A Luxury, What Can You Do About It?

“I’m pretty sure I’ll have to work half day on the day of my funeral”.

While it got a chuckle out of me, it was also sad and ‘sob’-ering at the same time. Because that’s probably close to the truth for some.

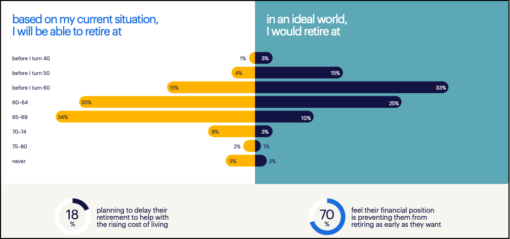

Retirement is becoming a luxury rather than the norm enjoyed by our parents generation. Retirement is taking the form of a life with less work instead of a life without work. Aside from those who never retire by choice, a whopping 70% cannot stop working when they would like, due to financial reason. This is the finding from a global survey by HR services company Randstad.

In fact, ‘unretirement‘ is a new buzzword creating ripples in the employment word. Most ex-retirees who return to work do so in order to cope with the high costs of living and economic uncertainty.

So what if you’ve faithfully followed the same rule: study, get a job, sock away some savings, live within your means and stay employed for 30 or more years? It is not guaranteed that days of playing bridge, chasing golf balls across fairways or extended travels will follow.

Reality Is Broken

Face it. We are no longer living in the same world when retirement was created. Hack, it is not even the same world compared to the start of this millennium.

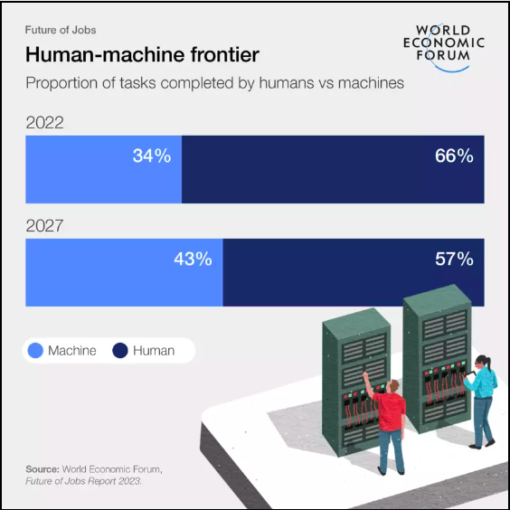

Work has changed. Life-long employment is exception rather than the rule. Contract work is on the rise while companies shift from defined benefits to defined contribution pension plans, further exacerbating the retirement conundrum. Digital innovation is making workers redundant and the rise of A.I means displacement of more jobs at faster rate. No doubt new jobs will be created but these will require different skillsets altogether.

Companies’ lifespan are getting shorter. Fast-changing consumer tastes, global competition and technological disruptions make it harder for them to navigate and survive.

We are living longer, a joy but can be a curse too. Modern living is making us less healthy, meaning higher healthcare costs. We are growing old before we grow rich, increasing the likelihood of outliving our money.

Public pension plans are under pressure. Governments are prioritising more urgent and placating expenditures like combating climate change, defence spending, rising healthcare costs, youth unemployment…

So what gives? The retirement dream.

What Now?

To expect the government or employers to bail us out is not realistic. Everybody has their own war to fight and our priorities rank low on their agenda. The best bet is to wake up to reality and find ways to help ourselves.

Most important are the actions, or inactions, in the 30 or so years leading up to retirement. The old ‘retirement formula’ of getting a job and keeping it is no longer enough. Yes, it serves as a good foundation. But what good is a foundation if it’s not built upon? Even the best foundation is but barren ground if left unattended.

Build Your Retirement Arsenal

- Be Your Own Boss (BYOB), no matter how good your employer is because ultimately, no one has your interest at heart better than yourself. By this, I mean to always remember you are working for yourself, for your own future.

- Explore a Portfolio Career to create safety net and Plan B in case the pink slip comes your way one day. It helps you to build different skill sets and offers opportunities to discover new career options.

- Learn to invest, as early as you can. The joy and importance of passive income cannot be over-stated. Investing is the fertiliser for the barren land. Truth is, saving alone is not longer enough. For the young, time is your greatest weapon. It provides a long runway to compound returns and to recover from bad moves. It takes time to be good at investing, to know your emotions and manage them. As what I’d tell my younger self, investing doesn’t have to be complicated.

- Real estate has been the path to wealth for centuries for its cashflow generation and use of leverage. There are many ways to invest in real estate: rental property, REITs, real estate crow-funding to name a few. It’s how I started my retirement journey and has added immensely to my life and brought me in touch with many interesting people and places.

What Else?

- Relocating to a lower cost area or country to stretch retirement funds for the adventure-minded. You can even up your lifestyle if you draw pension from your home country to cover living expenses there. Make sure to visit and do in-depth research before making any move, like what I did with Portugal and Spain after hearing wonderful things about both countries. Our tastes, preferences and motivations are different so what work for others may not be your cuppa.

- Co-housing or co-living with friends can be an option that enable you to retire by pooling resources and sharing the costs of living expenses. Besides financial, it also tackles the emotional and social engagement issues faced by retirees.

- Put in place the right insurance coverage while still gainfully employed or as part of retirement planning. Health insurance, life insurance and the very important long-term care insurance (LTC). We are living longer and spending more years in ill-heath. LTC insurance alleviates the cost of taking care of ourselves in later years.

- Taking a leaf from the leaky bucket approach, guard and protect what you already have. Every penny counts where retirement is concerned. Don’t fall victim to scams whose modus operandi are getting more sophisticated. My friend C is starting over at almost 80 after losing his life savings to scammers. Scammers are increasingly targeting older folks because they are less technology savvy, have a stash of money and trusting by nature

Help Yourself

Take action early to be in a better position for retirement. Even if you’ve missed the early boat, take heart that starting late is no hindrance. Take action now so that retirement does not become a luxury, but a reality.

Finally, and most importantly, no discussion on retirement is complete without stressing health. Longevity and retirement are meaningless without it. All forms of retirement, including unretirement, will be less enjoyable or even impossible without health.

Your retirement your reality,

Savvy Maverick

(Main image: Fer Gomez, Unsplash)

Disclaimer: The views expressed here are drawn from my own experience and do not constitute financial advise in any way whatsoever. Nothing published here constitutes an investment recommendation, nor should any data or content be relied upon for any investment activities. It is strongly recommended that independent and thorough research is undertaken before making any financial decisions, including consulting a qualified professional.