Retire With A Looming Recession?

If you have been planning to retire for a while and wondering if this is the year, you belong to the lucky camp. You have the power of choice, obviously better prepared than many others. A looming recession giving 2nd thoughts is prudent thinking.

For the unfortunate ones forced into retirement, the howling winds of recession in the background is jittery indeed. With some smart manoeuvres, it is possible to weather the storm.

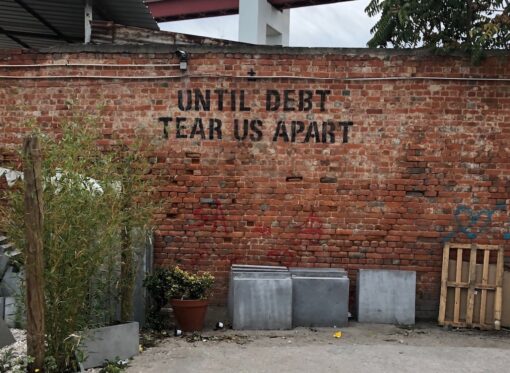

While nobody can predict how bad or how long this recession will be, the writings on the wall may provide some clues:

- Unprecedented scale of tech lay-offs, even by industry stalwarts like Microsoft (10,000), Amazon (18,000), Meta (11,000) and Alphabet (parent company of Google) 12,000

- A drawn-out Russian-Ukraine war gobbling up resources and straining many countries

- Hottest inflation in more than 2 decades jacking up cost of living

- Sky-high interest rates hurting borrowers and increasing costs for businesses

- Overheated property prices are fanning the risk of negative equity

Regardless whether retiring by choice or involuntary, it is sensible to shore up financial resources against the vagaries that a recession can unleash.

Beefing Up For Retirement

Retrenchment package – For those who already decided to retire, why not opt for voluntary retrenchment package if offered? This is like a pseudo ‘golden handshake’ that goes some way to booster your fire power against a looming recession.

Prioritise cashflow – Prioritise investments that generate regular cashflow. Cashflow is king, be it retirement, during recession or life in general. Switch from long-term Fixed Deposits (>2 years) or growth stocks to dividend stocks and REITs that pay regular dividends. Remember, we survive on cashflow not wealth.

Recognise though that FDs are principal guaranteed whereas stocks do not offer capital protection.On the other hand, stocks have growth potential unlike FDs. With stock markets in the doldrums and an investment horizon of 5 years or longer, this may work out smarter. Please do your own due diligence or consult qualified financial professionals before making any switch.

Downsize your home – This releases investment cash to generate cash flow to supplement living expenses. A lifetime annuity that pays a fixed monthly amount in exchange for lump-sum payment upfront is worth considering. Or bonds, treasury bills or stocks if you are more adventurous and financially savvy. Again, please conduct proper due diligence or consult qualified professionals. Otherwise, even plain vanilla fixed deposits are paying higher interest rates of late.

Home equity – Extract and use your home equity for line of credit or reverse mortgage if needed. This is why you should not pay down mortgage fully before retirement. A mortgage with equity is 1 of the most powerful and useful lifelines throughout your lifetime.

- Home equity line of credit offers emergency funds without having to earmark existing cash holding. It provides peace of mind knowing a substantial amount can be accessed if needed without hefty interest rates of normal overdraft accounts.

- Reverse mortgage is borrowing against the home value and equity for either lump-sum or monthly payouts. It is especially useful for people who are asset-rich and cash-poor by converting asset into needed cashflow.

Vacation rental – 1 of the most popular activities for new retirees is travel. Freshly released from the rigours of 9-to-5 work, there is now freedom, time and money to explore and visit places. Renting out your home via platforms like AirBnB or booking.com when you’re away is a smart way to collect some cash. If you plan to travel for more than 6months, you can even think about longer term rental.

Room rental – Renting out a spare room can provide an attractive side income. Recent skyrocketing property prices have bumped up rental with increasing demand. As a result of the mortgage hikes, many are unable to afford buying their own home so rental has become a viable alternative.

Home sharing – What about sharing a home with good friends? You get to double the fun while halving household expenses. You can look out for each other, stave off retirement loneliness and it is especially convenient if you share the same hobbies.

Retire overseas or to a cheaper city – To stretch your dollars, consider moving to a cheaper city or lower cost country. In many instances, such a move will up your lifestyle bringing along many other benefits. It is fun and adventurous to move and experience a new environment, make new friends, learn a new culture and language. This is a major move so in-depth research is advised.

Sell what you no longer need – Get rid of things you no longer need in retirement eg laser printer, big monitor screen, high-maintenance boat, gym equipment now that you have more time to exercise outside. Besides generating some cash, decluttering is a responsible move in retirement.

Part-time work – There are many ways to retire in modern society, aided by technological advancement and changing attitude to work and life itself. You can switch to lighter work or opt to continue working part-time. This generates money to supplement living expenses and retains an avenue for your knowledge and expertise. In also extends your social network.

Monetise your hobby – Turn your hobby or passion into side income. Baking, cooking, sewing, tennis lessons, photography…there are many avenues to monetise so check out within your community or online.

Of course, there are other ways to cope with a recession in retirement. The obvious being to reduce expenses and minimise drawdowns on your funds. I prefer the abundance mindset instead, going on the offensive by beefing up resources to live it up in retirement.

While not ideal to retire with a looming recession, aim to live life to your own rhythm and schedule. Build some buffer for added security and peace of mind. YOLO.

For those faced with involuntary retirement, what other choice than to puff up your protective vest and chin-up.

Belt-up…bumpy ride ahead,

Savvy Maverick

(Main image: Naomi Hesseling)

Disclaimer: The views expressed here are drawn from my own experiences and do not constitute financial advice in any way whatsoever. Nothing published here constitutes an investment recommendation, nor should any data or content be relied upon for any investment activities. It is strongly recommended that independent and thorough research be undertaken before making any financial decisions, including consulting a qualified professional.