Re-imagining Retirement In An Era Of Generative AI

Generative AI – undoubtedly THE biggest development past year. Its impact to society and mankind is set to fully unfold in 2024 and for years to come. It is expected to sweep through society pervasively, bringing about exponential changes. It has the potential to disrupt, interrupt and corrupt in some instances. Its effect will reach every level of society and everyone. Many aspects of life as we know it will change.

Will it be constructive or destructive? As with most technology it can be a double-edged sword. AI has been around for decades so it’s not a nascent technology. However the new generative AI holds so much more power that some believe it can post an existential threat to all of us. Firstly, knowing what generative AI is, is a good start.

What Is Generative AI?

I like to think of generative AI as a very smart computer that is not just good at finding answers and following instructions. This computer has the ability to create new things by studying petabytes (PB) of data and examples fed to it. This is done from a process known as data-scraping. Be it images, articles, stories, music to patterns and rules, the new generation of AI is able to use the knowledge to create new things that look or sound similar to what it has learnt.

Amazing, isn’t it? It’s like human minds except gazillion times faster, works non-stop and gets smarter with every gigabyte of data it receives. A living, growing, learning ‘thing’.

With a new year just round the corner and planning and projecting being customary, I thought it’d be interesting to let imagination run a little wild and think about how generative AI will affect retirement and retirement planning.

1. Job Displacement

One of the biggest concerns is the potential displacement of jobs due to AI. As capability increases, many jobs will be automated. And it will not be just the routine and manual jobs being eliminated but also white collar roles, including coding, legal assistants, accountants, finance, teaching and many more. The job market will see massive changes, affecting not only those currently in employment but also those planning to switch to lighter work instead of full retirement as well as those considering to re-enter the workforce.

More than ever, the idea to ‘Be Your Own Boss (B.Y.O.B)’ should not be emphasised. The sooner you understand that you work for yourself even when an organisation is paying for your time and effort, the more prepared you are for shocks to your career. You can then opt for portfolio career, which will become increasingly necessary and common. Adopting these mindset can help safeguard your own position and to secure your retirement plan.

Acquiring new skills that complement AI technologies is another way to enhance employability. As with most technologies, some jobs will be made obsolete but new ones will emerge that require new skills. This can extend your career runway through a new route.

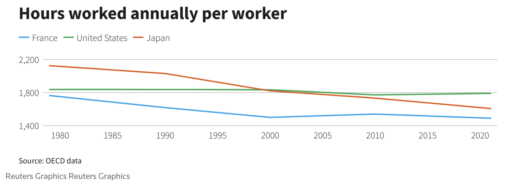

However not all is bad news as AI and automation has helped to reduce the number of hours worked in the past decades and is expected to continue this trajectory. So thanks to AI, we could be working less at the same pay. That’s surely welcomed news.

2. Financial Planning

Generative AI can revolutionise the way we approach financial planning for retirement. I imagine AI-powered tools better at providing customised financial solutions by analysing vast amounts of personal banking data, market trends, and individual financial profiles.

It will be able to analyse the financial situation, risk tolerance,and goals to generate personalised investment strategies. This could lead to more optimised investment portfolios tailored to each unique circumstance. How cool is that?

AI-enabled financial planning softwares and applications will allow for adjustments based on changing market conditions, life events, revised goals and health conditions. This adaptability will help to continuously solidify one’s financial future.

AI algorithms can assess and manage financial risks more effectively. By considering various factors, including market trends and economic indicators, generative AI can assist retirees in making informed decisions to protect their savings.

3. Healthcare

Generative AI can provide retirees with more personalised and efficient healthcare planning through predictive health analytics. AI can analyse health data to predict potential health issues, enabling retirees to take proactive measures for preventive care. Predictive analytics can assist in identifying and addressing health risks before they become serious.

Not only can it analyse individuals’ health records, lifestyle data and genetic information, it uses this data to generate customised health plans, including diet, exercise, and medical interventions.

Remote health monitoring is another aspect AI-powered devices and applications can facilitate better healthcare. By allowing health management from the comfort of own homes, this greatly enhances the services for the physically weak or disabled.

4. Lifestyle and Leisure

Generative AI can contribute to a more fulfilling retirement lifestyle by offering recommendations and enhancing leisure activities. I’ve taken to asking ChatGPT to draw up weekend plans when I have visiting guests stating their preferences like must-see sights, food choices and transport options. The itineraries drawn up have surpassed my expectation.

I imagine the AI algorithms will be able to generate recommendations tailored to preferences, interests, and historical choices to generate personalised recommendations for leisure activities, travel destinations, books, cuisine options and entertainment options.

AI-driven virtual and augmented reality experiences can bring new dimensions to leisure activities in retirement. From virtual travel experiences to interactive storytelling, these technologies can provide engaging and immersive forms of entertainment.

AI-powered chatbots and virtual assistants offering companionship and human-like interaction, keeping feelings of isolation at bay. These technologies can engage in interactive conversation, provide information, and even assist with daily tasks like reminders to take medication.

5. Cognitive Well-being

Maintaining cognitive health is a crucial aspect in retirement. Generative AI can play a role in cognitive well-being through AI-powered applications providing cognitive exercises and brain training programs. These tools aim to stimulate mental activity, potentially slowing down cognitive decline and promoting overall cognitive well-being. Think of interacting with a robot that responds verbally, helping to keep on hearing loss which can lead to dementia.

Not only retirees but everyone can and should use generative AI-driven educational platforms for continuous learning. Whether exploring new hobbies, acquiring new skills, or staying updated on current events, personalised learning experiences contribute to cognitive engagement.

Preparedness

In the end, how AI will impact our lives depends very much on how proactive we are in changing our mindset and taking measures to mitigate the negative outcomes. Embracing a mindset of adaptability, staying informed, and actively learning about how to apply AI to daily life are key elements of preparation.

Living with AI will be both exciting and filled with new possibilities that was hitherto unavailable. This will be true for everyone but especially for the retired and those planning for retirement. It can greatly improve our lifestyle if we embrace it and prepare for it. And what better time to get started than a brand new year?

Welcome 2024!

Savvy Maverick

(Main image: Growtika, Unsplash)

Disclaimer: The views expressed are drawn from personal experiences and do not constitute financial advice in any way whatsoever. Nothing published here constitutes an investment recommendation, nor should any data or content be relied upon for investment activities. Please seek independent and thorough research before making any financial decisions, including consulting a qualified professional. Data and information cited from sources will not be updated after publication.